Region:Europe

Author(s):Shubham

Product Code:KRAB5068

Pages:94

Published On:October 2025

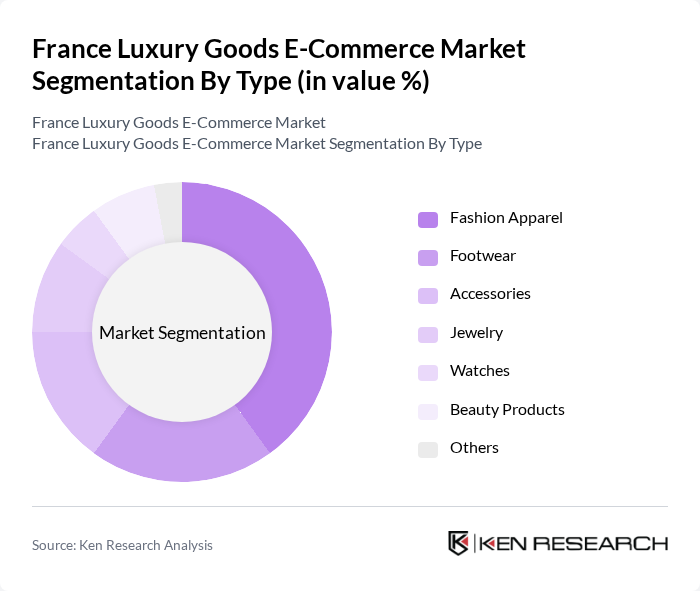

By Type:The luxury goods e-commerce market can be segmented into various types, including Fashion Apparel, Footwear, Accessories, Jewelry, Watches, Beauty Products, and Others. Among these, Fashion Apparel is the leading sub-segment, driven by the increasing demand for high-end clothing and the influence of fashion trends on consumer purchasing behavior. The rise of online fashion retailers has also contributed to the growth of this segment, making luxury apparel more accessible to a wider audience.

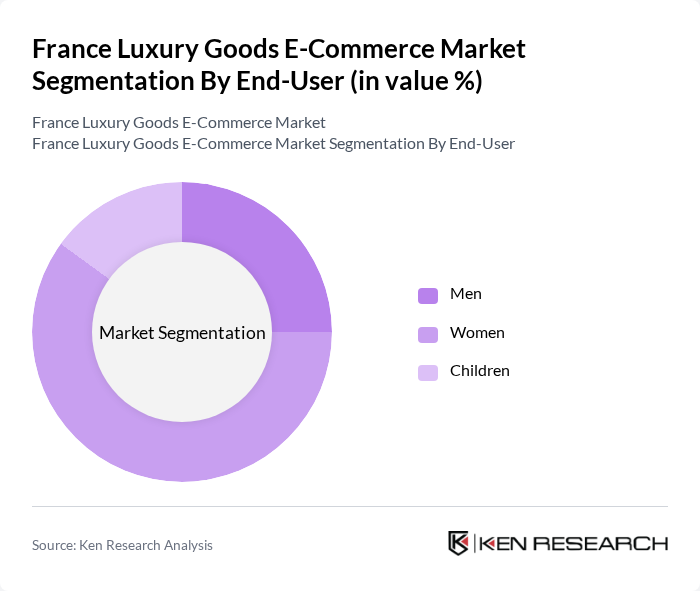

By End-User:The market can also be segmented by end-user demographics, including Men, Women, and Children. The Women segment dominates the market, driven by a higher propensity for luxury spending among female consumers. Women are increasingly seeking luxury products for personal use and gifting, which has led to a surge in demand for luxury fashion and beauty products tailored specifically for them.

The France Luxury Goods E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering S.A., Chanel S.A., Hermès International S.A., Richemont, Christian Dior SE, Burberry Group plc, Prada S.p.A., Valentino S.p.A., Moncler S.p.A., Balenciaga, Givenchy, Fendi, Bottega Veneta, Salvatore Ferragamo S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France luxury goods e-commerce market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms continue to enhance user experiences, brands are likely to invest in personalized marketing strategies and innovative shopping solutions. The integration of AI and machine learning will further refine customer interactions, while sustainability trends will shape product offerings. Overall, the market is poised for significant transformation, aligning with the values of modern consumers seeking luxury with purpose.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion Apparel Footwear Accessories Jewelry Watches Beauty Products Others |

| By End-User | Men Women Children |

| By Sales Channel | Direct-to-Consumer Online Marketplaces Brand Websites Social Media Platforms |

| By Price Range | Premium Mid-Range Affordable Luxury |

| By Distribution Mode | Home Delivery Click and Collect Subscription Services |

| By Brand Origin | Domestic Brands International Brands |

| By Consumer Demographics | Age Group Income Level Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion E-commerce | 150 | Brand Managers, E-commerce Directors |

| Luxury Accessories Market | 100 | Product Development Managers, Marketing Executives |

| High-End Cosmetics Sales | 80 | Retail Managers, Beauty Brand Executives |

| Luxury Goods Consumer Insights | 120 | Luxury Consumers, Market Research Analysts |

| Online Luxury Retail Trends | 90 | E-commerce Analysts, Digital Marketing Specialists |

The France Luxury Goods E-Commerce Market is valued at approximately USD 30 billion, reflecting significant growth driven by increased online shopping, rising disposable incomes, and the influence of social media on consumer purchasing decisions.