Region:Europe

Author(s):Geetanshi

Product Code:KRAA4555

Pages:97

Published On:September 2025

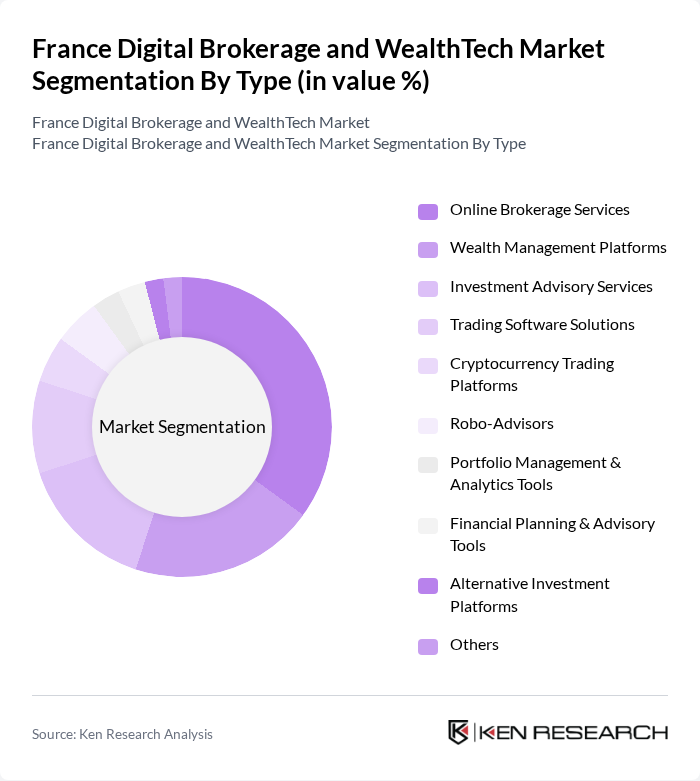

By Type:The market is segmented into Online Brokerage Services, Wealth Management Platforms, Investment Advisory Services, Trading Software Solutions, Cryptocurrency Trading Platforms, Robo-Advisors, Portfolio Management & Analytics Tools, Financial Planning & Advisory Tools, Alternative Investment Platforms, and Others. Among these, Online Brokerage Services are leading due to their accessibility, intuitive user interfaces, and the ability to offer low-cost, self-directed trading options. The rapid adoption of mobile trading apps and the expansion of commission-free models have attracted a large number of retail investors, while Wealth Management Platforms and Robo-Advisors are gaining traction for their personalized and automated investment solutions .

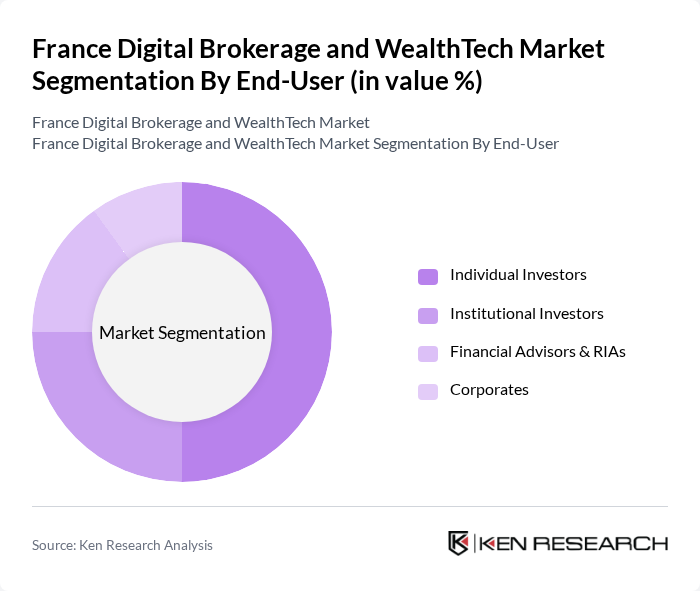

By End-User:The market is segmented by end-users into Individual Investors, Institutional Investors, Financial Advisors & RIAs, and Corporates. Individual Investors dominate the market, driven by the increasing number of retail participants leveraging digital platforms to manage portfolios independently. The proliferation of mobile trading applications, user-friendly digital onboarding, and access to educational resources have empowered these investors to engage actively in financial markets. Institutional Investors and Financial Advisors are increasingly adopting advanced analytics and portfolio management tools to optimize investment strategies and client engagement .

The France Digital Brokerage and WealthTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as BNP Paribas, Société Générale, Amundi, Boursorama, Fortuneo, Degiro, eToro, Interactive Brokers, Saxo Bank, Revolut, N26, Yomoni, Advize, Ramify, and Scalable Capital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital brokerage and WealthTech market in France appears promising, driven by ongoing technological advancements and increasing consumer demand for personalized financial services. As the market evolves, firms are likely to invest heavily in AI and machine learning to enhance user experience and operational efficiency. Furthermore, the growing emphasis on sustainable investing will likely shape product offerings, aligning with consumer preferences for ESG-compliant investments. This dynamic environment presents opportunities for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Brokerage Services Wealth Management Platforms Investment Advisory Services Trading Software Solutions Cryptocurrency Trading Platforms Robo-Advisors Portfolio Management & Analytics Tools Financial Planning & Advisory Tools Alternative Investment Platforms Others |

| By End-User | Individual Investors Institutional Investors Financial Advisors & RIAs Corporates |

| By Investment Type | Equities Fixed Income Mutual Funds ETFs Alternatives (Private Equity, Real Estate, Commodities) Cryptocurrencies Others |

| By Distribution Channel | Direct Sales Online Platforms Financial Advisors Partnerships with Banks White-Label Solutions |

| By Customer Segment | High Net-Worth Individuals (HNWIs) Mass Affluent Retail Investors Millennials & Gen Z |

| By Service Model | Full-Service Brokerage Discount Brokerage Hybrid Models Self-Directed Platforms |

| By Regulatory Compliance | MiFID II Compliant Services GDPR Compliant Services Non-Compliant Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Brokerage User Experience | 100 | Retail Investors, Financial Advisors |

| WealthTech Adoption Trends | 80 | Wealth Managers, Investment Analysts |

| Regulatory Impact on WealthTech | 60 | Compliance Officers, Legal Advisors |

| Investment Behavior of Millennials | 90 | Young Investors, Financial Influencers |

| Technological Innovations in Brokerage | 70 | CTOs, Product Managers in FinTech |

The France Digital Brokerage and WealthTech Market is valued at approximately USD 140 million, driven by the increasing adoption of digital financial services and advancements in technology, particularly artificial intelligence and analytics.