Italy Luxury Cosmetics and Skincare Market Overview

- The Italy Luxury Cosmetics and Skincare Market is valued at USD 12.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for high-quality, premium products, coupled with a rising trend towards self-care and wellness. The market has seen a significant shift towards online retailing, with consumers increasingly seeking luxury products through digital platforms, enhancing accessibility and convenience.

- Key cities such as Milan, Rome, and Florence dominate the luxury cosmetics and skincare market due to their status as fashion capitals and cultural hubs. These cities attract both local and international consumers, fostering a vibrant retail environment. The presence of numerous luxury brands and flagship stores in these locations further solidifies their dominance in the market.

- In 2023, the Italian government implemented regulations aimed at enhancing product safety and sustainability in the cosmetics industry. This includes stricter guidelines on ingredient transparency and eco-friendly packaging, which are designed to protect consumer health and promote environmentally responsible practices among manufacturers.

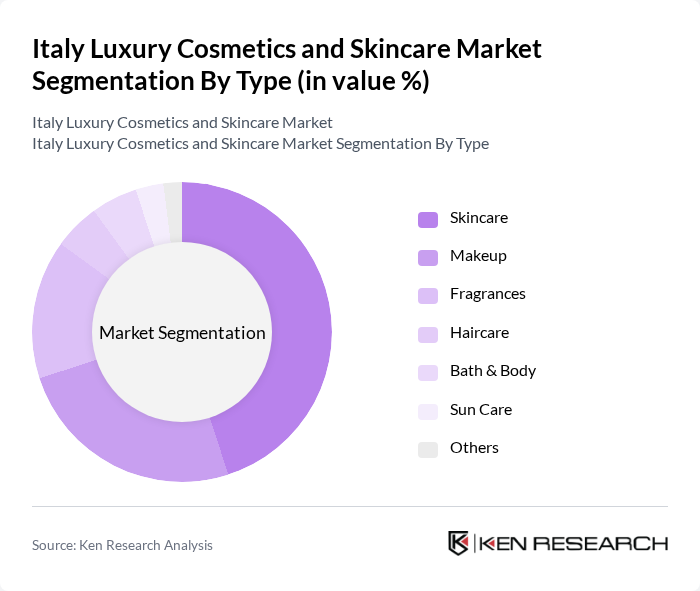

Italy Luxury Cosmetics and Skincare Market Segmentation

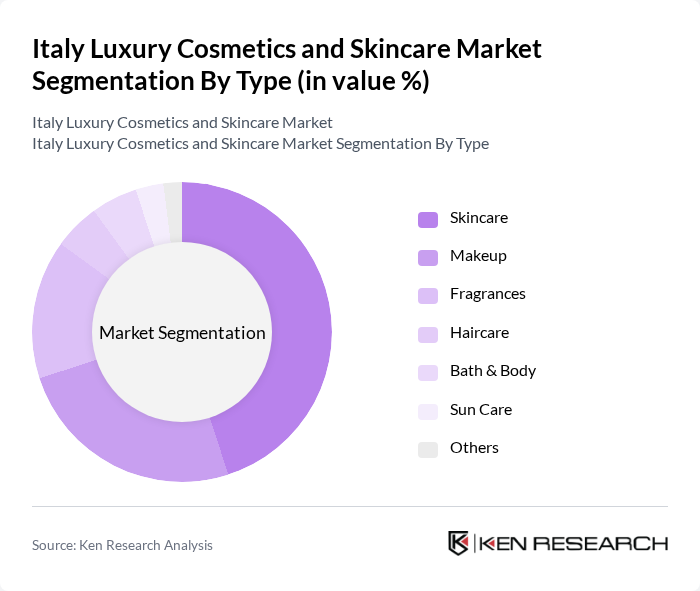

By Type:The luxury cosmetics and skincare market is segmented into various types, including skincare, makeup, fragrances, haircare, bath & body, sun care, and others. Among these, skincare products dominate the market due to the increasing consumer focus on skin health and anti-aging solutions. The demand for high-quality moisturizers, serums, and treatments has surged, driven by a growing awareness of skincare routines and the importance of using premium ingredients. Makeup products also hold a significant share, particularly with the rise of social media influencers promoting beauty trends.

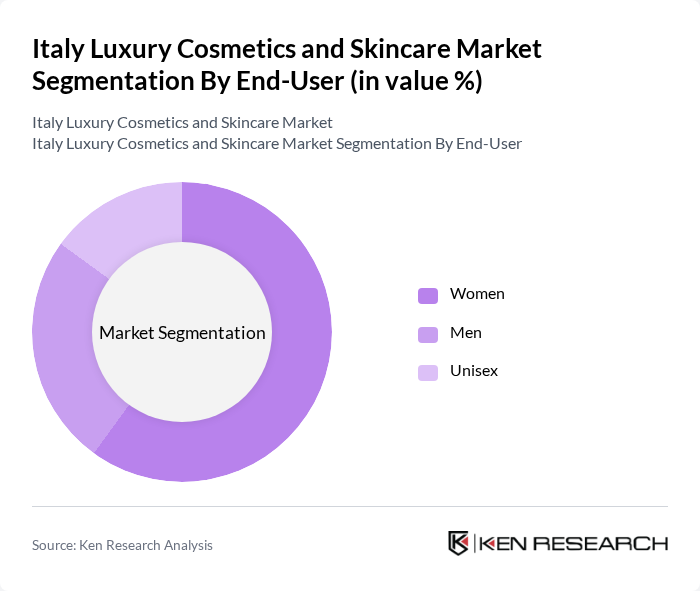

By End-User:The market is segmented by end-user into women, men, and unisex products. Women represent the largest segment, driven by a strong inclination towards beauty and skincare routines. The increasing availability of specialized products catering to women's needs, such as anti-aging and moisturizing solutions, has further fueled this demand. The men's segment is also growing, as more men are becoming conscious of their grooming and skincare, leading to a rise in male-targeted luxury products.

Italy Luxury Cosmetics and Skincare Market Competitive Landscape

The Italy Luxury Cosmetics and Skincare Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oreal S.A., Estée Lauder Companies Inc., Coty Inc., Shiseido Company, Limited, Procter & Gamble Co., Chanel S.A., Dior (Christian Dior SE), Unilever PLC, Beiersdorf AG, Clarins Group, Amway Corporation, Oriflame Holding AG, Mary Kay Inc., Natura & Co., and Avon Products, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Italy Luxury Cosmetics and Skincare Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Skincare:The Italian luxury cosmetics market is experiencing a surge in consumer awareness regarding skincare, with 70% of consumers actively seeking products that enhance skin health. This trend is supported by a report from the Italian National Institute of Statistics, which indicates that 65% of Italians prioritize skincare in their beauty routines. The growing influence of social media and beauty influencers has further amplified this awareness, driving demand for high-quality skincare products.

- Rising Disposable Income:Italy's GDP per capita is projected to reach €38,000, reflecting a 5% increase from the previous year. This rise in disposable income allows consumers to allocate more funds towards luxury cosmetics and skincare products. According to the Bank of Italy, households are expected to spend an average of €1,300 annually on beauty and personal care, indicating a robust market for premium skincare brands that cater to affluent consumers.

- Growth of E-commerce Platforms:The e-commerce sector in Italy is anticipated to grow by 18%, with online sales of luxury cosmetics and skincare products projected to reach €1.8 billion. This growth is driven by increased internet penetration, which stands at 92%, and the convenience of online shopping. A report by Statista highlights that 45% of consumers prefer purchasing beauty products online, creating significant opportunities for brands to expand their digital presence and reach a broader audience.

Market Challenges

- Intense Competition:The Italian luxury cosmetics market is characterized by fierce competition, with over 220 brands vying for market share. Major players like L'Oréal and Estée Lauder dominate, making it challenging for new entrants to establish themselves. According to a market analysis, the top five brands account for 62% of total sales, leaving limited room for smaller companies. This competitive landscape necessitates innovative marketing strategies and unique product offerings to capture consumer attention.

- Regulatory Compliance Costs:Compliance with EU cosmetics regulations imposes significant costs on luxury skincare brands. Companies are expected to spend an average of €260,000 annually to meet safety assessments and labeling requirements. The European Commission's stringent regulations require extensive testing and documentation, which can strain the resources of smaller brands. This financial burden may hinder their ability to compete effectively in the market, limiting innovation and growth potential.

Italy Luxury Cosmetics and Skincare Market Future Outlook

The future of the Italian luxury cosmetics and skincare market appears promising, driven by evolving consumer preferences and technological advancements. The rise of clean beauty and sustainable practices is reshaping product offerings, with brands increasingly focusing on eco-friendly ingredients and packaging. Additionally, the integration of artificial intelligence in personalized skincare solutions is expected to enhance customer engagement and satisfaction, positioning companies to capitalize on emerging trends and consumer demands in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Italian luxury brands have a significant opportunity to expand into emerging markets, particularly in Asia and Latin America. With a combined population of over 2.5 billion, these regions are witnessing a growing middle class eager to invest in premium skincare products. Targeting these markets can lead to increased sales and brand recognition, as consumers seek high-quality, luxury offerings.

- Collaborations with Influencers:Collaborating with social media influencers presents a lucrative opportunity for luxury skincare brands. Influencer marketing is projected to generate €600 million in revenue for the beauty sector. By leveraging the reach and credibility of influencers, brands can effectively engage younger consumers and enhance brand loyalty, driving sales and market penetration in a competitive landscape.