Region:Europe

Author(s):Dev

Product Code:KRAB0651

Pages:84

Published On:August 2025

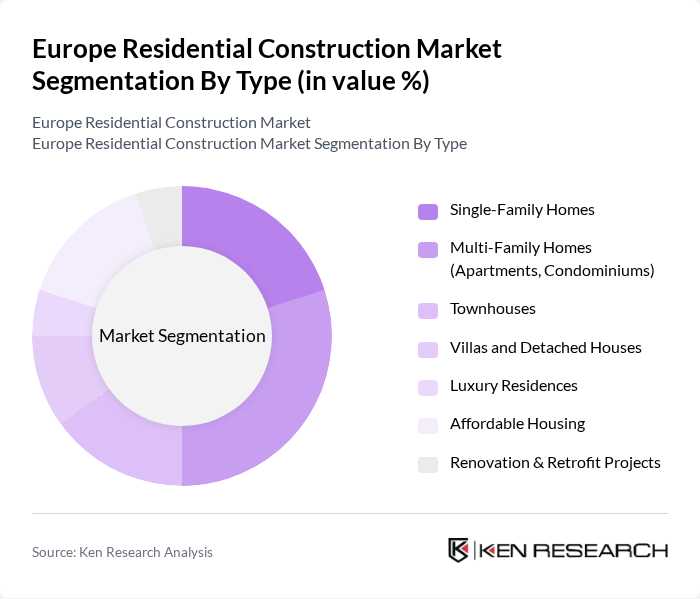

By Type:The residential construction market can be segmented into various types, including Single-Family Homes, Multi-Family Homes (Apartments, Condominiums), Townhouses, Villas and Detached Houses, Luxury Residences, Affordable Housing, and Renovation & Retrofit Projects. Among these, Multi-Family Homes have gained significant traction due to urbanization trends and the increasing demand for affordable housing solutions in metropolitan areas. Renovation and retrofit projects are also expanding, driven by regulatory requirements for energy efficiency upgrades and modernization of aging housing stock .

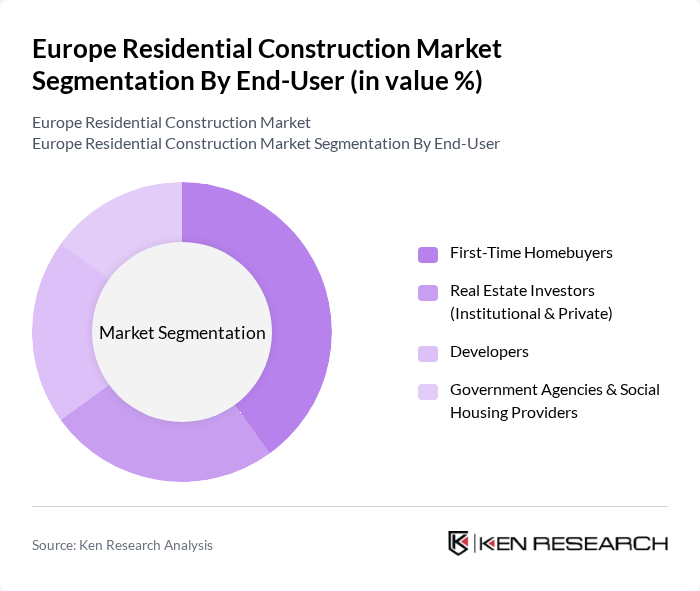

By End-User:The end-user segmentation includes First-Time Homebuyers, Real Estate Investors (Institutional & Private), Developers, and Government Agencies & Social Housing Providers. First-Time Homebuyers are currently the leading segment, driven by favorable mortgage rates, government incentives, and policies promoting home ownership among younger demographics. Real estate investors and developers are also active, responding to strong rental demand and urban redevelopment opportunities .

The Europe Residential Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bouygues Construction, Skanska AB, Vinci SA, Balfour Beatty plc, Strabag SE, Eiffage SA, Ferrovial SA, Acciona SA, Hochtief AG, Porr AG, Martifer SGPS, Altrad Group, Barratt Developments plc, Vistry Group plc, Vonovia SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the residential construction market in Europe appears promising, driven by ongoing urbanization and government initiatives aimed at increasing housing supply. As digitalization and sustainable practices gain traction, the industry is likely to see enhanced efficiency and reduced environmental impact. Furthermore, the integration of smart technologies in new developments is expected to attract tech-savvy buyers, creating a dynamic market landscape that adapts to evolving consumer preferences and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Multi-Family Homes (Apartments, Condominiums) Townhouses Villas and Detached Houses Luxury Residences Affordable Housing Renovation & Retrofit Projects |

| By End-User | First-Time Homebuyers Real Estate Investors (Institutional & Private) Developers Government Agencies & Social Housing Providers |

| By Region | Western Europe (e.g., UK, France, Germany, Netherlands, Belgium) Eastern Europe (e.g., Poland, Hungary, Czech Republic, Romania) Northern Europe (e.g., Sweden, Denmark, Finland, Norway) Southern Europe (e.g., Spain, Italy, Portugal, Greece) |

| By Financing Type | Mortgages Cash Purchases Government Grants & Subsidies Private Equity & Institutional Investments |

| By Construction Method | Traditional (On-site) Construction Prefabricated & Modular Construction Sustainable & Green Construction |

| By Project Size | Small Projects (up to 10 units) Medium Projects (11–50 units) Large Projects (51+ units) |

| By Policy Support | Subsidies Tax Incentives Grants Energy Efficiency Mandates & Other Regulatory Supports |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Supervisors |

| Homebuyer Preferences | 120 | First-time Buyers, Real Estate Investors |

| Architectural Trends | 80 | Architects, Interior Designers |

| Construction Material Suppliers | 60 | Supply Chain Managers, Product Managers |

| Regulatory Compliance Insights | 50 | Compliance Officers, Legal Advisors |

The Europe Residential Construction Market is valued at approximately USD 1.14 trillion, driven by urbanization, rising disposable incomes, and increased demand for housing due to population growth. This market has seen significant investments in infrastructure and residential projects, particularly in urban areas.