Europe Poultry Feed Market Overview

- The Europe Poultry Feed Market is valued at approximately USD 30 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for poultry products, rising consumer awareness regarding protein-rich diets, and advancements in feed formulations that enhance poultry health and productivity. Recent trends include a shift toward sustainable and specialty feed ingredients, as well as the adoption of precision nutrition technologies to improve feed efficiency and animal welfare .

- Countries such as Germany, France, and the United Kingdom dominate the market due to their robust poultry farming sectors, advanced agricultural practices, and significant investments in feed technology. These nations have established themselves as key players in poultry production, contributing to the overall growth of the feed market. Additionally, the presence of large integrated poultry producers and feed manufacturers further strengthens their market position .

- In 2023, the European Union implemented regulations aimed at reducing antibiotic use in animal feed, promoting the use of alternative feed additives. This regulation is part of a broader strategy to enhance food safety and animal welfare, ensuring that poultry feed meets stringent health standards. The trend toward plant-based and specialty feed ingredients is also being encouraged by regulatory boards to achieve both feed safety and sustainability .

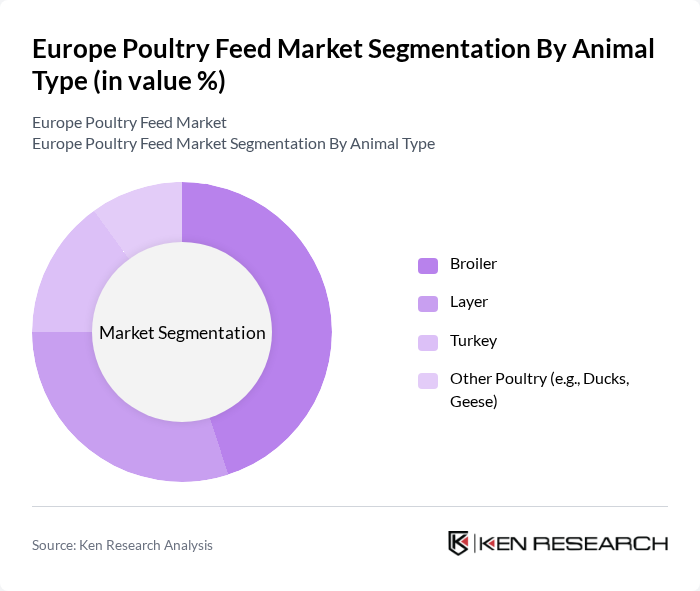

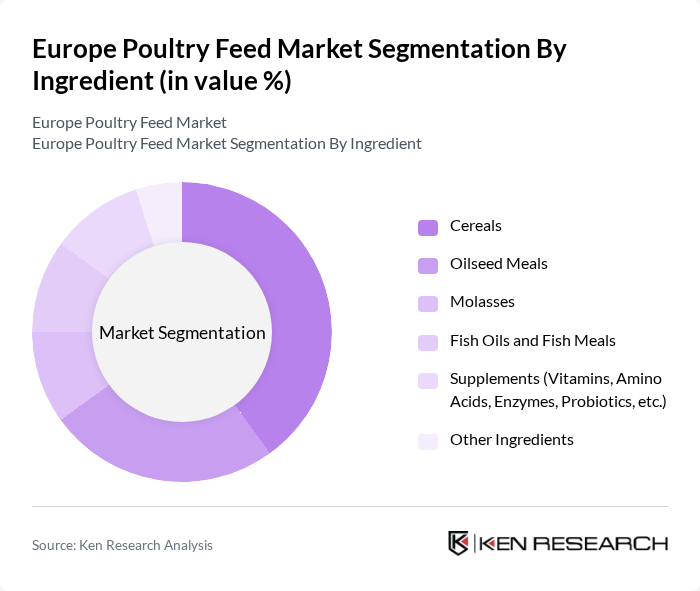

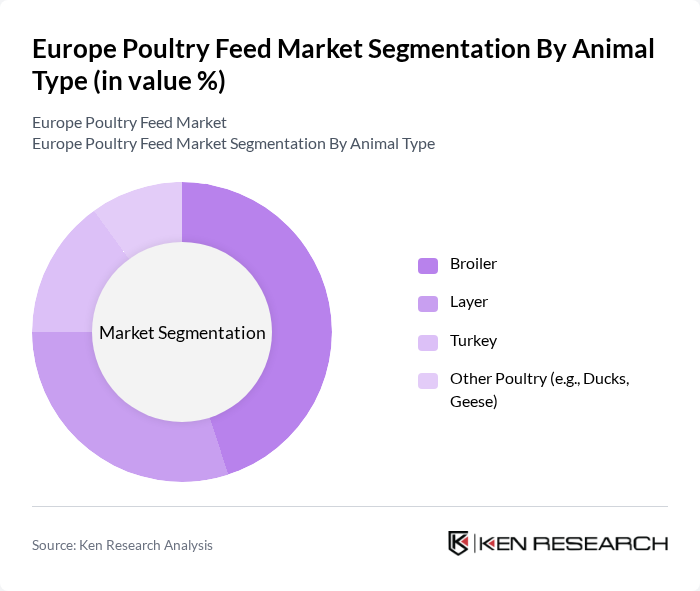

Europe Poultry Feed Market Segmentation

By Animal Type:The poultry feed market can be segmented into four main animal types: Broiler, Layer, Turkey, and Other Poultry (e.g., Ducks, Geese). Among these, the Broiler segment is the most significant due to the high demand for chicken meat, which is a staple protein source in many European diets. The Layer segment also holds a substantial share, driven by the increasing consumption of eggs. The Turkey segment is growing steadily, while Other Poultry types are niche markets with specific consumer bases. These segmentation trends are consistent with the latest industry analyses .

By Ingredient:The market can also be segmented based on the ingredients used in poultry feed, including Cereals, Oilseed Meals, Molasses, Fish Oils and Fish Meals, Supplements (Vitamins, Amino Acids, Enzymes, Probiotics, etc.), and Other Ingredients. Cereals are the dominant ingredient due to their high energy content, followed by Oilseed Meals, which provide essential proteins. Supplements are increasingly being used to enhance the nutritional profile of feeds, reflecting a trend towards more health-conscious poultry farming. The move toward plant-based and specialty feed ingredients is also notable .

Europe Poultry Feed Market Competitive Landscape

The Europe Poultry Feed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., Archer Daniels Midland Company (ADM), Alltech, Inc., Nutreco N.V., De Heus Animal Nutrition, ForFarmers N.V., BASF SE, Evonik Industries AG, DSM-Firmenich (formerly DSM Nutritional Products), Land O'Lakes, Inc. (Purina Animal Nutrition), Trouw Nutrition (a Nutreco company), Beneo GmbH, Kemin Industries, Inc., Phibro Animal Health Corporation, and Adisseo contribute to innovation, geographic expansion, and service delivery in this space.

Europe Poultry Feed Market Industry Analysis

Growth Drivers

- Increasing Demand for Poultry Products:The European poultry market is projected to reach approximately 13.5 million metric tons in future, driven by rising consumer preferences for poultry as a primary protein source. The per capita consumption of poultry in Europe is expected to increase to 25.5 kg, reflecting a growing trend towards healthier eating habits. This surge in demand is supported by the increasing population and urbanization, which are expected to contribute to higher poultry product consumption across the region.

- Rising Awareness of Animal Nutrition:In future, the European animal nutrition market is anticipated to exceed €10 billion, highlighting a significant shift towards improved feed quality and nutritional value. Farmers are increasingly investing in specialized poultry feed formulations that enhance growth rates and overall health. This trend is further supported by educational initiatives from agricultural organizations, emphasizing the importance of balanced nutrition in poultry farming for better yield and profitability.

- Technological Advancements in Feed Production:The integration of advanced technologies in feed production is expected to enhance efficiency and reduce costs. In future, the adoption of automation and precision feeding technologies is projected to increase by 20%, leading to improved feed conversion ratios. Innovations such as feed additives and probiotics are gaining traction, contributing to healthier poultry and higher production rates, thus driving the overall growth of the poultry feed market in Europe.

Market Challenges

- Fluctuating Raw Material Prices:The volatility in raw material prices poses a significant challenge for the poultry feed industry. In future, the cost of key ingredients like corn and soybean meal is expected to fluctuate between €200 and €300 per metric ton, influenced by global supply chain disruptions and climate change. This unpredictability can lead to increased production costs, affecting profit margins for poultry farmers and feed manufacturers alike.

- Stringent Regulatory Compliance:The European Union's regulatory framework for animal feed is becoming increasingly stringent, with compliance costs projected to rise by 15% in future. Regulations concerning feed safety, labeling, and traceability are critical for market access. Companies must invest in quality assurance and compliance measures, which can strain resources, particularly for smaller producers, thereby impacting their competitiveness in the market.

Europe Poultry Feed Market Future Outlook

The future of the Europe poultry feed market appears promising, driven by a combination of technological advancements and a growing focus on sustainability. As consumer preferences shift towards organic and sustainably sourced products, the demand for innovative feed solutions is expected to rise. Additionally, the expansion of digital solutions in feed management will enhance operational efficiencies, allowing producers to optimize feed formulations and reduce waste, ultimately supporting market growth in the coming years.

Market Opportunities

- Growth in Organic Poultry Feed Segment:The organic poultry feed segment is projected to grow significantly, with an estimated market value of €1.5 billion in future. This growth is driven by increasing consumer demand for organic products, as health-conscious consumers seek poultry raised on organic feed, presenting a lucrative opportunity for feed manufacturers to innovate and expand their product lines.

- Expansion into Emerging Markets:Emerging markets in Eastern Europe are expected to see a surge in poultry production, with an annual growth rate of 5% projected in future. This expansion presents opportunities for established feed companies to enter these markets, leveraging their expertise and product offerings to meet the rising demand for poultry products in these regions.