Region:Europe

Author(s):Rebecca

Product Code:KRAA2393

Pages:93

Published On:August 2025

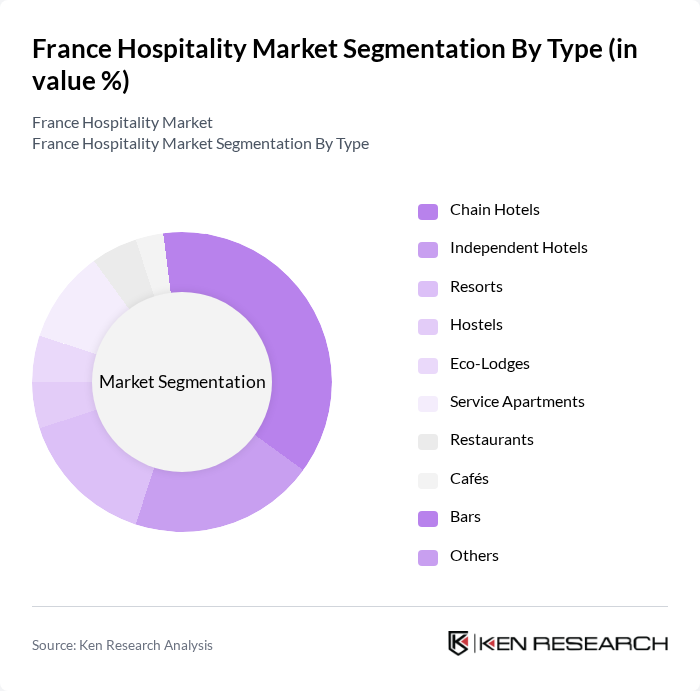

By Type:The hospitality market in France is segmented into various types, including Chain Hotels, Independent Hotels, Resorts, Hostels, Eco-Lodges, Service Apartments, Restaurants, Cafés, Bars, and Others. Each of these sub-segments addresses distinct consumer preferences and market demands, with Chain Hotels and Restaurants maintaining dominance due to their established brand recognition, operational scale, and customer loyalty. The rise of eco-lodges and boutique accommodations reflects a growing demand for sustainable and personalized travel experiences.

By End-User:The end-user segmentation of the hospitality market includes Business Travelers, Leisure Travelers, Event Organizers, and Tour Operators. Business Travelers represent a significant portion of the market, driven by the increasing number of corporate events and conferences held in major cities. Leisure Travelers continue to drive demand for diverse accommodation and dining options, while Event Organizers and Tour Operators play a pivotal role in group and incentive travel segments.

The France Hospitality Market is characterized by a dynamic mix of regional and international players. Leading participants such as AccorHotels, Hilton Worldwide, Marriott International, InterContinental Hotels Group (IHG), Best Western Hotels & Resorts, Radisson Hotel Group, B&B Hotels, Groupe Pierre & Vacances, Club Med, Louvre Hotels Group, Campanile, Kyriad, Relais & Châteaux, AccorInvest, Les Hôtels de Paris, Hyatt Hotels Corporation, Choice Hotels International, Mama Shelter, OKKO Hotels, Groupe Barrière, Warwick Hotels & Resorts, Oceania Hotels, Brit Hotel, Appart’City, The Hoxton Paris contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France hospitality market appears promising, driven by a combination of increasing domestic and international tourism. The anticipated rise in visitor numbers, particularly during major events like the Paris Olympics, is expected to stimulate demand for diverse accommodation options. Additionally, the integration of technology and sustainability practices will likely enhance guest experiences, positioning the market for robust growth in the coming years, despite existing challenges such as labor shortages and economic fluctuations.

| Segment | Sub-Segments |

|---|---|

| By Type | Chain Hotels Independent Hotels Resorts Hostels Eco-Lodges Service Apartments Restaurants Cafés Bars Others |

| By End-User | Business Travelers Leisure Travelers Event Organizers Tour Operators |

| By Service Type | Room Service Food and Beverage Services Event Hosting Concierge Services |

| By Location | Urban Areas Rural Areas Tourist Attractions Coastal Areas Mountain Regions |

| By Price Range | Luxury Mid-Range Budget |

| By Customer Demographics | Families Couples Solo Travelers Groups |

| By Booking Channel | Online Travel Agencies (OTAs) Direct Bookings Travel Agents Corporate Booking Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 60 | General Managers, Marketing Directors |

| Mid-range Accommodation | 50 | Operations Managers, Front Desk Supervisors |

| Budget Hotels and Hostels | 40 | Owners, Customer Service Representatives |

| Vacation Rentals | 40 | Property Managers, Rental Agents |

| Tourism and Travel Agencies | 50 | Travel Consultants, Sales Managers |

The France Hospitality Market is valued at approximately USD 21 billion, reflecting a significant growth driven by increased domestic and inbound tourism, as well as a rising preference for authentic travel experiences among consumers.