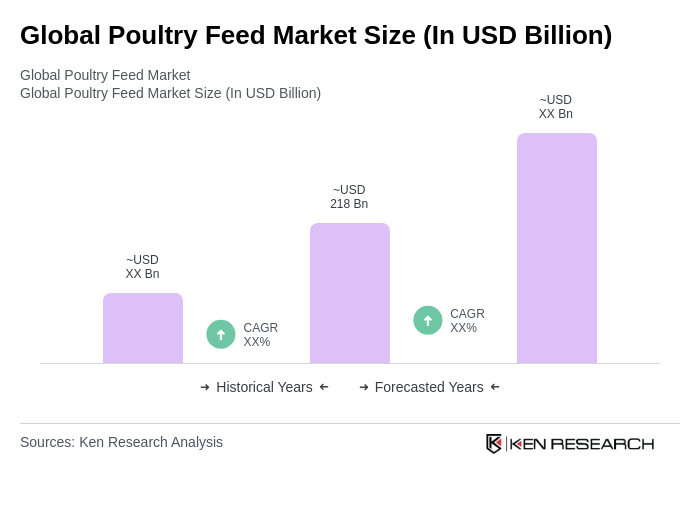

Global Poultry Feed Market Overview

- The Global Poultry Feed Market is valued at USD 218 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for poultry products, rising global population, and the need for protein-rich diets. The market is also influenced by advancements in feed formulation technology, a growing emphasis on sustainable and antibiotic-free feed solutions, and the expansion of international trade agreements in the agriculture sector .

- Key players in this market include the United States, China, and Brazil. The United States leads due to its advanced agricultural infrastructure and large-scale poultry production. China follows closely, driven by its massive population and increasing demand for poultry meat and eggs. Brazil's strong export market and favorable climate for poultry farming also contribute to its significant presence in the global market .

- In 2023, the European Union implemented regulations aimed at reducing antibiotic use in animal feed. These regulations require all feed producers to comply with strict guidelines on antibiotic usage, promoting the adoption of alternative feed additives such as probiotics, enzymes, and organic acids to enhance animal health and growth performance. This initiative is part of a broader strategy to ensure food safety and sustainability in the poultry industry .

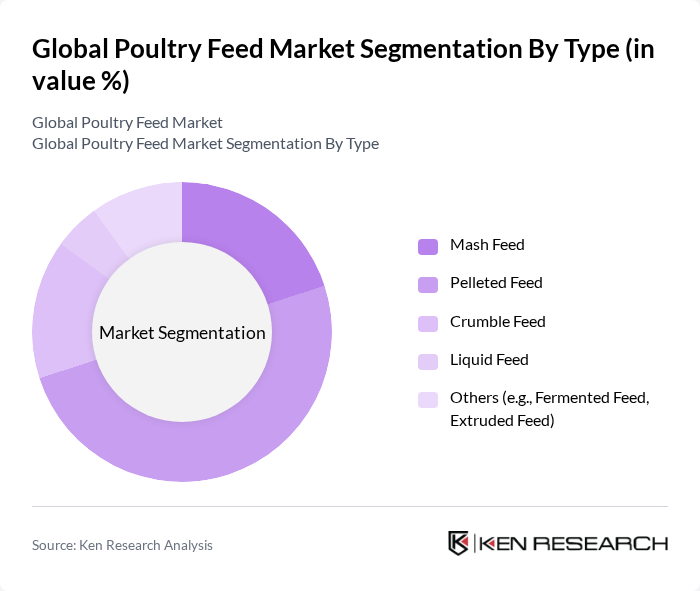

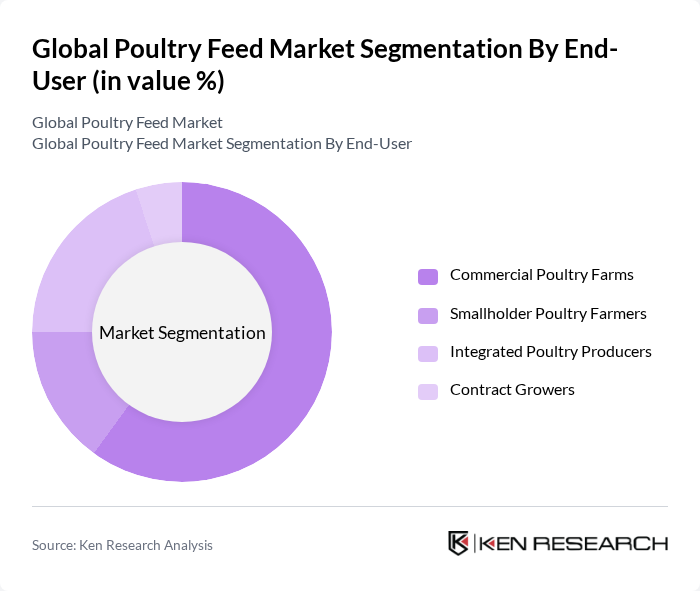

Global Poultry Feed Market Segmentation

By Type:The poultry feed market is segmented into Mash Feed, Pelleted Feed, Crumble Feed, Liquid Feed, and Others (e.g., Fermented Feed, Extruded Feed). Among these, Pelleted Feed is the most dominant due to its ease of handling, improved feed conversion efficiency, and ability to reduce feed wastage. Pelleted Feed is preferred by commercial poultry farms as it enhances nutrient absorption and supports higher productivity, aligning with the industry's focus on efficiency and animal health .

By End-User:The end-user segmentation includes Commercial Poultry Farms, Smallholder Poultry Farmers, Integrated Poultry Producers, and Contract Growers. Commercial Poultry Farms dominate the market due to their large-scale operations and capacity to invest in high-quality, specialized feed formulations. These farms focus on optimizing feed efficiency and nutritional value to maximize growth rates and maintain poultry health, reflecting the industry's emphasis on productivity and food safety .

Global Poultry Feed Market Competitive Landscape

The Global Poultry Feed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., Archer Daniels Midland Company, Alltech, Inc., Nutreco N.V., Charoen Pokphand Foods PCL, Land O'Lakes, Inc., BASF SE, Evonik Industries AG, De Heus Animal Nutrition, ForFarmers N.V., New Hope Liuhe Co., Ltd., Perdue Farms Inc., Tyson Foods, Inc., Groupe Grimaud, Provimi, Wen's Food Group Co., Ltd., Guangdong Haid Group Co., Ltd., Suguna Foods Pvt. Ltd., BRF S.A., Nutriad (Adisseo Group) contribute to innovation, geographic expansion, and service delivery in this space.

Global Poultry Feed Market Industry Analysis

Growth Drivers

- Increasing Demand for Poultry Products:The global poultry meat consumption reached approximately 138 million metric tons in future, driven by rising population and urbanization. The World Bank projects a 1.6% annual growth in global meat consumption in future, particularly in developing regions. This surge in demand for poultry products directly correlates with the need for increased poultry feed production, as farmers strive to meet consumer preferences for affordable protein sources.

- Rising Awareness of Animal Nutrition:The global focus on animal health and nutrition has intensified, with the animal nutrition market valued at $48 billion in future. This awareness is leading to a shift towards high-quality feed formulations that enhance growth rates and feed efficiency. As farmers increasingly recognize the benefits of optimized nutrition, the demand for specialized poultry feed is expected to rise, supporting healthier livestock and improved production outcomes.

- Technological Advancements in Feed Production:Innovations in feed technology, such as precision nutrition and automated feed systems, are revolutionizing poultry feed production. The global feed additives market, which includes these technologies, was valued at $22 billion in future and is projected to grow significantly. These advancements not only improve feed efficiency but also reduce waste, making poultry farming more sustainable and economically viable, thus driving demand for advanced feed solutions.

Market Challenges

- Fluctuating Raw Material Prices:The poultry feed industry faces significant challenges due to volatile raw material prices, particularly for corn and soybean meal, which account for over 70% of feed composition. In future, corn prices averaged $6.80 per bushel, while soybean meal reached $420 per ton. Such fluctuations can severely impact profit margins for feed manufacturers, forcing them to adjust pricing strategies and potentially limiting production capacity.

- Stringent Regulatory Compliance:Compliance with increasingly stringent regulations regarding feed safety and quality poses a challenge for poultry feed manufacturers. In future, the European Union implemented new regulations that require comprehensive testing for contaminants in feed products. These regulations can lead to increased operational costs and necessitate investments in quality assurance processes, which may hinder smaller producers from competing effectively in the market.

Global Poultry Feed Market Future Outlook

The future of the poultry feed market is poised for transformation, driven by sustainability and technological integration. As consumers demand more ethically produced poultry products, feed manufacturers are likely to adopt sustainable practices, including the use of alternative protein sources. Additionally, advancements in digital solutions for feed management will enhance operational efficiency, allowing producers to optimize feed formulations and reduce waste. These trends will shape the market landscape, fostering innovation and growth in the coming years.

Market Opportunities

- Growth in Organic Poultry Feed Segment:The organic poultry feed segment is experiencing rapid growth, with a market value of $6 billion in future. This trend is driven by increasing consumer demand for organic products, which is projected to rise by 11% annually. Producers who invest in organic feed formulations can capitalize on this growing market, appealing to health-conscious consumers and enhancing their brand reputation.

- Innovations in Feed Formulation:The development of innovative feed formulations, including functional ingredients and probiotics, presents significant market opportunities. The feed additives market is expected to grow by $4 billion in future, driven by the demand for enhanced animal performance and health. Companies that focus on research and development in this area can differentiate their products and capture a larger market share.