Region:Middle East

Author(s):Rebecca

Product Code:KRAC3330

Pages:96

Published On:October 2025

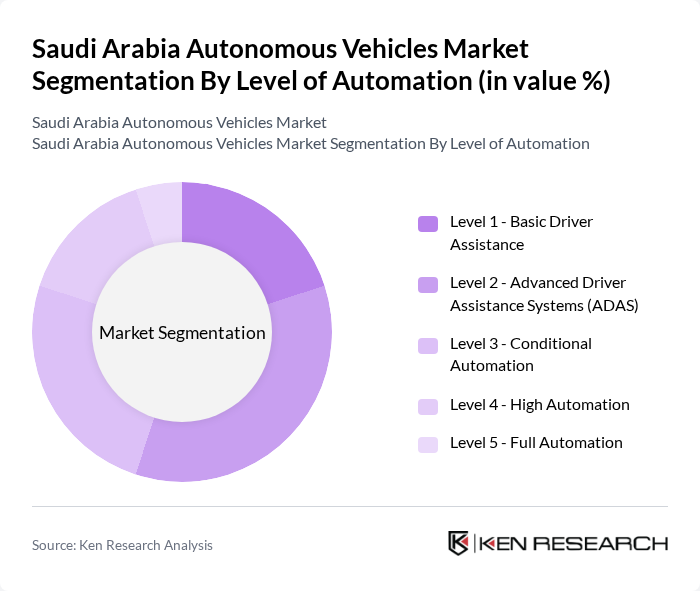

By Level of Automation:The market is segmented into five levels of automation, ranging from Level 1, which includes basic driver assistance features, to Level 5, representing fully autonomous vehicles. Each level offers varying degrees of automation, addressing diverse consumer preferences and regulatory requirements. Level 1 and Level 2 systems are widely adopted due to their integration in mainstream vehicles, while Levels 3 to 5 are emerging through pilot projects and premium offerings .

By Vehicle Type:The market is divided into two primary vehicle types: passenger vehicles and commercial vehicles. Passenger vehicles account for the largest share, driven by rising consumer demand for advanced safety and convenience features. Commercial vehicles are experiencing rapid growth, supported by logistics, ride-hailing, and smart city initiatives targeting fleet automation and operational efficiency .

The Saudi Arabia Autonomous Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Tesla, Inc., General Motors Company, Ford Motor Company, Nissan Motor Co., Ltd., Bayerische Motoren Werke AG (BMW), Mercedes-Benz Group AG, Hyundai Motor Company, Kia Corporation, Volvo AB, Renault SA, SoftBank Group Corp., Denso Corporation, Local Motors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian autonomous vehicles market appears promising, driven by ongoing government initiatives and technological advancements. In future, the integration of electric vehicles with autonomous technology is expected to gain momentum, aligning with global sustainability trends. Additionally, the rise of Mobility-as-a-Service (MaaS) platforms will reshape urban transportation, offering innovative solutions that cater to the growing urban population. These developments will likely create a robust ecosystem for autonomous vehicles, enhancing their adoption and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Level of Automation | Level 1 - Basic Driver Assistance Level 2 - Advanced Driver Assistance Systems (ADAS) Level 3 - Conditional Automation Level 4 - High Automation Level 5 - Full Automation |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles |

| By Application | Transportation and Logistics Military and Defense Ride-Hailing and Mobility-as-a-Service (MaaS) Public Transportation |

| By Region | Northern & Central Region Eastern Region Western Region Southern Region |

| By Propulsion Type | Internal Combustion Engine (ICE) Electric Vehicles |

| By Component | Hardware (Sensors, LiDAR, Radar, Cameras) Software and Services |

| By Autonomy Classification | Semi-Autonomous Fully Autonomous |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Acceptance of Autonomous Vehicles | 120 | General Public, Early Adopters |

| Automotive Industry Stakeholders | 60 | Manufacturers, Technology Providers |

| Urban Planning and Infrastructure Readiness | 50 | City Planners, Transportation Authorities |

| Regulatory and Policy Framework | 40 | Government Officials, Policy Makers |

| Investment and Funding Opportunities | 45 | Venture Capitalists, Financial Analysts |

The Saudi Arabia Autonomous Vehicles Market is valued at approximately USD 1.0 billion, driven by advancements in AI, sensor technologies, and government initiatives under Vision 2030, which emphasizes digital transformation and sustainable transportation.