Region:Europe

Author(s):Rebecca

Product Code:KRAD0194

Pages:95

Published On:August 2025

By Type:The ice cream market is segmented into impulse ice cream, take-home ice cream, artisanal ice cream, gelato, sorbet, frozen yogurt, vegan/plant-based ice cream, and others. Impulse ice cream includes single-serve products such as cones, bars, and sticks, typically purchased for immediate consumption. Take-home ice cream covers larger packs like tubs and cartons for home use. Artisanal ice cream refers to small-batch, handcrafted products often sold in specialty shops. Gelato is an Italian-style ice cream known for its dense texture and intense flavor. Sorbet is a dairy-free frozen dessert made from fruit and sugar. Frozen yogurt offers a tangy, lower-fat alternative to traditional ice cream. Vegan/plant-based ice cream uses non-dairy bases like almond, coconut, or oat milk. The 'others' category includes niche and innovative formats, such as protein-enriched or functional ice creams.

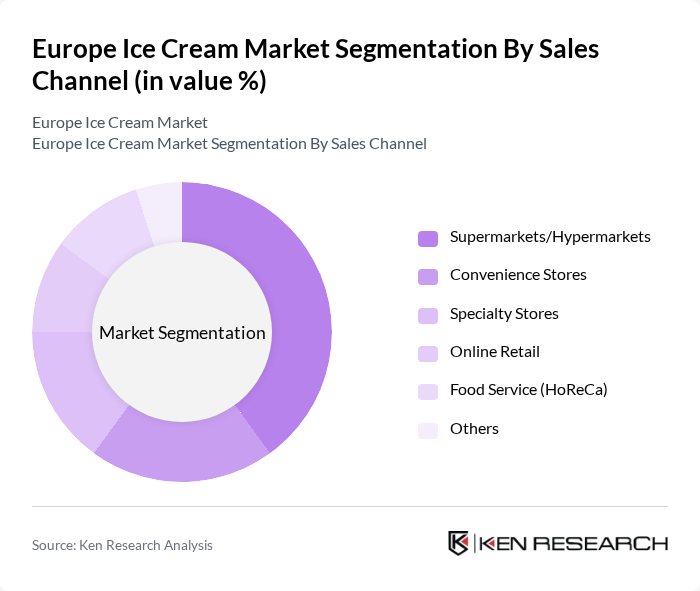

By Sales Channel:The sales channels for ice cream include supermarkets/hypermarkets, convenience stores, specialty stores, online retail, food service (HoReCa), and others. Supermarkets/hypermarkets remain the leading channel due to their extensive reach and variety, while convenience stores cater to impulse purchases. Specialty stores focus on premium and artisanal offerings. Online retail is gaining traction for both direct-to-consumer and subscription models. Food service (HoReCa) encompasses restaurants, cafes, and catering services, which increasingly feature premium and plant-based ice cream options. The 'others' channel includes vending machines and mobile vendors.

The Europe Ice Cream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever plc, Nestlé S.A., Froneri Ltd., General Mills, Inc. (Häagen-Dazs, Yoplait), Mars, Incorporated, Lotte Wellfood Co., Ltd. (formerly Lotte Confectionery), DMK Group (Mövenpick, Milram), Valio Ltd., Emmi Group, Granarolo S.p.A., Amul (Gujarat Cooperative Milk Marketing Federation), Arla Foods amba, R&R Ice Cream (now part of Froneri), Yasso, Inc., Talenti Gelato (Unilever brand) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European ice cream market appears promising, driven by evolving consumer preferences and innovative product offerings. The trend towards premiumization is expected to continue, with consumers increasingly seeking unique flavors and high-quality ingredients. Additionally, the rise of health-conscious choices will likely lead to further development of low-calorie and dairy-free options. As e-commerce continues to grow, brands that effectively leverage online platforms will enhance their market presence and reach a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Impulse Ice Cream Take-Home Ice Cream Artisanal Ice Cream Gelato Sorbet Frozen Yogurt Vegan/Plant-Based Ice Cream Others |

| By Sales Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Stores Online Retail Food Service (HoReCa) Others |

| By Flavor | Chocolate Vanilla Fruit (e.g., Strawberry, Berry, Mango, etc.) Nut-Based (e.g., Pistachio, Hazelnut, etc.) Coffee/Coffee-Based Others (Salted Caramel, Cookies, etc.) |

| By Packaging Type | Cups Cones Tubs & Bricks Bars & Sticks Pints Others |

| By Region | Western Europe (UK, Germany, France, etc.) Northern Europe (Sweden, Denmark, Finland, etc.) Southern Europe (Italy, Spain, Greece, etc.) Eastern Europe (Poland, Russia, etc.) Rest of Europe |

| By Consumer Age Group | Children Teenagers Adults Seniors |

| By Price Range | Premium Mid-Range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Ice Cream | 150 | General Consumers, Ice Cream Enthusiasts |

| Retail Insights on Ice Cream Sales | 100 | Store Managers, Category Buyers |

| Manufacturing Trends in Ice Cream Production | 80 | Production Managers, Quality Control Officers |

| Distribution Channels for Ice Cream Products | 70 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations in Ice Cream | 40 | Product Development Managers, Marketing Managers |

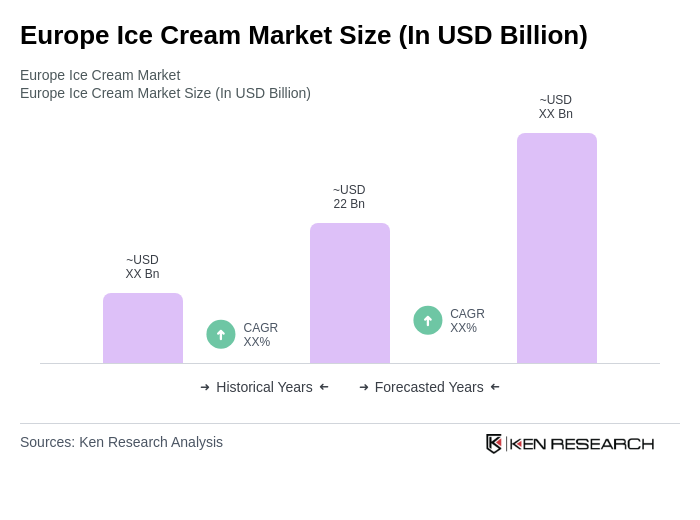

The Europe Ice Cream Market is valued at approximately USD 22 billion, driven by increasing consumer demand for premium flavors and healthier options, alongside the expansion of distribution channels such as online retail and foodservice.