Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KRAB5851

Pages:93

Published On:October 2025

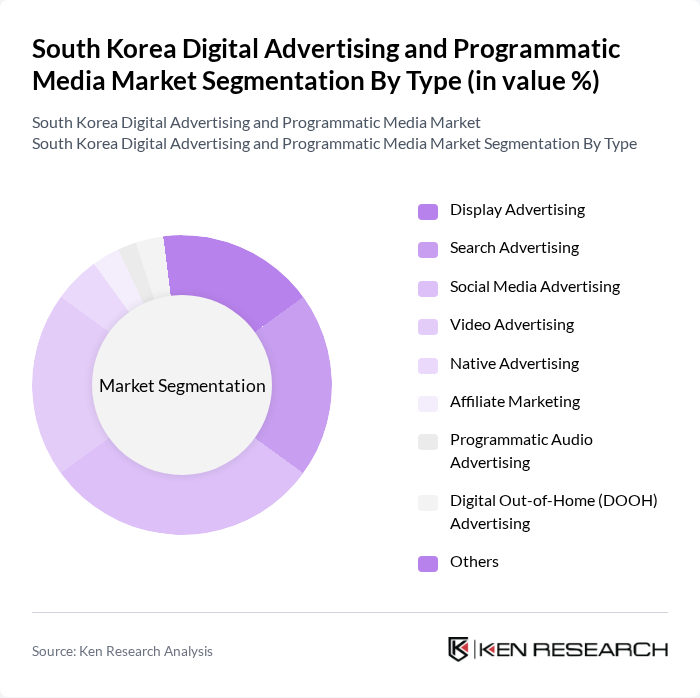

By Type:The digital advertising market in South Korea is segmented into Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, Programmatic Audio Advertising, Digital Out-of-Home (DOOH) Advertising, and Others. Social Media Advertising is a dominant force, driven by the widespread use of platforms such as KakaoTalk, Instagram, and YouTube, which enable highly targeted campaigns and high engagement rates. The growing consumer preference for video content, especially on mobile devices, has also propelled Video Advertising, making it a significant contributor to market expansion .

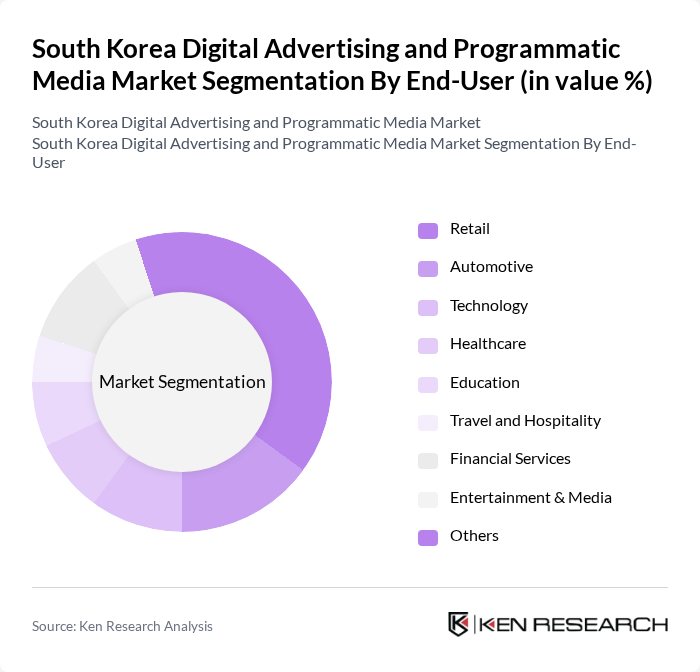

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Technology, Healthcare, Education, Travel and Hospitality, Financial Services, Entertainment & Media, and Others. The Retail sector is the leading end-user, leveraging digital advertising to enhance customer engagement and drive online sales. The surge in online shopping and the demand for personalized marketing strategies have made Retail a primary growth driver. Other sectors such as Technology and Financial Services are also increasing their digital ad investments to capture digitally savvy consumers .

The South Korea Digital Advertising and Programmatic Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Ads, Naver Corporation, Kakao Corp, SK Telecom, LG Uplus, Daum Communications, CJ ENM, Dable, Adfitter, TMON (Ticket Monster), Coupang, Interpark, Wavve, Tving, Watcha, Cheil Worldwide, Innocean Worldwide, Daehong Communications, HS Ad, Adop, Atarget, Google Korea, Meta Platforms (Facebook Korea), YouTube Korea, Twitch Korea contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean digital advertising market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As brands increasingly adopt omnichannel marketing strategies, the integration of artificial intelligence and machine learning will enhance targeting and personalization. Furthermore, the rise of video content and influencer marketing will reshape advertising dynamics, compelling companies to innovate continuously. The focus on sustainability in advertising practices will also gain traction, aligning with consumer expectations for responsible brand engagement in the digital space.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Programmatic Audio Advertising Digital Out-of-Home (DOOH) Advertising Others |

| By End-User | Retail Automotive Technology Healthcare Education Travel and Hospitality Financial Services Entertainment & Media Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Connected TV (CTV) Platforms Others |

| By Advertising Format | Banner Ads Interstitial Ads Video Ads Sponsored Content Rich Media Ads Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Geo-targeting Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Acquisition Customer Retention App Install Campaigns Others |

| By Pricing Model | Cost Per Click (CPC) Cost Per Impression (CPM) Cost Per Acquisition (CPA) Cost Per View (CPV) Flat Rate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Account Managers, Media Planners |

| Programmatic Ad Platforms | 60 | Product Managers, Data Analysts |

| Brand Marketing Teams | 50 | Marketing Directors, Digital Strategists |

| Consumer Insights Groups | 40 | Market Researchers, Consumer Behavior Analysts |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The South Korea Digital Advertising and Programmatic Media Market is valued at approximately USD 7.6 billion, reflecting significant growth driven by smartphone penetration, social media usage, e-commerce expansion, and advanced data analytics technologies.