Region:Middle East

Author(s):Shubham

Product Code:KRAA2270

Pages:100

Published On:August 2025

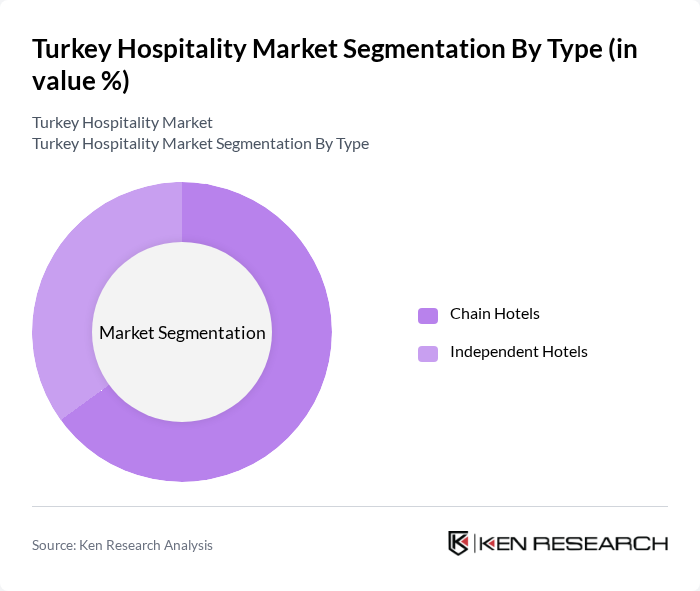

By Type:The Turkey Hospitality Market is segmented into Chain Hotels and Independent Hotels. Chain Hotels lead the market due to their established brand reputation, loyalty programs, and standardized service offerings that appeal to both business and leisure travelers. Independent Hotels, while fewer in number, provide unique and personalized experiences, catering to niche segments and travelers seeking authenticity .

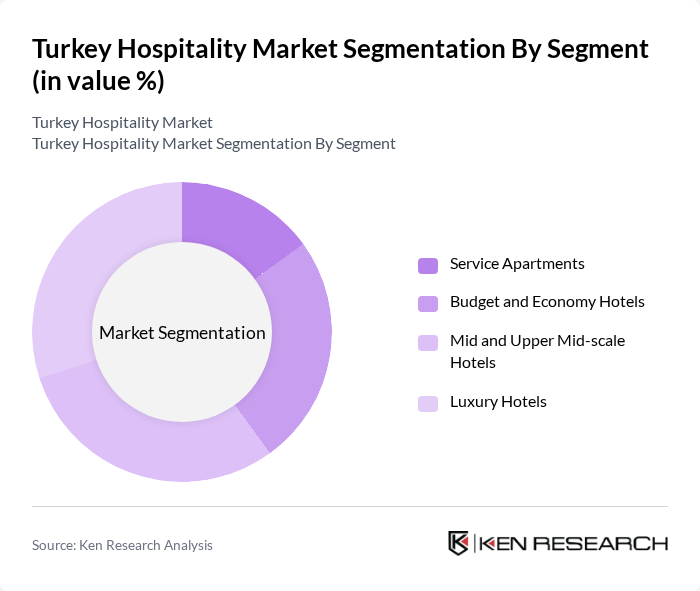

By Segment:The market is further segmented into Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, and Luxury Hotels. Service Apartments are increasingly favored by long-stay travelers and expatriates for their space and amenities. Budget and Economy Hotels appeal to cost-conscious tourists, while Mid and Upper Mid-scale Hotels attract a broad clientele. Luxury Hotels cater to affluent travelers seeking premium experiences and exclusive services .

The Turkey Hospitality Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hilton Hotels & Resorts, Marriott International, Inc., AccorHotels, Radisson Hotel Group, InterContinental Hotels Group (IHG), Wyndham Hotels & Resorts, Rixos Hotels, Divan Hotels, Dedeman Hotels & Resorts International, The Marmara Collection, Swissôtel Hotels & Resorts, Titanic Hotels, Elite World Hotels & Resorts, Barut Hotels, and Limak Hotels contribute to innovation, geographic expansion, and service delivery in this space .

The Turkey hospitality market is poised for significant transformation in the coming years, driven by technological advancements and evolving consumer preferences. The integration of digital solutions in service delivery will enhance guest experiences, while a focus on sustainability will attract environmentally conscious travelers. Additionally, the anticipated growth in MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism will further bolster the sector, as businesses seek venues in Turkey's vibrant cities. Overall, the market is expected to adapt and thrive amid these dynamic changes.

| Segment | Sub-Segments |

|---|---|

| By Type | Chain Hotels Independent Hotels |

| By Segment | Service Apartments Budget and Economy Hotels Mid and Upper Mid-scale Hotels Luxury Hotels |

| By Geography | Istanbul Antalya Aegean Region Central Anatolia Other Regions |

| By End-User | Leisure Travelers Business Travelers Group Travelers Government and NGOs |

| By Service Type | Room Services Food and Beverage Services Event Management Services Spa and Wellness Services |

| By Distribution Channel | Online Travel Agencies (OTAs) Direct Bookings Travel Agents Corporate Bookings |

| By Price Range | Budget Mid-Range Premium |

| By Customer Segment | Families Couples Solo Travelers Business Groups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 60 | General Managers, Marketing Directors |

| Mid-range Accommodation | 50 | Operations Managers, Front Office Supervisors |

| Budget Hotels and Hostels | 40 | Owners, Revenue Managers |

| Tourism and Travel Agencies | 45 | Travel Agents, Business Development Managers |

| Tourist Experience Feedback | 70 | Domestic and International Tourists |

The Turkey Hospitality Market is valued at approximately USD 5.6 billion, reflecting a robust recovery post-pandemic, driven by increased domestic and international tourism, rising disposable incomes, and significant investments in infrastructure.