France Insurance Technology (InsurTech) and Digital Brokers Market Overview

- The France Insurance Technology (InsurTech) and Digital Brokers Market is valued at USD 330 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital solutions in the insurance sector, enhanced customer experience, and the rise of innovative business models that leverage technology to streamline operations and reduce costs. Recent trends highlight the impact of artificial intelligence, automation, and data-driven platforms in reshaping insurance operations, with significant venture capital investment fueling further expansion and innovation in the sector .

- Key players in this market are concentrated in major urban centers such as Paris, Lyon, and Marseille. These cities dominate due to their robust financial ecosystems, access to technology talent, and a high concentration of startups and established insurance companies that foster collaboration and innovation in the InsurTech space. The Paris region, in particular, is recognized as a leading hub for InsurTech activity and investment .

- Regulatory support for InsurTech and digital brokers in France is governed by the Insurance Distribution Directive (IDD) as revised by the European Union and implemented in France, along with updates to Solvency II regulations. These instruments, enforced by the Autorité de Contrôle Prudentiel et de Résolution (ACPR), require digital brokers and InsurTech firms to comply with strict consumer protection, transparency, and operational standards, including licensing, fit and proper requirements, and ongoing compliance with risk management and reporting obligations. The IDD (Directive (EU) 2016/97, implemented in France by Ordonnance n°2018-361 of 16 May 2018) specifically addresses digital distribution and the integration of new technologies in insurance .

and Digital Brokers Market.png)

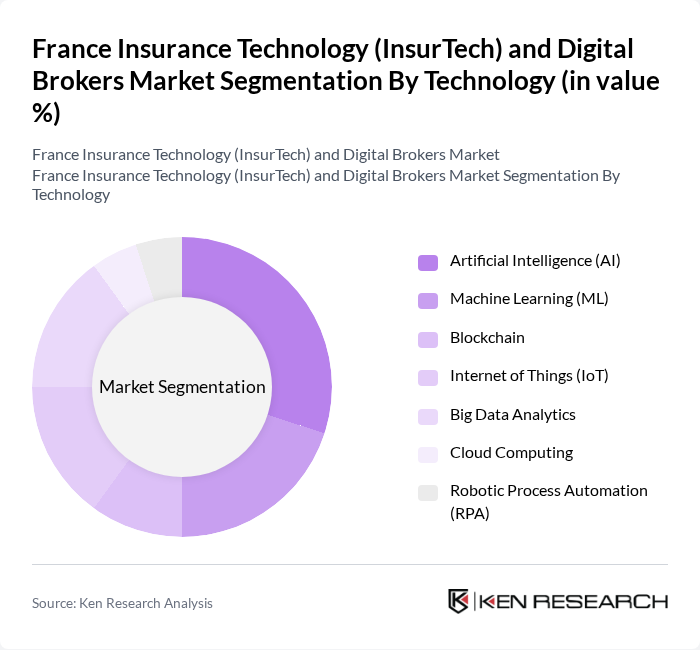

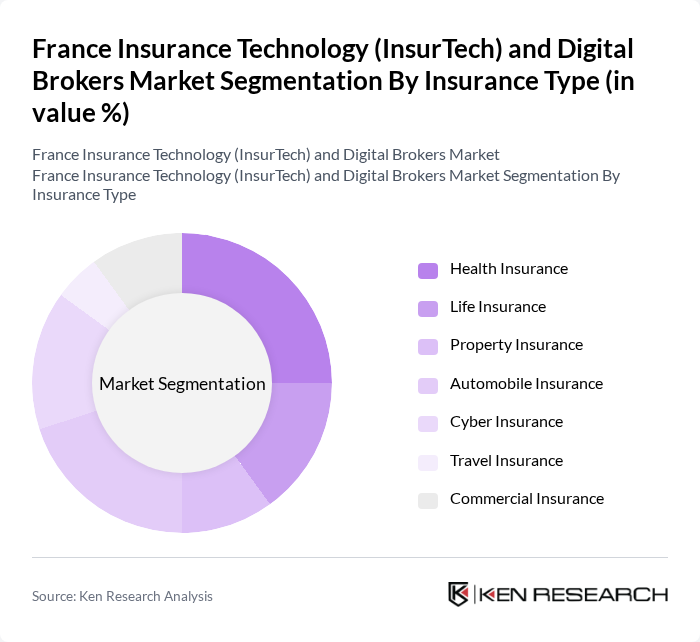

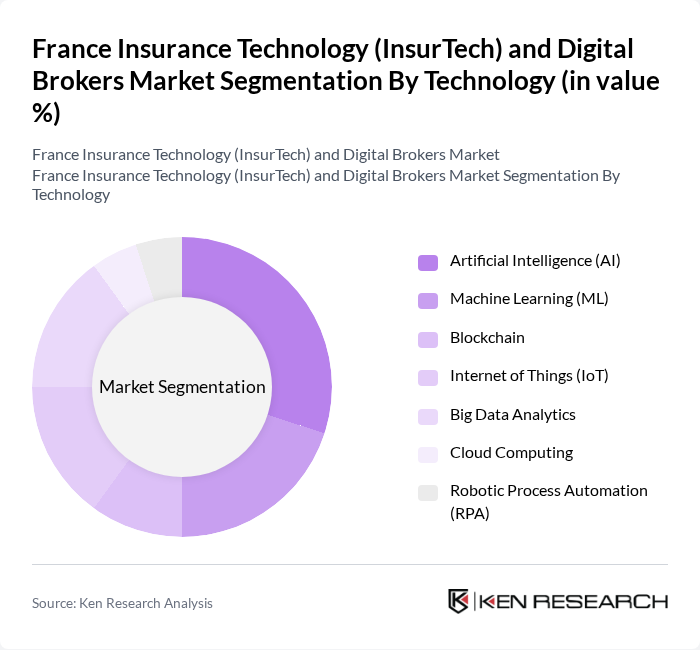

France Insurance Technology (InsurTech) and Digital Brokers Market Segmentation

By Technology:The technology segment encompasses various innovative solutions that are transforming the insurance landscape. Key subsegments include Artificial Intelligence (AI), Machine Learning (ML), Blockchain, Internet of Things (IoT), Big Data Analytics, Cloud Computing, and Robotic Process Automation (RPA). Among these, AI and Big Data Analytics are leading the market due to their ability to enhance risk assessment, improve customer engagement, and streamline claims processing. The increasing demand for personalized insurance products and efficient service delivery is driving the adoption of these technologies. Recent market analysis confirms that AI, IoT, and data-driven automation are central to the French InsurTech ecosystem, with strong adoption among both startups and established insurers .

By Insurance Type:This segment includes various types of insurance products offered in the market, such as Health Insurance, Life Insurance, Property Insurance, Automobile Insurance, Cyber Insurance, Travel Insurance, and Commercial Insurance. Health Insurance and Automobile Insurance are currently the dominant subsegments, driven by increasing consumer awareness and regulatory mandates for health coverage, as well as the growing number of vehicles on the road. The rise in cyber threats has also led to a surge in demand for Cyber Insurance, making it a rapidly growing segment. The French market is also witnessing increased interest in flexible, usage-based insurance models, particularly in auto and property segments, enabled by digital platforms and telematics .

France Insurance Technology (InsurTech) and Digital Brokers Market Competitive Landscape

The France Insurance Technology (InsurTech) and Digital Brokers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alan, Luko, Shift Technology, Descartes Underwriting, Lovys, Assurly, Qover, WeSurance, Zego, Lemonade, AXA Next, Allianz France Digital, Generali Vitality, MAIF Digital, and Groupama Innovation contribute to innovation, geographic expansion, and service delivery in this space.

France Insurance Technology (InsurTech) and Digital Brokers Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital transformation in France has accelerated, with internet penetration reaching 92% in future, according to the French National Institute of Statistics and Economic Studies (INSEE). This widespread access to digital platforms has enabled consumers to engage with InsurTech solutions more readily. Additionally, mobile device usage has surged, with over 80% of the population using smartphones, facilitating the adoption of mobile insurance applications and digital brokers, thus driving market growth.

- Demand for Personalized Insurance Products:In future, the demand for personalized insurance products is projected to increase significantly, with 65% of consumers expressing a preference for tailored coverage options, as reported by the French Insurance Federation. This shift is driven by changing consumer expectations and the desire for customized solutions that meet individual needs. InsurTech firms are leveraging advanced analytics and customer data to create personalized offerings, enhancing customer satisfaction and loyalty in the competitive landscape.

- Regulatory Support for InsurTech Innovations:The French government has implemented supportive regulations to foster innovation in the InsurTech sector. In future, the Ministry of Economy allocated €50 million to support digital innovation initiatives, including InsurTech startups. This regulatory environment encourages investment and development in the sector, allowing companies to experiment with new technologies and business models, ultimately driving growth and enhancing the overall market landscape.

Market Challenges

- Data Privacy Concerns:Data privacy remains a significant challenge for the InsurTech market in France, particularly with the implementation of the General Data Protection Regulation (GDPR). In future, 70% of consumers expressed concerns about how their personal data is used by insurance companies, according to a survey by the French Data Protection Authority. This apprehension can hinder the adoption of digital insurance solutions, as consumers may be reluctant to share sensitive information, impacting market growth.

- High Competition Among InsurTech Startups:The InsurTech landscape in France is characterized by intense competition, with over 300 startups vying for market share in future. This saturation can lead to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Additionally, established insurance companies are increasingly investing in their own digital solutions, further intensifying competition and creating barriers for smaller InsurTech firms to thrive in the market.

France Insurance Technology (InsurTech) and Digital Brokers Market Future Outlook

The future of the InsurTech market in France appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, InsurTech firms are expected to innovate further, enhancing customer experiences through personalized offerings. Additionally, the integration of artificial intelligence and machine learning will likely streamline operations and improve risk assessment. However, addressing data privacy concerns and navigating regulatory landscapes will be crucial for sustained growth and market stability in the coming years.

Market Opportunities

- Expansion into Underinsured Segments:There is a significant opportunity for InsurTech firms to target underinsured segments in France, particularly among small businesses and freelancers. In future, approximately 40% of small enterprises lack adequate insurance coverage, presenting a market gap that can be addressed through tailored products and services, ultimately driving growth and enhancing financial security for these businesses.

- Partnerships with Traditional Insurers:Collaborations between InsurTech startups and traditional insurance companies present a lucrative opportunity. In future, over 60% of traditional insurers are actively seeking partnerships to leverage innovative technologies. These alliances can enhance product offerings, improve customer engagement, and streamline operations, creating a win-win scenario that fosters growth and innovation in the InsurTech landscape.

and Digital Brokers Market.png)