Region:Middle East

Author(s):Dev

Product Code:KRAB4232

Pages:95

Published On:October 2025

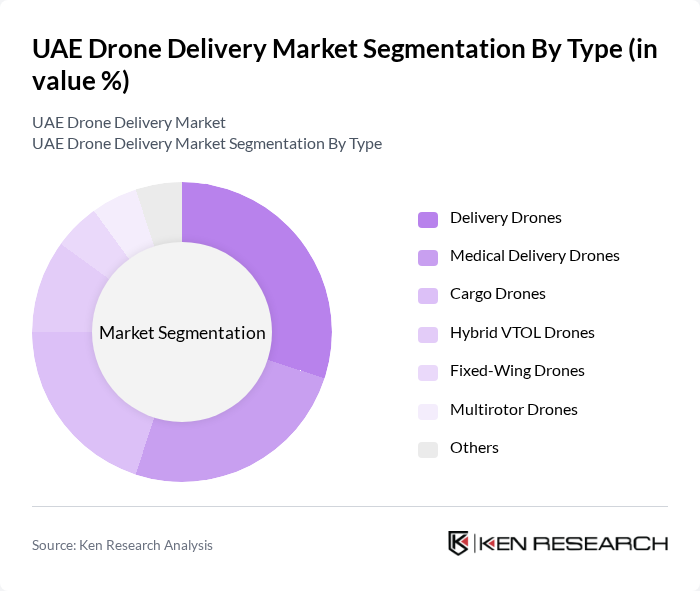

By Type:The market is segmented into various types of drones, including Delivery Drones, Medical Delivery Drones, Cargo Drones, Hybrid VTOL Drones, Fixed-Wing Drones, Multirotor Drones, and Others. Each type serves specific purposes, catering to different industry needs and consumer demands. Industry reports confirm segmentation by drone type (multi-rotor, fixed-wing, hybrid), payload capacity, range, and operation mode (remotely piloted, partially autonomous, fully autonomous), but do not provide specific market share percentages by sub-type.

The Delivery Drones segment is currently dominating the market due to the increasing demand for fast and efficient delivery services, particularly in the e-commerce sector. These drones are designed for short-range deliveries, making them ideal for urban environments. The Medical Delivery Drones segment is also gaining traction, especially for transporting medical supplies and vaccines, which has become crucial during health crises. The growing acceptance of drone technology among consumers and businesses is driving the expansion of these segments.

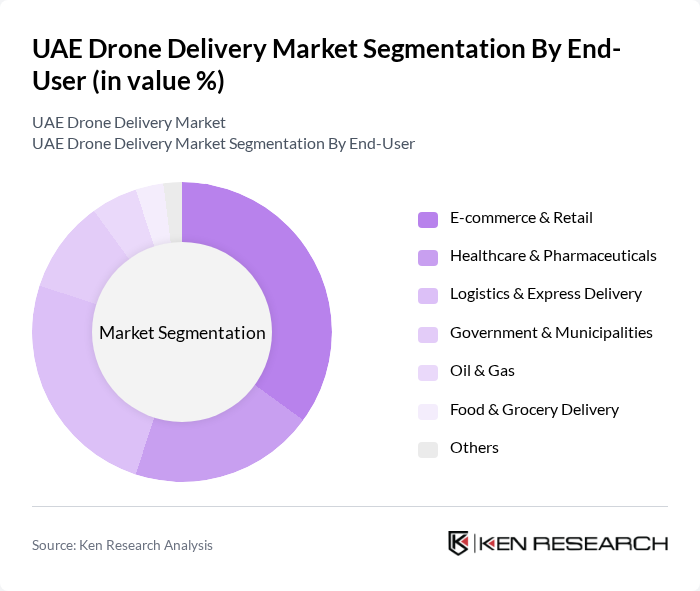

By End-User:The market is segmented by end-users, including E-commerce & Retail, Healthcare & Pharmaceuticals, Logistics & Express Delivery, Government & Municipalities, Oil & Gas, Food & Grocery Delivery, and Others. Each end-user category has unique requirements and applications for drone delivery services. Available data confirms segmentation by application (retail & e-commerce, healthcare, food & beverages, logistics & transportation, military & defense, agriculture), but does not specify exact market share percentages by end-user.

The E-commerce & Retail segment is the leading end-user in the market, driven by the surge in online shopping and the demand for quick delivery options. This segment benefits from the convenience and efficiency that drone delivery offers, allowing retailers to enhance customer satisfaction. The Healthcare & Pharmaceuticals segment is also significant, particularly for urgent deliveries of medical supplies and medications, which have become increasingly important in recent years.

The UAE Drone Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Group, Emirates SkyCargo, Flytrex, Zipline, Drone Delivery Canada Corp., United Parcel Service Inc. (UPS), Amazon.com Inc. (Amazon Prime Air), Wing (Alphabet Inc.), Matternet, Skyports, Airbus SE, Boeing Co., FedEx Corp., Keeta Drone, EHang contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE drone delivery market appears promising, driven by technological advancements and increasing consumer demand for rapid services. As the government continues to enhance regulatory frameworks, more businesses are likely to invest in drone technology. Additionally, the integration of drones into smart city initiatives will further streamline logistics operations. The focus on sustainability will also encourage the development of eco-friendly delivery solutions, positioning the UAE as a leader in innovative logistics.

| Segment | Sub-Segments |

|---|---|

| By Type | Delivery Drones Medical Delivery Drones Cargo Drones Hybrid VTOL Drones Fixed-Wing Drones Multirotor Drones Others |

| By End-User | E-commerce & Retail Healthcare & Pharmaceuticals Logistics & Express Delivery Government & Municipalities Oil & Gas Food & Grocery Delivery Others |

| By Application | Package Delivery Medical Supply Delivery Food & Beverage Delivery Emergency Response & Disaster Relief Infrastructure & Asset Delivery Others |

| By Distribution Mode | Direct Sales Online Sales Retail Partnerships Third-party Logistics Others |

| By Payload Capacity | Less than 5 kg kg to 10 kg kg to 20 kg More than 20 kg |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing Discount Pricing |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Delivery Services | 50 | Operations Managers, Delivery Coordinators |

| Healthcare Logistics | 60 | Pharmacy Managers, Supply Chain Directors |

| E-commerce Delivery Solutions | 80 | eCommerce Managers, Logistics Analysts |

| Urban Drone Regulations | 40 | Regulatory Officials, Policy Advisors |

| Drone Technology Providers | 70 | Product Development Managers, Technical Leads |

The UAE Drone Delivery Market is valued at approximately USD 17 million, driven by advancements in drone technology, increased demand for efficient delivery solutions, and the growth of e-commerce. This market is expected to expand further as technology and infrastructure improve.