Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3135

Pages:94

Published On:October 2025

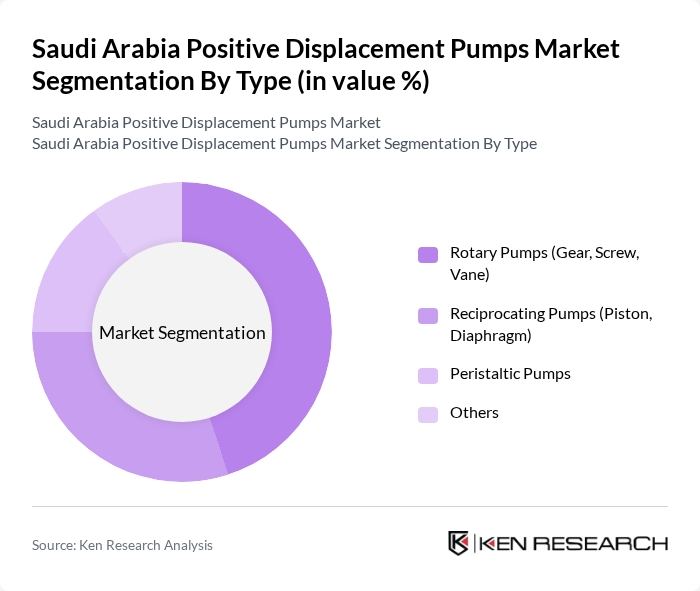

By Type:The positive displacement pumps market can be segmented into various types, including rotary pumps, reciprocating pumps, peristaltic pumps, and others. Among these, rotary pumps, which include gear, screw, and vane types, are particularly popular due to their efficiency in handling various fluids and their widespread application in the oil and gas sector. Reciprocating pumps, including piston and diaphragm types, are also significant, especially in applications requiring high pressure and precise flow control.

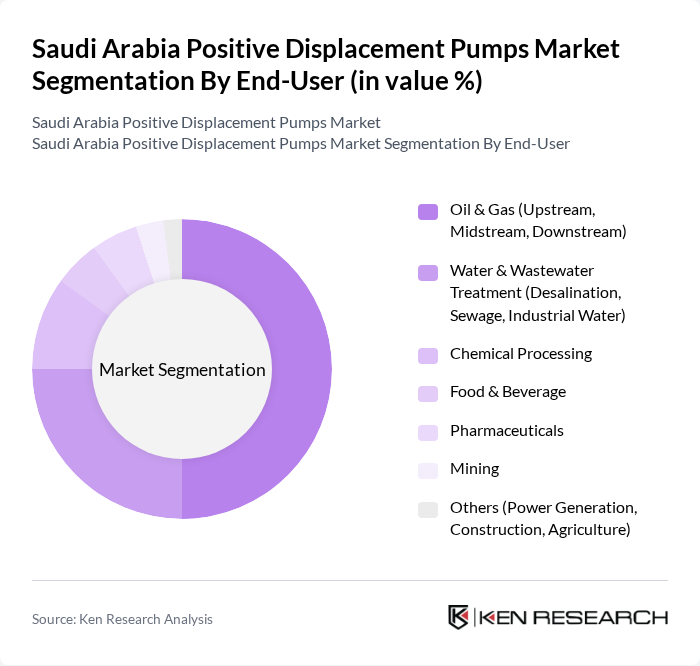

By End-User:The end-user segmentation of the positive displacement pumps market includes oil and gas, water and wastewater treatment, chemical processing, food and beverage, pharmaceuticals, mining, and others. The oil and gas sector is the leading end-user, driven by the need for efficient fluid handling in upstream, midstream, and downstream operations. Water and wastewater treatment is also a significant segment, particularly with the increasing focus on desalination and sewage treatment in the region, supported by substantial government investments and the expansion of the Saline Water Conversion Corporation and National Water Company infrastructure. Chemical processing, food and beverage, and pharmaceuticals also contribute to demand, though to a lesser extent, reflecting the diversified industrial base of the Kingdom.

The Saudi Arabia Positive Displacement Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos Holding A/S, KSB SE & Co. KGaA, Flowserve Corporation, Sulzer Ltd., ITT Inc., Xylem Inc., Ebara Corporation, Pentair plc, Alfa Laval AB, ARO (Ingersoll Rand), Viking Pump, Inc., Gorman-Rupp Company, Weir Group PLC, SPX Flow, Inc., Tuthill Corporation, Saudi Pump Factory, Al Rushaid Group, Al-Khorayef Group, Al Jazira Pumps, Al Kifah Holding Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the positive displacement pumps market in Saudi Arabia appears promising, driven by technological advancements and increasing demand for energy-efficient solutions. As industries adopt smart technologies, the integration of IoT in pump monitoring is expected to enhance operational efficiency. Furthermore, the government's commitment to diversifying the economy and investing in renewable energy projects will likely create new opportunities for positive displacement pumps, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary Pumps (Gear, Screw, Vane) Reciprocating Pumps (Piston, Diaphragm) Peristaltic Pumps Others |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Water & Wastewater Treatment (Desalination, Sewage, Industrial Water) Chemical Processing Food & Beverage Pharmaceuticals Mining Others (Power Generation, Construction, Agriculture) |

| By Application | Fluid Transfer Metering (Chemical Dosing, Additive Injection) Pressure Boosting Recirculation Others |

| By Distribution Channel | Direct Sales (OEM, EPC) Distributors & Dealers Online Sales Retail Others |

| By Region | Eastern Province (Dammam, Al Khobar, Jubail – Oil & Gas Hub) Central Region (Riyadh – Urban & Industrial) Western Region (Jeddah, Yanbu – Desalination, Petrochemicals) Southern Region Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Electric Pumps Hydraulic Pumps Pneumatic Pumps Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 60 | Project Managers, Operations Engineers |

| Water Treatment Facilities | 50 | Facility Managers, Environmental Engineers |

| Manufacturing Industry | 40 | Production Managers, Maintenance Supervisors |

| Agricultural Sector | 40 | Agronomists, Irrigation Specialists |

| Construction Projects | 50 | Site Managers, Procurement Officers |

The Saudi Arabia Positive Displacement Pumps Market is valued at approximately USD 135 million, reflecting a five-year historical analysis that highlights the increasing demand for efficient fluid transfer solutions across various industries, including oil and gas, water treatment, and chemical processing.