Region:Middle East

Author(s):Rebecca

Product Code:KRAB7030

Pages:90

Published On:October 2025

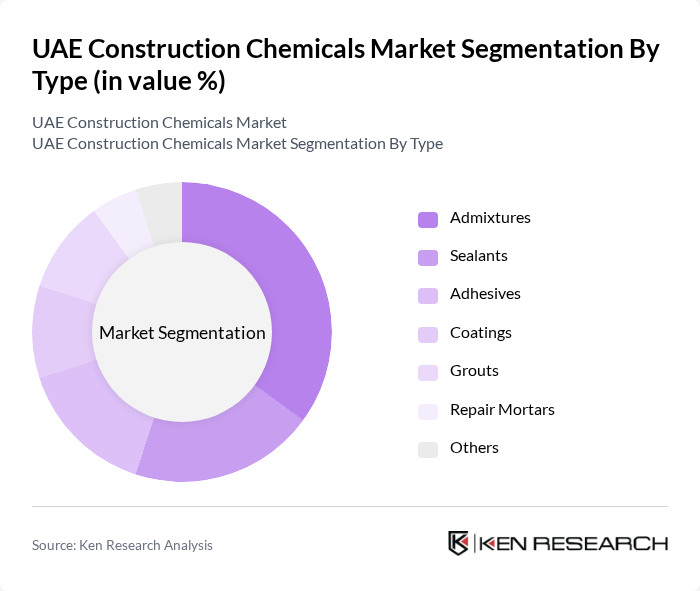

By Type:The market is segmented into various types of construction chemicals, including admixtures, sealants, adhesives, coatings, grouts, repair mortars, and others. Among these, admixtures are the most widely used due to their ability to enhance the properties of concrete, such as workability, strength, and durability. The increasing focus on high-performance concrete in construction projects has led to a significant demand for admixtures, making them a dominant sub-segment in the market.

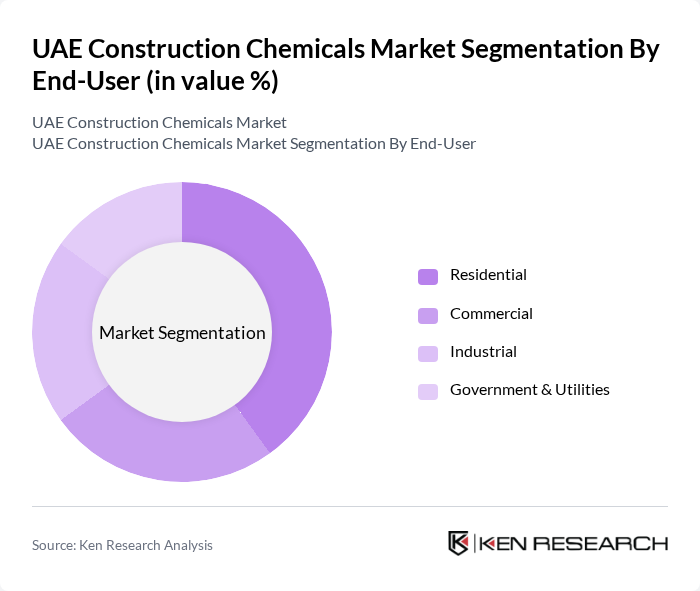

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The residential sector is the leading end-user, driven by the rapid growth in housing projects and the increasing demand for high-quality construction materials. The trend towards urbanization and the development of smart homes have further fueled the demand for construction chemicals in this segment, making it a significant contributor to market growth.

The UAE Construction Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, Mapei S.p.A., Fosroc International Limited, Ardex Group, GCP Applied Technologies Inc., Dow Chemical Company, RPM International Inc., Bostik SA, Saint-Gobain S.A., Pidilite Industries Limited, Henkel AG & Co. KGaA, CEMEX S.A.B. de C.V., KCC Corporation, TREMCO Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The UAE construction chemicals market is poised for significant transformation driven by technological advancements and sustainability trends. As the government continues to invest in infrastructure and smart city initiatives, the demand for innovative and eco-friendly construction solutions will rise. Companies are likely to focus on developing high-performance products that meet stringent regulatory standards while also addressing environmental concerns. This evolving landscape presents opportunities for growth and collaboration among industry stakeholders, fostering a more sustainable construction ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Admixtures Sealants Adhesives Coatings Grouts Repair Mortars Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Infrastructure Residential Buildings Commercial Buildings Industrial Facilities Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Price Range | Low Medium High |

| By Product Formulation | Water-Based Solvent-Based Powder-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Chemicals | 100 | Project Managers, Procurement Officers |

| Commercial Building Materials | 80 | Construction Managers, Architects |

| Infrastructure Development Chemicals | 70 | Site Engineers, Quality Control Managers |

| Specialty Coatings and Sealants | 60 | Product Development Managers, Technical Sales Representatives |

| Adhesives in Construction | 90 | Supply Chain Managers, Operations Directors |

The UAE Construction Chemicals Market is valued at approximately USD 1.5 billion, driven by rapid urbanization, infrastructural development, and a growing demand for high-performance construction materials and sustainable building solutions.