Region:North America

Author(s):Dev

Product Code:KRAA3035

Pages:93

Published On:August 2025

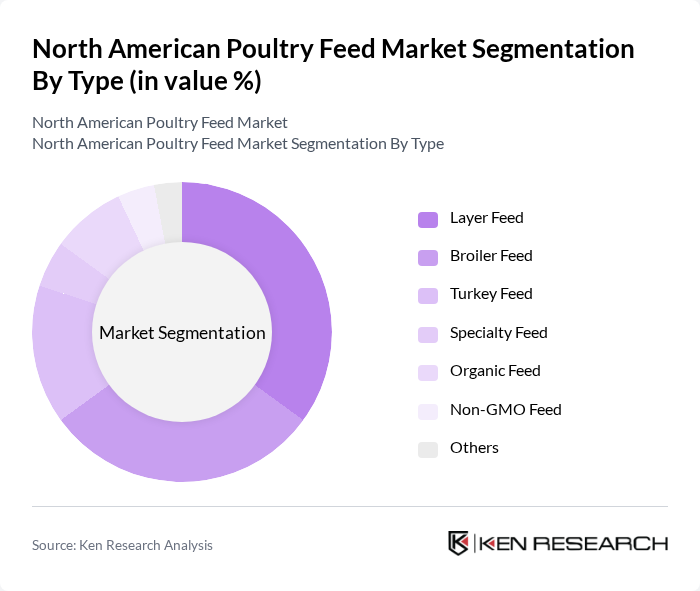

By Type:The poultry feed market is segmented into Layer Feed, Broiler Feed, Turkey Feed, Specialty Feed, Organic Feed, Non-GMO Feed, and Others. Layer Feed remains the most dominant segment, supported by sustained demand for eggs and the expansion of commercial layer farms. Broiler Feed follows closely, reflecting the high consumption of chicken meat across North America. Demand for organic and non-GMO feed is rising as consumers increasingly seek transparency and health-focused options in animal protein sources .

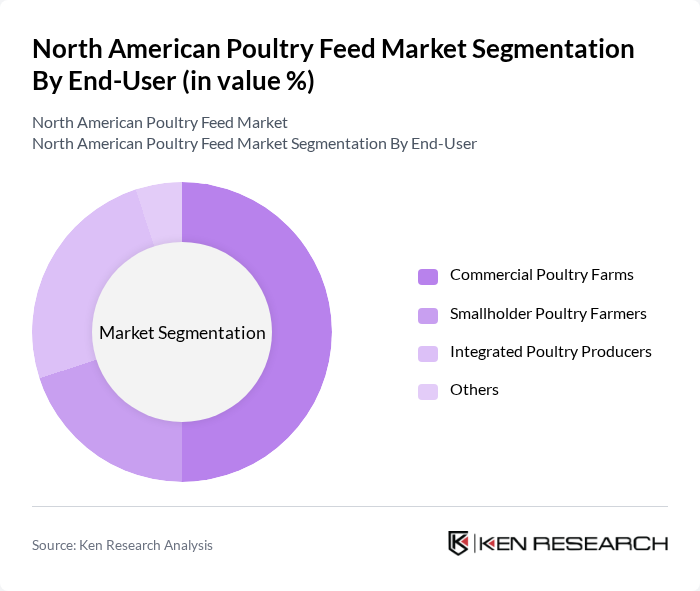

By End-User:End-user segmentation includes Commercial Poultry Farms, Smallholder Poultry Farmers, Integrated Poultry Producers, and Others. Commercial Poultry Farms are the leading segment, reflecting the scale and efficiency of industrial poultry operations in North America. Integrated Poultry Producers also play a significant role by managing the entire value chain from feed production to poultry processing, ensuring consistent product quality and supply chain control .

The North American Poultry Feed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., Archer Daniels Midland Company, Purina Animal Nutrition (Land O'Lakes, Inc.), Alltech, Inc., Nutreco N.V., Land O'Lakes, Inc., Tyson Foods, Inc., Bunge Limited, De Heus Animal Nutrition, Diamond V (Cargill, Inc.), Elanco Animal Health, BASF SE, DSM Nutritional Products, Kemin Industries, Inc., Charoen Pokphand Foods (CPF), and Invivo Group contribute to innovation, geographic expansion, and service delivery in this space .

The North American poultry feed market is poised for significant transformation, driven by a shift towards sustainable practices and technological integration. As consumer preferences evolve, the demand for organic and non-GMO feed is expected to rise, aligning with health-conscious trends. Additionally, advancements in digital feed management systems will enhance operational efficiency. The focus on animal welfare will further shape product offerings, ensuring that the industry adapts to changing consumer expectations while maintaining profitability and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Layer Feed Broiler Feed Turkey Feed Specialty Feed Organic Feed Non-GMO Feed Others |

| By End-User | Commercial Poultry Farms Smallholder Poultry Farmers Integrated Poultry Producers Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Others |

| By Ingredient Type | Cereal Grains (e.g., Corn, Wheat, Barley) Oilseed Meals (e.g., Soybean Meal, Canola Meal) Animal Protein Meals (e.g., Fish Meal, Meat & Bone Meal) Additives (Amino Acids, Enzymes, Probiotics, Antioxidants, Acidifiers, Antibiotics, Vitamins, Minerals) Fats & Oils (e.g., Fish Oil, Vegetable Oils) Others |

| By Packaging Type | Bulk Packaging Bagged Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | United States Canada Mexico Rest of North America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Feed Manufacturers | 100 | Production Managers, Sales Directors |

| Poultry Farmers | 120 | Farm Owners, Operations Managers |

| Feed Ingredient Suppliers | 80 | Procurement Managers, Supply Chain Analysts |

| Veterinarians and Nutritionists | 60 | Animal Health Experts, Feed Consultants |

| Industry Experts and Analysts | 40 | Market Researchers, Policy Advisors |

The North American Poultry Feed Market is valued at approximately USD 56 billion, driven by increasing demand for poultry products, advancements in feed formulations, and rising consumer awareness of animal nutrition.