Italy Digital Advertising and Programmatic Media Market Overview

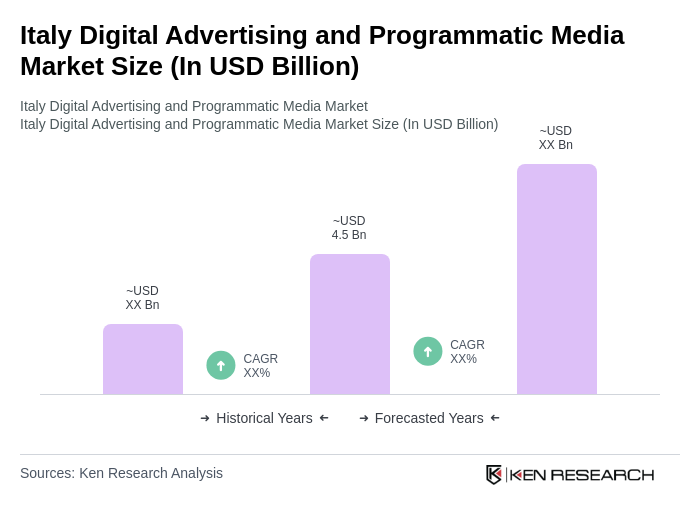

- The Italy Digital Advertising Market is valued at USD 4.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet and mobile devices, alongside a shift in advertising budgets from traditional media to digital platforms. The rise of e-commerce and social media has further accelerated the demand for targeted advertising solutions. As of early 2025, Italy had an online penetration of 89.9%, with 53.3 million individuals using the internet.

- Key cities such as Milan, Rome, and Turin dominate the market due to their status as economic and cultural hubs. These cities host a large number of businesses and advertising agencies, fostering innovation and competition. The concentration of tech-savvy consumers in urban areas also drives higher engagement with digital advertising, making them critical markets for advertisers.

- In Italy, regulations aimed at enhancing transparency in digital advertising are crucial. However, specific regulations such as mandatory disclosures for programmatic ad placements and stricter guidelines on data privacy are not detailed in available sources. Generally, regulatory efforts focus on ensuring consumer data is handled responsibly, building trust among consumers and improving the integrity of the digital advertising ecosystem.

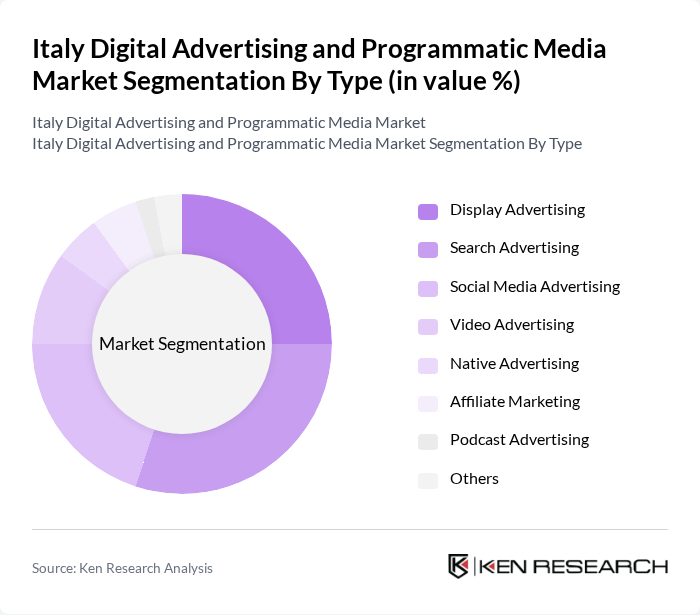

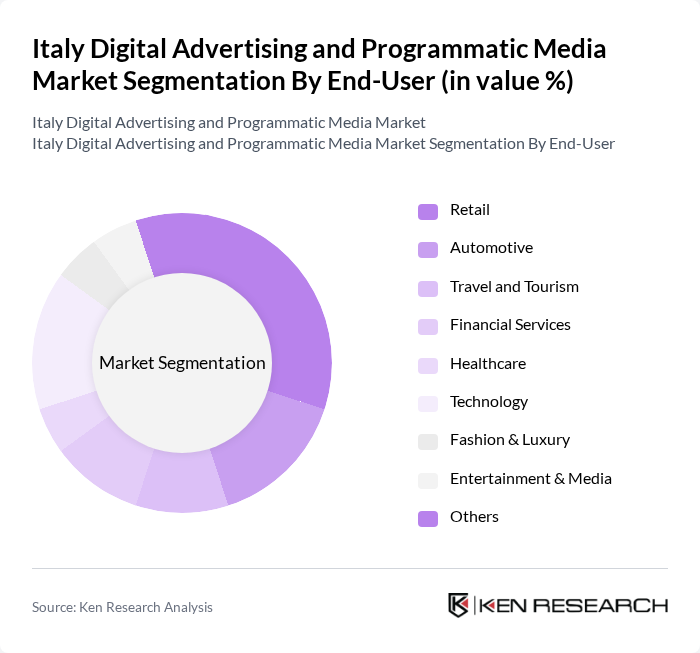

Italy Digital Advertising and Programmatic Media Market Segmentation

By Type:The digital advertising market in Italy is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, Podcast Advertising, and Others. Each of these segments caters to different advertising needs and consumer behaviors, with specific platforms and formats that resonate with target audiences.

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, Fashion & Luxury, Entertainment & Media, and Others. Each sector utilizes digital advertising to reach its specific audience, leveraging various platforms and strategies to maximize engagement and conversion rates.

Italy Digital Advertising and Programmatic Media Market Competitive Landscape

The Italy Digital Advertising and Programmatic Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc. (Facebook, Instagram, WhatsApp), Amazon Advertising, Adform A/S, Criteo S.A., The Trade Desk, Inc., Verizon Media (now Yahoo Inc.), MediaMath, Inc., Sizmek, Inc., Taboola.com Ltd., Outbrain Inc., AdRoll, Inc., Xandr, Inc. (now part of Microsoft Advertising), Quantcast Corporation, Dentsu Italia S.p.A., GroupM Italy (WPP), Publicis Groupe Italia S.p.A., Havas Media Group Italy, Digital Angels S.p.A., Webranking S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

Italy Digital Advertising and Programmatic Media Market Industry Analysis

Growth Drivers

- Increased Internet Penetration:Italy's internet penetration rate reached 84% in future, with approximately 50 million users accessing online content. This growth is driven by improved infrastructure and increased smartphone usage, which is projected to reach approximately 83% by future. The rise in internet accessibility has led to a surge in digital advertising investments, with companies allocating more resources to online platforms to reach a broader audience effectively. This trend is expected to continue, further enhancing the digital advertising landscape.

- Rise of Mobile Advertising:Mobile advertising in Italy is projected to generate revenues of €3.7 billion in future, reflecting a significant increase from €2.8 billion in future. The proliferation of mobile devices and applications has transformed consumer behavior, with over 80% of internet users engaging with mobile ads. This shift has prompted advertisers to optimize their campaigns for mobile platforms, leading to increased spending on mobile-specific strategies and formats, thereby driving overall market growth.

- Demand for Data-Driven Marketing:The demand for data-driven marketing strategies in Italy is on the rise, with over 60% of marketers prioritizing data analytics in their campaigns. This trend is supported by the increasing availability of consumer data, which allows for more targeted advertising. In future, investments in data analytics tools are expected to exceed €1 billion, enabling businesses to enhance customer engagement and improve return on investment (ROI) through personalized marketing efforts, thus fueling market expansion.

Market Challenges

- Privacy Regulations:The implementation of GDPR has significantly impacted the digital advertising landscape in Italy, with companies facing fines of up to €20 million for non-compliance. As of future, 40% of businesses reported challenges in adapting to these regulations, which restrict data collection and usage. This has led to increased operational costs and necessitated the development of compliant advertising strategies, posing a challenge to market growth and innovation in the sector.

- Ad Fraud Issues:Ad fraud remains a critical challenge in Italy's digital advertising market, with estimated losses reaching €1.1 billion in future. This issue is exacerbated by the lack of transparency in programmatic advertising, leading to concerns over the effectiveness of ad spend. As advertisers become more aware of these risks, they are increasingly cautious, which may hinder investment in digital channels and slow down overall market growth in future.

Italy Digital Advertising and Programmatic Media Market Future Outlook

The future of Italy's digital advertising and programmatic media market appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt omnichannel marketing strategies, the integration of artificial intelligence and machine learning will enhance targeting and personalization. Additionally, the growing emphasis on sustainability in advertising practices will likely shape brand strategies, fostering a more responsible approach to digital marketing. These trends indicate a dynamic landscape that will continue to evolve in response to consumer demands and regulatory changes.

Market Opportunities

- Expansion of Programmatic Buying:The programmatic advertising segment is expected to grow significantly, with investments projected to reach €2.2 billion in future. This growth presents opportunities for advertisers to leverage automated buying processes, enhancing efficiency and targeting capabilities. As more companies adopt programmatic strategies, the market will likely see increased competition and innovation, driving further advancements in digital advertising technologies.

- Integration of AI in Advertising:The integration of artificial intelligence in advertising is set to revolutionize the industry, with expected investments of €550 million in AI-driven tools in future. This technology will enable advertisers to analyze consumer behavior more effectively, optimize campaigns in real-time, and enhance personalization. As AI adoption increases, it will create new avenues for engagement and improve overall advertising effectiveness, presenting a significant opportunity for growth.