Region:Europe

Author(s):Rebecca

Product Code:KRAA4625

Pages:89

Published On:September 2025

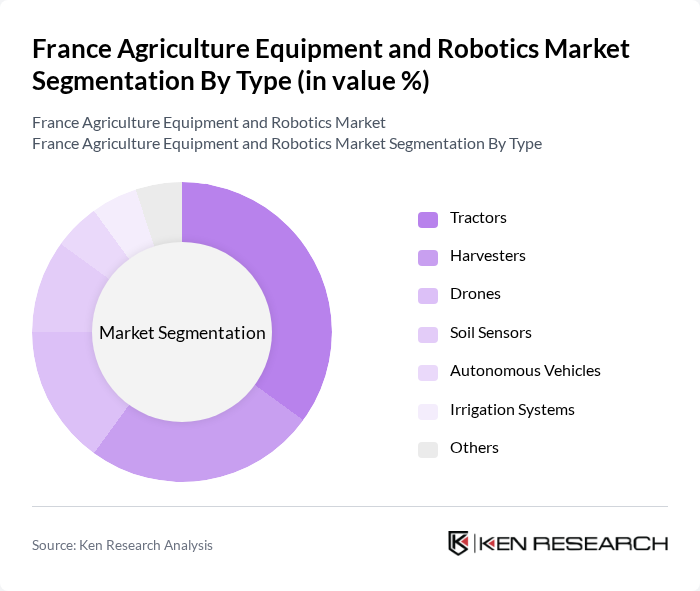

By Type:The market is segmented into various types of agricultural equipment and robotics, including tractors, harvesters, drones, soil sensors, autonomous vehicles, irrigation systems, and others. Each of these sub-segments plays a crucial role in enhancing agricultural productivity and efficiency. Among these, tractors and harvesters are the most widely used, driven by their essential functions in crop cultivation and harvesting processes.

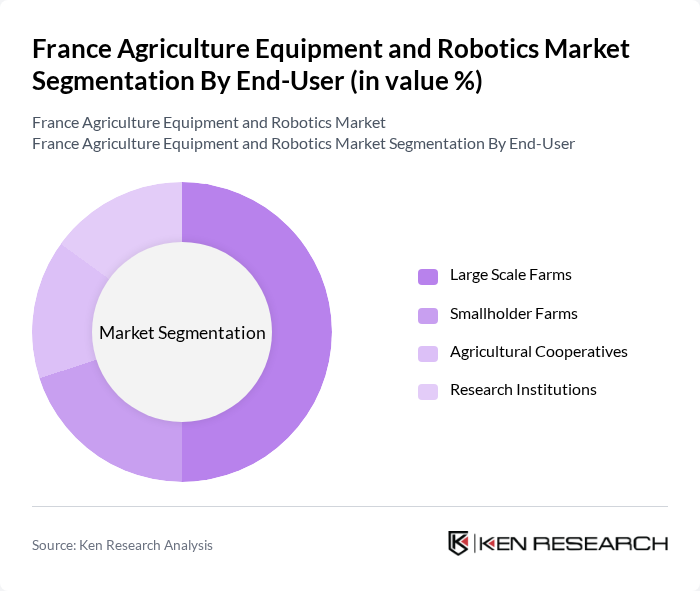

By End-User:The end-user segmentation includes large scale farms, smallholder farms, agricultural cooperatives, and research institutions. Large scale farms dominate the market due to their capacity to invest in advanced technologies and equipment, which significantly enhances their operational efficiency and productivity. Smallholder farms are increasingly adopting these technologies as well, driven by the need to improve yields and sustainability.

The France Agriculture Equipment and Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, AGCO Corporation, CNH Industrial, Trimble Inc., Yara International, BASF SE, Bayer AG, Valmont Industries, Raven Industries, Kubota Corporation, AG Leader Technology, CLAAS KGaA mbH, Lely, Drones for Agriculture, EcoRobotix contribute to innovation, geographic expansion, and service delivery in this space.

The future of the agriculture equipment and robotics market in France appears promising, driven by ongoing technological advancements and increasing consumer demand for sustainable practices. As farmers increasingly adopt IoT and AI technologies, operational efficiencies are expected to improve significantly. Additionally, the shift towards organic farming solutions will likely create new market segments. With government support and rising awareness, the market is poised for substantial growth, fostering innovation and sustainability in the agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Drones Soil Sensors Autonomous Vehicles Irrigation Systems Others |

| By End-User | Large Scale Farms Smallholder Farms Agricultural Cooperatives Research Institutions |

| By Application | Crop Production Livestock Management Soil Management Pest Control |

| By Sales Channel | Direct Sales Distributors Online Retail |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor and Equipment Manufacturers | 100 | Product Managers, Sales Directors |

| Farmers Utilizing Robotics | 150 | Farm Owners, Agricultural Technicians |

| Agricultural Cooperatives | 80 | Cooperative Managers, Procurement Officers |

| Research Institutions in Agriculture | 60 | Research Scientists, Agricultural Economists |

| Government Agricultural Departments | 50 | Policy Makers, Agricultural Advisors |

The France Agriculture Equipment and Robotics Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by technological advancements, increased food production demand, and sustainable farming practices.