Region:Europe

Author(s):Shubham

Product Code:KRAB5629

Pages:87

Published On:October 2025

By Type:The market is segmented into various types of digital advertising, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, and Others. Each of these segments plays a crucial role in shaping the overall landscape of digital advertising in France. Display Advertising is particularly popular due to its visual appeal and effectiveness in brand awareness campaigns, while Search Advertising remains a staple for businesses aiming to capture intent-driven traffic.

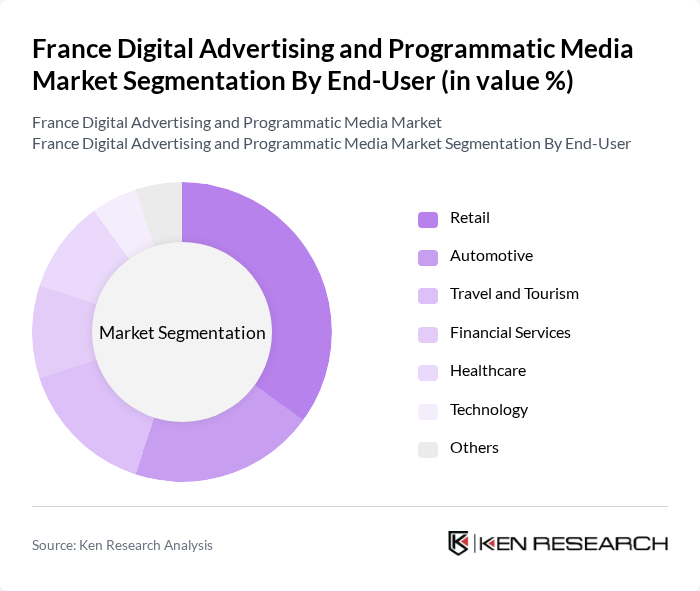

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, and Others. Retail is the leading segment, driven by the rapid growth of e-commerce and the need for brands to engage consumers through targeted digital campaigns. The Automotive sector also significantly contributes to the market, leveraging digital advertising to showcase new models and promotions.

The France Digital Advertising and Programmatic Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Publicis Groupe, Havas Group, GroupM, Dentsu International, Omnicom Media Group, IPG Mediabrands, Adform, Criteo, Taboola, Outbrain, Teads, AdRoll, Quantcast, Sizmek, The Trade Desk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital advertising landscape in France appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt programmatic advertising, the market is expected to witness enhanced efficiency and targeting capabilities. Additionally, the integration of artificial intelligence in advertising strategies will likely lead to more personalized and engaging consumer experiences. These trends, coupled with a growing emphasis on sustainability, will shape the future of digital marketing in France, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Technology Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Others |

| By Advertising Format | Banner Ads Interstitial Ads Sponsored Content Rich Media Ads Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Conversion Campaigns Retargeting Campaigns Others |

| By Budget Size | Small Budget Campaigns Medium Budget Campaigns Large Budget Campaigns Others |

| By Agency Type | Full-Service Agencies Digital-Only Agencies In-House Teams Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Agency Executives, Media Planners |

| Programmatic Media Buyers | 80 | Digital Marketing Managers, Ad Operations Specialists |

| Brand Advertisers | 70 | Marketing Directors, Brand Managers |

| Technology Providers in Ad Tech | 60 | Product Managers, Technical Leads |

| Regulatory Bodies and Industry Associations | 50 | Policy Makers, Industry Analysts |

The France Digital Advertising and Programmatic Media Market is valued at approximately USD 6.5 billion, reflecting significant growth driven by the increasing adoption of digital platforms and data-driven marketing strategies.