Region:Middle East

Author(s):Shubham

Product Code:KRAA0697

Pages:93

Published On:August 2025

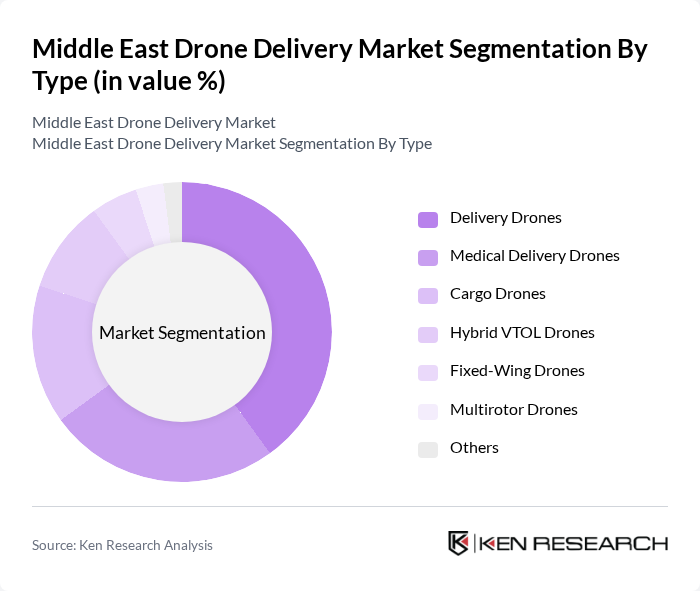

By Type:The market is segmented into various types of drones, including Delivery Drones, Medical Delivery Drones, Cargo Drones, Hybrid VTOL Drones, Fixed-Wing Drones, Multirotor Drones, and Others. Delivery Drones are leading the market due to their versatility and widespread application in e-commerce, retail, and last-mile logistics. Medical Delivery Drones are gaining traction, especially for rapid transport of medical supplies to remote or inaccessible areas. Demand for Cargo Drones is increasing as logistics companies and industrial sectors seek to optimize supply chains and reduce delivery times .

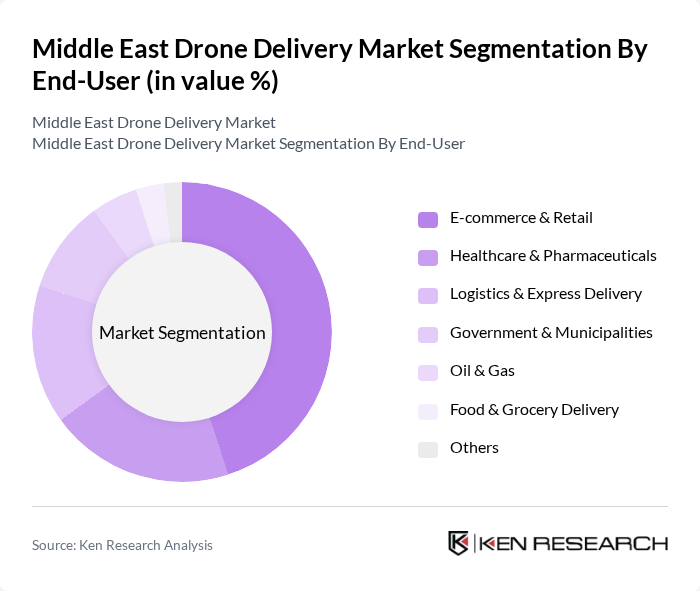

By End-User:The end-user segmentation includes E-commerce & Retail, Healthcare & Pharmaceuticals, Logistics & Express Delivery, Government & Municipalities, Oil & Gas, Food & Grocery Delivery, and Others. The E-commerce & Retail sector is the dominant end-user, driven by the increasing consumer preference for fast and convenient delivery options and the rapid expansion of online shopping. The Healthcare sector is also significant, particularly for medical supply deliveries, which have become crucial during health crises and for reaching remote communities .

The Middle East Drone Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as SZ DJI Technology Co., Ltd., FalconViz, Matternet, Zipline, Israel Aerospace Industries Ltd., Parrot SA, AeroVironment Inc., Wing (Alphabet Inc.), Flytrex, Skyports, EHang, Drone Delivery Canada, Skycart, Manna Drone Delivery, Gulf Navigation (Wings Logistics Hub JV) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East drone delivery market appears promising, driven by technological advancements and increasing urbanization. As cities expand and e-commerce continues to grow, the demand for efficient delivery solutions will rise. Furthermore, the integration of drones into smart city initiatives is expected to enhance logistics capabilities. Companies are likely to invest in partnerships with logistics firms, facilitating the development of specialized drone services tailored to meet diverse consumer needs, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Delivery Drones Medical Delivery Drones Cargo Drones Hybrid VTOL Drones Fixed-Wing Drones Multirotor Drones Others |

| By End-User | E-commerce & Retail Healthcare & Pharmaceuticals Logistics & Express Delivery Government & Municipalities Oil & Gas Food & Grocery Delivery Others |

| By Application | Package Delivery Medical Supply Delivery Food & Beverage Delivery Emergency Response & Disaster Relief Infrastructure & Asset Delivery Others |

| By Delivery Distance | Short Range (<10 km) Medium Range (10–50 km) Long Range (>50 km) Others |

| By Payload Capacity | Less than 5 kg kg to 10 kg kg to 20 kg More than 20 kg Others |

| By Country | Saudi Arabia United Arab Emirates Israel Qatar Turkey Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Drone Delivery Services | 60 | Healthcare Logistics Managers, Pharmacy Directors |

| E-commerce Drone Delivery Operations | 90 | E-commerce Operations Managers, Supply Chain Analysts |

| Food Delivery Drone Services | 55 | Restaurant Owners, Delivery Service Coordinators |

| Government Regulatory Bodies | 40 | Aviation Regulators, Policy Makers |

| Drone Technology Providers | 45 | Product Development Managers, Technical Engineers |

The Middle East Drone Delivery Market is valued at approximately USD 1.3 billion, driven by advancements in drone technology, increased demand for efficient delivery solutions, and the growth of e-commerce in the region.