Region:Global

Author(s):Rebecca

Product Code:KRAB0311

Pages:84

Published On:August 2025

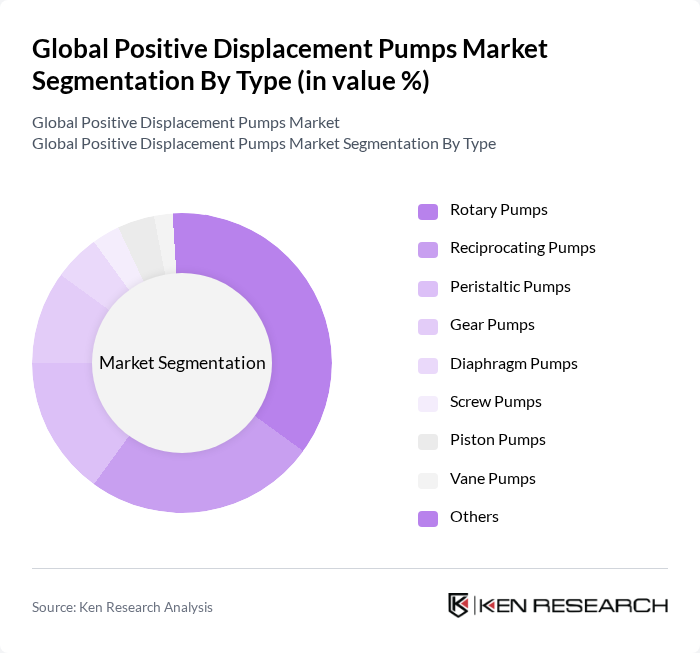

By Type:The positive displacement pumps market is segmented into various types, including rotary pumps, reciprocating pumps, peristaltic pumps, gear pumps, diaphragm pumps, screw pumps, piston pumps, vane pumps, and others. Among these, rotary pumps account for the largest share due to their efficiency and versatility in handling different fluids. Reciprocating pumps also hold a significant share, particularly in applications requiring high pressure and precise flow control. The demand for peristaltic pumps is increasing in sectors like pharmaceuticals and food processing, where hygiene and contamination control are critical.

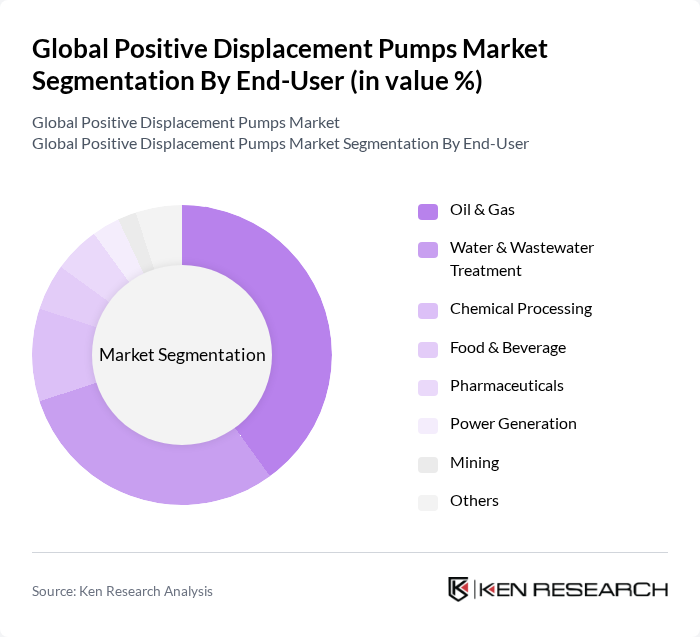

By End-User:The end-user segmentation of the positive displacement pumps market includes oil and gas, water and wastewater treatment, chemical processing, food and beverage, pharmaceuticals, power generation, mining, and others. The oil and gas sector remains the largest consumer of positive displacement pumps, driven by the need for efficient fluid transfer in exploration and production activities. Water and wastewater treatment is also a significant segment, as municipalities and industries seek reliable pumping solutions to manage water resources effectively. The chemical processing industry is another key segment, leveraging positive displacement pumps for handling high-viscosity and corrosive fluids.

The Global Positive Displacement Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos Holding A/S, Flowserve Corporation, KSB SE & Co. KGaA, ITT Inc., Sulzer AG, Xylem Inc., Ebara Corporation, Pentair plc, Alfa Laval AB, ARO (Ingersoll Rand), Graco Inc., Viking Pump, Inc., Haskel International, Inc., Cat Pumps, Tuthill Corporation, Schlumberger Limited, Parker Hannifin Corporation, SPX FLOW, Inc., Honeywell International Inc., Weir Group PLC, Wilo SE, Dover Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the positive displacement pumps market appears promising, driven by increasing investments in infrastructure and technological innovations. As industries prioritize energy efficiency and sustainability, the demand for advanced pumping solutions is expected to rise. Furthermore, the integration of automation and IoT technologies will enhance operational efficiency, making these pumps more appealing. Companies that adapt to these trends and invest in R&D will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary Pumps Reciprocating Pumps Peristaltic Pumps Gear Pumps Diaphragm Pumps Screw Pumps Piston Pumps Vane Pumps Others |

| By End-User | Oil & Gas Water & Wastewater Treatment Chemical Processing Food & Beverage Pharmaceuticals Power Generation Mining Others |

| By Application | Industrial Processes HVAC Systems Fire Protection Systems Agricultural Irrigation Hygienic Applications Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Capacity | Low Capacity Pumps Medium Capacity Pumps High Capacity Pumps |

| By Technology | Electric Pumps Hydraulic Pumps Pneumatic Pumps Others |

| By Raw Material | Cast Iron Stainless Steel Bronze Polycarbonate Others |

| By Pump Characteristics | Standard Pumps Engineered Pumps Special Purpose Pumps |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Industry Applications | 100 | Process Engineers, Operations Managers |

| Water Treatment Facilities | 80 | Plant Managers, Environmental Engineers |

| Food & Beverage Processing | 60 | Quality Control Managers, Production Supervisors |

| Chemical Processing Plants | 90 | Maintenance Managers, Chemical Engineers |

| Pharmaceutical Manufacturing | 50 | Regulatory Affairs Specialists, Production Managers |

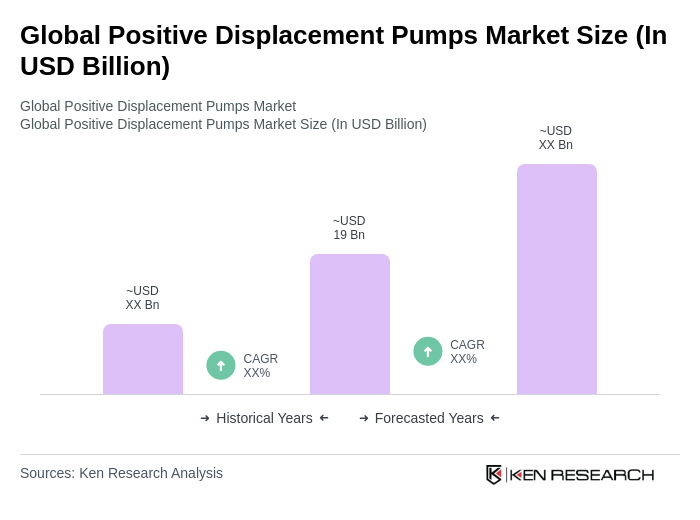

The Global Positive Displacement Pumps Market is valued at approximately USD 19 billion, driven by the increasing demand for efficient fluid handling solutions across various industries, including oil and gas, water treatment, and chemical processing.