Region:Europe

Author(s):Geetanshi

Product Code:KRAB4576

Pages:81

Published On:October 2025

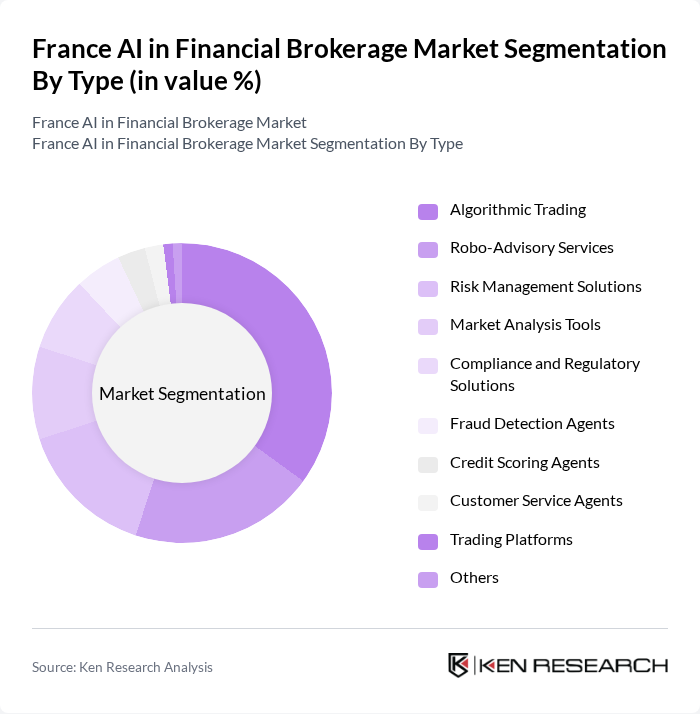

By Type:The market is segmented into various types, including Algorithmic Trading, Robo-Advisory Services, Risk Management Solutions, Market Analysis Tools, Compliance and Regulatory Solutions, Fraud Detection Agents, Credit Scoring Agents, Customer Service Agents, Trading Platforms, and Others. Among these, Algorithmic Trading is the leading sub-segment, driven by the increasing demand for automated trading solutions that enhance speed and efficiency in executing trades. The rise of high-frequency trading and the need for real-time data analysis further bolster the growth of this segment. AI-driven fraud detection and customer service agents are also experiencing rapid growth due to heightened security needs and the push for personalized client engagement .

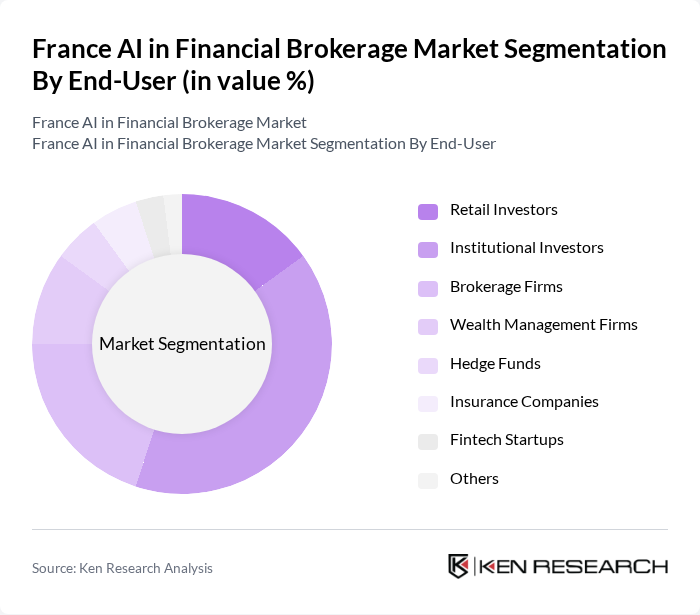

By End-User:The end-user segmentation includes Retail Investors, Institutional Investors, Brokerage Firms, Wealth Management Firms, Hedge Funds, Insurance Companies, Fintech Startups, and Others. Institutional Investors are the dominant segment, as they increasingly leverage AI technologies for portfolio management, risk assessment, and trading strategies. The growing complexity of financial markets and the need for data-driven insights are driving institutional investors to adopt AI solutions to enhance their investment performance. Fintech startups are also rapidly adopting AI to deliver innovative brokerage services and improve operational efficiency .

The France AI in Financial Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as BNP Paribas, Société Générale, Crédit Agricole, Amundi, Natixis, AXA Investment Managers, CACEIS, Boursorama, ING France, Fortuneo, La Banque Postale, HSBC France, Deutsche Bank France, Oddo BHF, Tikehau Capital, Rothschild & Co, Groupama Asset Management, BRED Banque Populaire, Banque Palatine, Yomoni, Lydia, Aria, October, Lemon Way contribute to innovation, geographic expansion, and service delivery in this space .

The future of the AI in financial brokerage market in France appears promising, driven by technological advancements and increasing investor participation. As firms continue to integrate AI into their operations, the focus will shift towards enhancing customer experiences and developing innovative financial products. Additionally, the collaboration between brokerage firms and technology companies is expected to foster new solutions, ensuring that the market remains competitive and responsive to evolving consumer needs and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Algorithmic Trading Robo-Advisory Services Risk Management Solutions Market Analysis Tools Compliance and Regulatory Solutions Fraud Detection Agents Credit Scoring Agents Customer Service Agents Trading Platforms Others |

| By End-User | Retail Investors Institutional Investors Brokerage Firms Wealth Management Firms Hedge Funds Insurance Companies Fintech Startups Others |

| By Application | Portfolio Management Trading Optimization Fraud Detection Customer Service Automation Market Forecasting Risk Assessment Compliance Monitoring Investment Advisory Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Advisors Brokerages Third-party Resellers Others |

| By Pricing Model | Subscription-based Pay-per-use Freemium Tiered Pricing Others |

| By Customer Segment | High Net Worth Individuals Mass Affluent Retail Investors Institutional Investors Small and Medium Enterprises Large Corporations Others |

| By Regulatory Compliance | MiFID II Compliance GDPR Compliance Anti-Money Laundering Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Adoption in Brokerage Firms | 50 | IT Managers, Operations Directors |

| Impact of AI on Trading Strategies | 40 | Financial Analysts, Portfolio Managers |

| Regulatory Compliance and AI | 40 | Compliance Officers, Risk Managers |

| Client Perception of AI Tools | 50 | Retail Investors, Institutional Clients |

| Future Trends in AI for Finance | 40 | Market Researchers, Strategy Consultants |

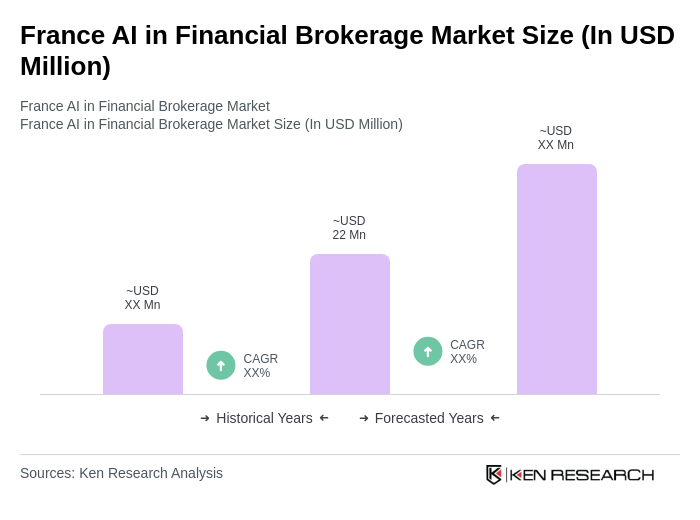

The France AI in Financial Brokerage Market is valued at approximately USD 22 million, reflecting a significant growth driven by the adoption of AI technologies in trading, risk management, and customer service within financial institutions.