Region:Europe

Author(s):Rebecca

Product Code:KRAB2970

Pages:98

Published On:October 2025

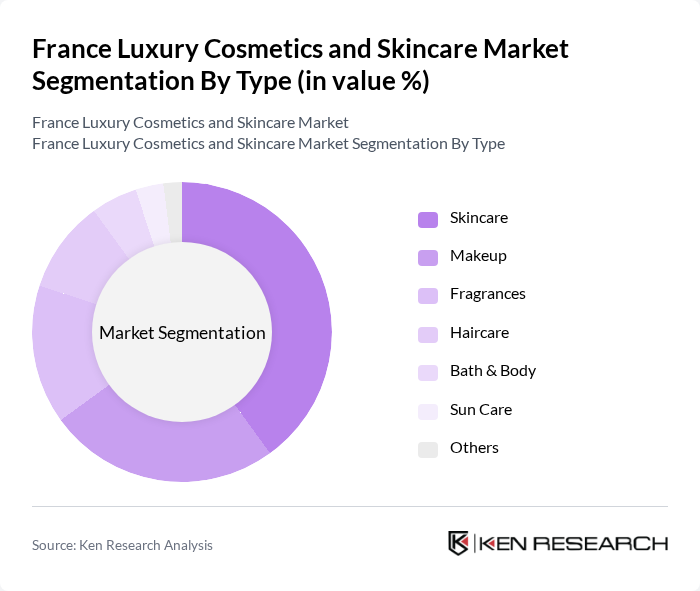

By Type:The luxury cosmetics and skincare market is segmented into various types, including Skincare, Makeup, Fragrances, Haircare, Bath & Body, Sun Care, and Others. Among these, Skincare products dominate the market due to the increasing focus on skin health and anti-aging solutions. Consumers are increasingly investing in high-quality skincare products that promise visible results, leading to a surge in demand for serums, moisturizers, and treatments.

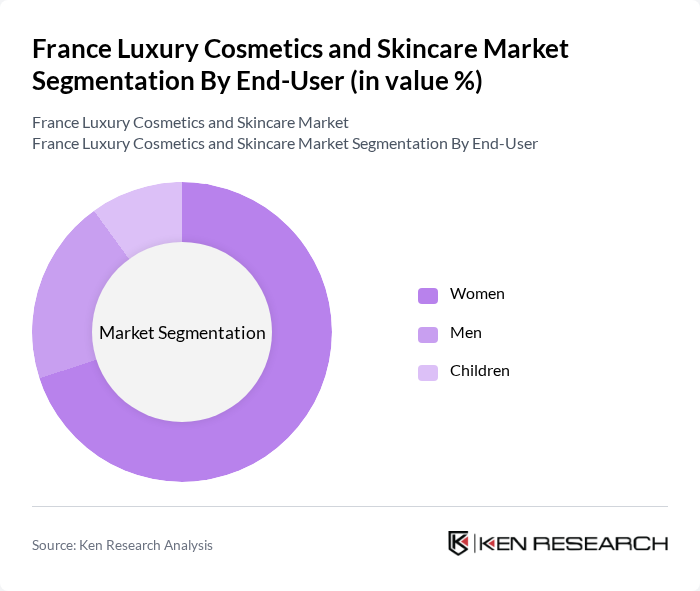

By End-User:The market is also segmented by end-user demographics, including Women, Men, and Children. Women represent the largest segment, driven by their higher spending on beauty and skincare products. The increasing awareness of skincare routines and the influence of social media on beauty trends have led to a significant rise in product adoption among women.

The France Luxury Cosmetics and Skincare Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oreal S.A., Estée Lauder Companies Inc., Chanel S.A., Dior S.A., Lancôme (L'Oreal S.A.), Clarins Group, Givenchy (LVMH), Yves Saint Laurent (L'Oreal S.A.), Guerlain (LVMH), Shiseido Company, Limited, Coty Inc., Amorepacific Corporation, Kiehl's (L'Oreal S.A.), Nuxe, and Caudalie contribute to innovation, geographic expansion, and service delivery in this space.

The future of the French luxury cosmetics and skincare market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and eco-friendly practices is expected to shape product development, with brands investing in biodegradable packaging and natural ingredients. Additionally, the integration of augmented reality in online shopping experiences is likely to enhance consumer engagement, allowing for personalized product trials. As the market adapts to these trends, growth opportunities will emerge, particularly in niche segments catering to specific consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Makeup Fragrances Haircare Bath & Body Sun Care Others |

| By End-User | Women Men Children |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Drugstores Direct Sales Others |

| By Price Range | Premium Mid-range Budget |

| By Packaging Type | Bottles Jars Tubes Others |

| By Ingredient Type | Natural Synthetic Organic |

| By Brand Positioning | Luxury Mass Niche |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Skincare Product Users | 150 | Affluent Consumers, Beauty Enthusiasts |

| Makeup Product Purchasers | 120 | Makeup Artists, Retail Customers |

| Fragrance Buyers | 100 | Luxury Brand Loyalists, Gift Shoppers |

| Online Luxury Cosmetics Shoppers | 80 | E-commerce Users, Digital Marketing Experts |

| Beauty Influencers and Bloggers | 50 | Social Media Influencers, Content Creators |

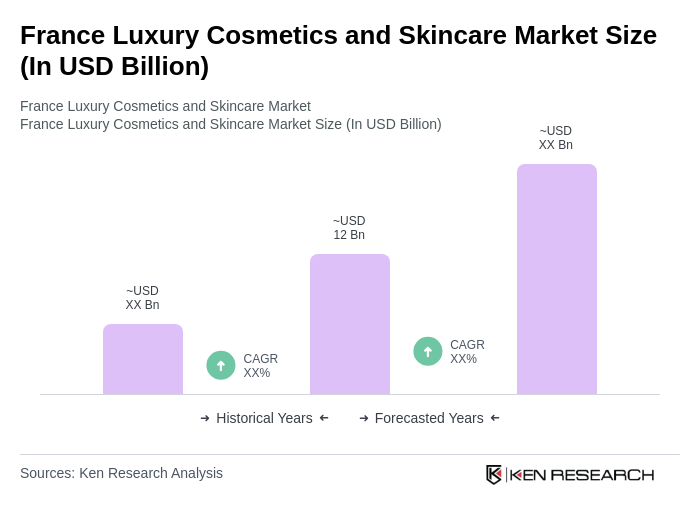

The France Luxury Cosmetics and Skincare Market is valued at approximately USD 12 billion, reflecting a significant growth driven by consumer demand for premium products and a focus on self-care and wellness.