Region:Europe

Author(s):Geetanshi

Product Code:KRAA1964

Pages:97

Published On:August 2025

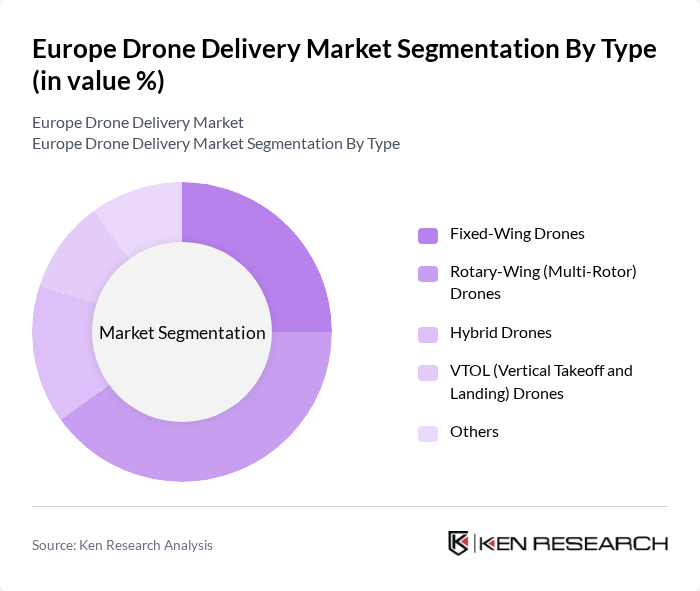

By Type:The market is segmented into Fixed-Wing Drones, Rotary-Wing (Multi-Rotor) Drones, Hybrid Drones, VTOL (Vertical Takeoff and Landing) Drones, and Others. Each type serves different operational needs, with varying payload capacities and flight durations.

The Rotary-Wing (Multi-Rotor) Drones segment is currently dominating the market due to their versatility, ability to hover, and suitability for short-range, last-mile urban deliveries. Their design enables precise navigation in dense environments, which is essential for e-commerce and medical logistics. Recent improvements in battery life and autonomous navigation systems have further increased their operational efficiency, accelerating adoption among logistics providers. The rise of on-demand and contactless delivery services continues to drive demand for multi-rotor drones.

By End-User:The market is segmented into E-commerce & Retail, Healthcare & Medical Logistics, Food & Grocery Delivery, Logistics & Parcel Services, Government & Emergency Services, and Others. Each end-user segment has unique requirements and applications for drone delivery.

The E-commerce & Retail segment leads the market, fueled by the surge in online shopping and the need for rapid, flexible delivery solutions. Drones offer a significant advantage in reducing delivery times and operational costs for retailers. Healthcare & Medical Logistics is also a major segment, leveraging drones for urgent transport of medical supplies, blood, and pharmaceuticals, particularly in remote or congested areas.

The Europe Drone Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Parcelcopter (Deutsche Post DHL Group), Amazon Prime Air, UPS Flight Forward, Zipline International, Wing (Alphabet Inc.), Flytrex, Matternet, Volocopter, Skyports, EHang, Manna Drone Delivery, Drone Delivery Systems Ltd., Dronamics, Aerit, Terra Drone Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the drone delivery market in Europe appears promising, driven by technological advancements and increasing consumer demand for efficient logistics solutions. As companies invest in autonomous delivery systems, the integration of drones into existing supply chains is expected to enhance operational efficiency. Furthermore, the collaboration between drone operators and e-commerce platforms will likely accelerate market penetration, paving the way for innovative delivery solutions that cater to diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Drones Rotary-Wing (Multi-Rotor) Drones Hybrid Drones VTOL (Vertical Takeoff and Landing) Drones Others |

| By End-User | E-commerce & Retail Healthcare & Medical Logistics Food & Grocery Delivery Logistics & Parcel Services Government & Emergency Services Others |

| By Application | Last-Mile Delivery Emergency Medical Supply Food & Grocery Delivery Inter-facility Logistics Others |

| By Payload Capacity | Less than 2 kg kg to 5 kg kg to 10 kg More than 10 kg |

| By Distribution Mode | Direct-to-Consumer Third-Party Logistics Providers Hybrid Models Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Regulatory Compliance Level | Fully Compliant (EASA/CAA Approved) Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Drone Deliveries | 60 | Pharmacy Managers, Hospital Logistics Coordinators |

| Retail Drone Delivery Services | 100 | Retail Operations Managers, E-commerce Directors |

| Food Delivery via Drones | 50 | Restaurant Owners, Food Service Managers |

| Urban Air Mobility Initiatives | 40 | City Planners, Transportation Policy Makers |

| Drone Technology Providers | 70 | Product Development Engineers, Business Development Managers |

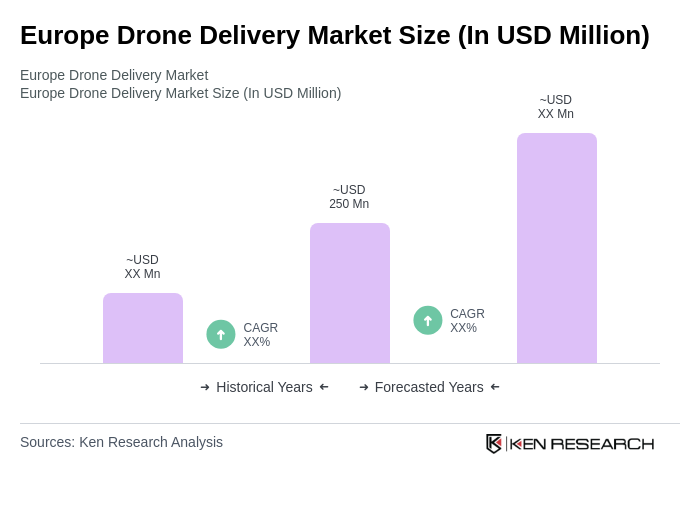

The Europe Drone Delivery Market is valued at approximately USD 250 million, driven by advancements in drone technology, increased demand for rapid last-mile delivery, and the expansion of e-commerce logistics networks across the region.