Region:Europe

Author(s):Dev

Product Code:KRAC0524

Pages:87

Published On:August 2025

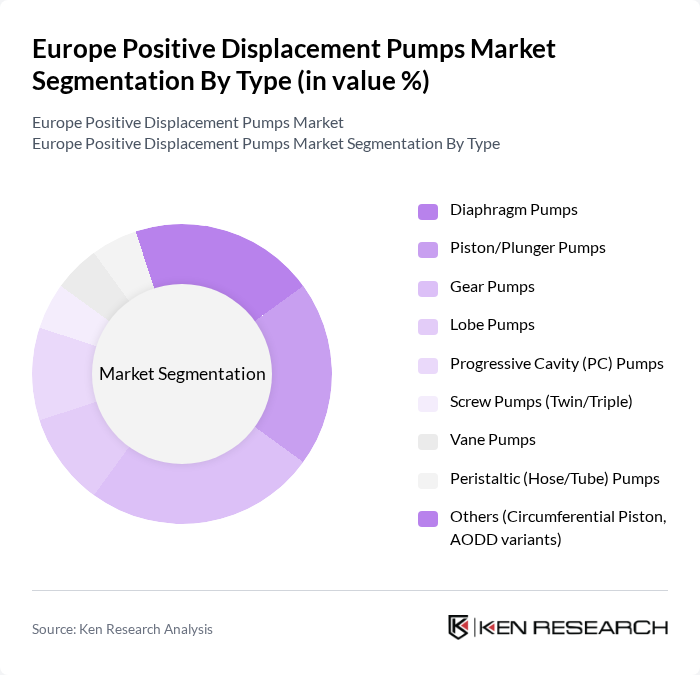

By Type:The positive displacement pumps market can be segmented into various types, including diaphragm pumps, piston/plunger pumps, gear pumps, lobe pumps, progressive cavity pumps, screw pumps, vane pumps, peristaltic pumps, and others. Each type serves specific applications and industries, contributing to the overall market dynamics.

The gear pumps segment is currently dominating the market due to their versatility and efficiency in handling various fluids, including viscous and shear-sensitive materials. Their widespread application in oil and gas, chemicals, and food processing has led to increased adoption. Additionally, advancements in sealing, hygienic designs, and energy-efficient configurations, coupled with rising automation and condition monitoring adoption in process industries, are reinforcing uptake among end users.

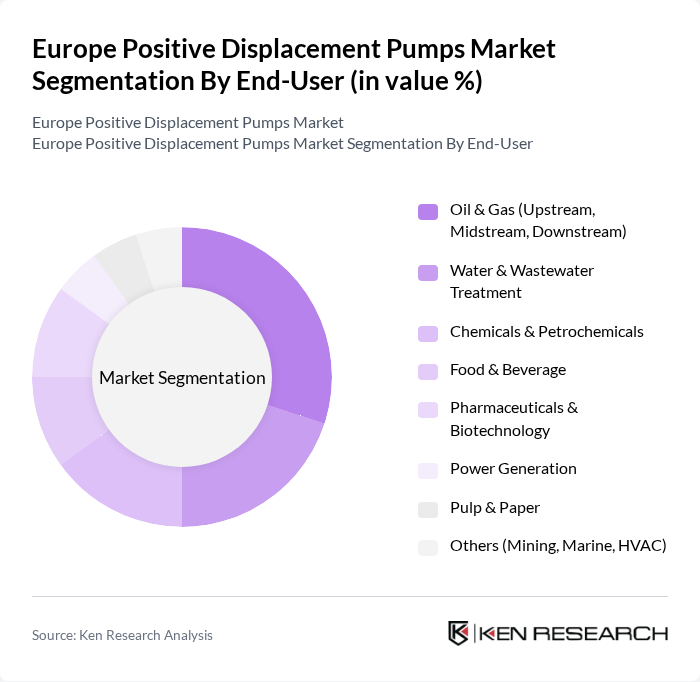

By End-User:The positive displacement pumps market is segmented by end-user industries, including oil and gas, water and wastewater treatment, chemicals and petrochemicals, food and beverage, pharmaceuticals and biotechnology, power generation, pulp and paper, and others. Each sector has unique requirements that influence the demand for specific pump types.

The oil and gas sector is the leading end-user of positive displacement pumps, driven by requirements for dosing, injection, transfer, and metering across upstream, midstream, and downstream operations, while regulatory compliance and safety standards intensify reliability and maintenance needs. Concurrently, Europe’s water and wastewater treatment investments and tightening environmental rules sustain robust deployment of metering, sludge, and chemical dosing pumps across utilities.

The Europe Positive Displacement Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos Holding A/S, KSB SE & Co. KGaA, Flowserve Corporation, Sulzer Ltd, Xylem Inc., Ebara Corporation, ITT Inc., Alfa Laval AB, The Weir Group PLC, Ingersoll Rand (ARO), Viking Pump, Inc. (IDEX Corporation), PSG Dover (Incl. Wilden, Blackmer, Abaque), NETZSCH Pumpen & Systeme GmbH, Seepex GmbH (Ingersoll Rand), and Verder Group (Verder Liquids) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the positive displacement pumps market in Europe appears promising, driven by technological advancements and increasing environmental regulations. As industries prioritize energy efficiency and sustainability, the demand for innovative pumping solutions is expected to rise. Additionally, the integration of IoT technologies will enhance operational efficiency, allowing for real-time monitoring and predictive maintenance. Companies that adapt to these trends and invest in smart technologies will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Diaphragm Pumps Piston/Plunger Pumps Gear Pumps Lobe Pumps Progressive Cavity (PC) Pumps Screw Pumps (Twin/Triple) Vane Pumps Peristaltic (Hose/Tube) Pumps Others (Circumferential Piston, AODD variants) |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Water & Wastewater Treatment Chemicals & Petrochemicals Food & Beverage Pharmaceuticals & Biotechnology Power Generation Pulp & Paper Others (Mining, Marine, HVAC) |

| By Application | Dosing/Metering Transfer/Loading-Unloading Sludge/Slurry Handling High-Pressure Injection Hygienic/Sanitary Processing Viscous/Shear-Sensitive Fluids Others |

| By Distribution Channel | Direct (OEM/Tier-1) Authorized Distributors/Channel Partners EPC/System Integrators Online/ E-commerce Others (Aftermarket/Service) |

| By Region | Germany United Kingdom France Italy Spain Nordics (Sweden, Denmark, Finland, Norway) Benelux (Belgium, Netherlands, Luxembourg) Central & Eastern Europe (Poland, Czech Republic, Hungary, Others) Rest of Europe |

| By Price Range | Entry-Level/Standard Mid-Range/Engineered Premium/Special Purpose |

| By Technology | Rotary (Gear, Lobe, Vane, Screw, Progressive Cavity) Reciprocating (Diaphragm, Piston/Plunger) Air-Operated Double Diaphragm (AODD) Smart/Connected (IIoT-enabled monitoring, VFD integration) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 110 | Process Engineers, Operations Managers |

| Water Treatment Facilities | 90 | Plant Managers, Environmental Engineers |

| Food & Beverage Industry | 70 | Production Supervisors, Quality Control Managers |

| Chemical Processing Plants | 90 | Maintenance Managers, Procurement Specialists |

| Agricultural Applications | 60 | Agricultural Engineers, Farm Equipment Managers |

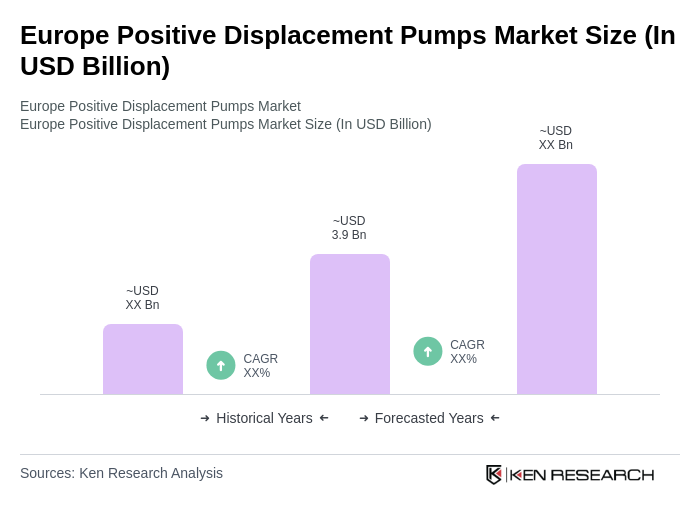

The Europe Positive Displacement Pumps Market is valued at approximately USD 3.9 billion, reflecting a robust demand driven by various industries such as oil and gas, water treatment, chemicals, food and beverage, and pharmaceuticals.