Region:Europe

Author(s):Shubham

Product Code:KRAA5189

Pages:80

Published On:September 2025

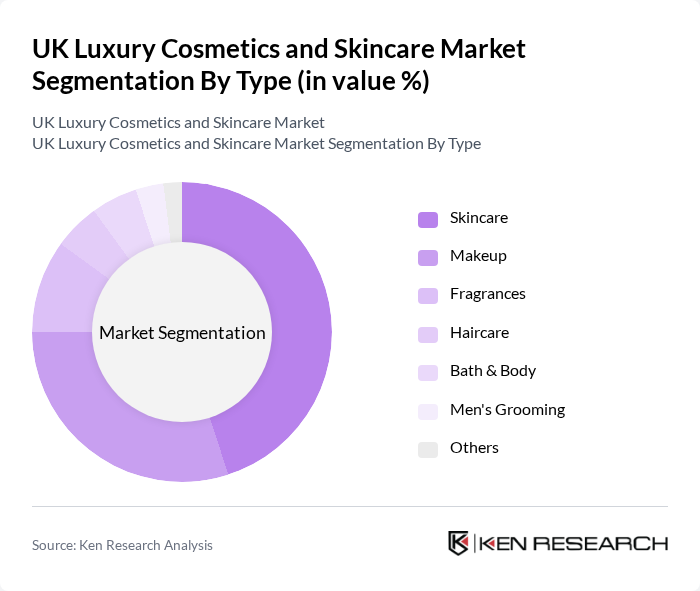

By Type:The luxury cosmetics and skincare market is segmented into various types, including skincare, makeup, fragrances, haircare, bath & body, men's grooming, and others. Among these, skincare products dominate the market due to the increasing focus on skin health and the rising popularity of anti-aging and moisturizing products. Consumers are increasingly investing in high-quality skincare routines, which has led to a surge in demand for premium skincare items. Makeup products also hold a significant share, driven by trends in beauty and self-expression.

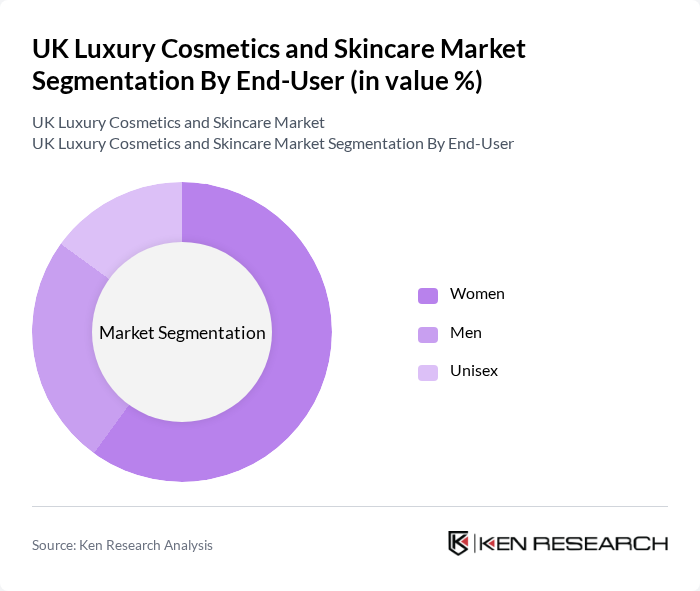

By End-User:The market is segmented by end-user into women, men, and unisex products. Women represent the largest segment, driven by a strong inclination towards beauty and skincare routines. The increasing availability of products tailored specifically for women, along with targeted marketing strategies, has solidified their dominance in the market. Men's grooming is also gaining traction, with more men investing in skincare and grooming products, reflecting changing societal norms regarding male beauty.

The UK Luxury Cosmetics and Skincare Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oreal Group, Estée Lauder Companies Inc., Coty Inc., Shiseido Company, Limited, Procter & Gamble Co., Unilever PLC, Chanel S.A., Dior (Christian Dior SE), Clarins Group, Beiersdorf AG, Kiehl's Since 1851, Lancôme, NARS Cosmetics, Tom Ford Beauty, Huda Beauty contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK luxury cosmetics and skincare market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value, brands are expected to innovate with eco-friendly packaging and formulations. Additionally, the integration of augmented reality in retail experiences is likely to enhance consumer engagement, allowing for personalized shopping experiences. The market is poised for growth as brands adapt to these trends while maintaining high-quality standards and transparency in their offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Makeup Fragrances Haircare Bath & Body Men's Grooming Others |

| By End-User | Women Men Unisex |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Direct Sales |

| By Price Range | Premium Super Premium Luxury |

| By Ingredient Type | Natural Synthetic Organic |

| By Packaging Type | Bottles Jars Tubes |

| By Brand Positioning | Established Brands Emerging Brands Niche Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Skincare Product Users | 150 | Affluent Consumers, Skincare Enthusiasts |

| High-End Cosmetics Retailers | 100 | Store Managers, Beauty Advisors |

| Online Luxury Cosmetics Shoppers | 120 | eCommerce Managers, Digital Marketing Specialists |

| Beauty Influencers and Bloggers | 80 | Content Creators, Social Media Managers |

| Dermatologists and Skincare Experts | 60 | Medical Professionals, Beauty Consultants |

The UK Luxury Cosmetics and Skincare Market is valued at approximately USD 12 billion, reflecting a significant growth trend driven by consumer demand for premium products and increased awareness of skincare routines.