France Luxury Goods Market Overview

- The France Luxury Goods Market is valued at USD 25 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, an expanding base of affluent consumers, robust tourism, and a strong demand for high-quality products. The luxury sector has experienced a significant rebound following the pandemic, with consumers showing renewed interest in premium brands and exclusive experiences. Notably, the market benefits from the enduring global appeal of French luxury brands and the increasing influence of digital channels on consumer purchasing behavior .

- Key cities such as Paris, Nice, and Lyon continue to dominate the luxury goods market due to their status as fashion capitals and major tourist destinations. Paris, in particular, is renowned for its concentration of luxury boutiques and flagship stores, attracting both local and international shoppers. The city's rich cultural heritage, iconic shopping districts, and events like Paris Fashion Week further reinforce its leadership in the luxury sector .

- In recent years, the French government has introduced regulations aimed at promoting sustainability in the luxury goods sector. These measures include guidelines for eco-friendly production, increased transparency in supply chains, and incentives for brands to adopt sustainable materials and ethical sourcing. The initiative aligns the luxury market with global sustainability objectives while preserving its prestigious image .

France Luxury Goods Market Segmentation

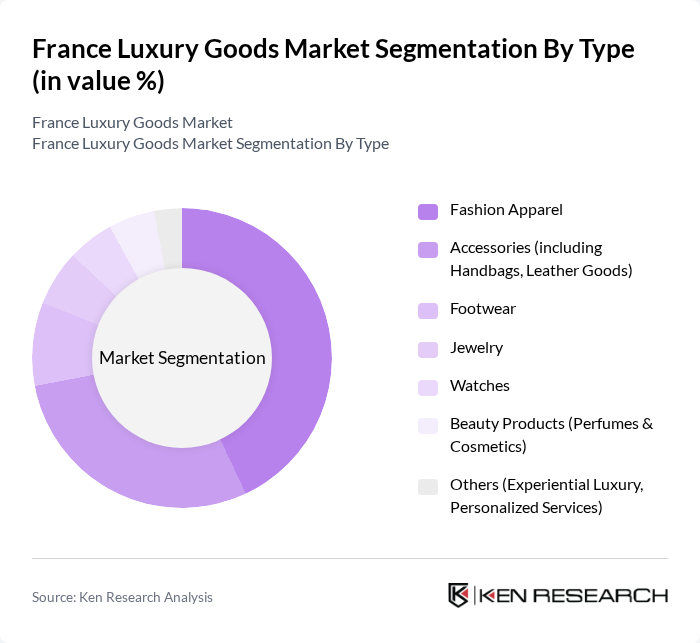

By Type:The luxury goods market in France is segmented into Fashion Apparel, Accessories (including Handbags, Leather Goods), Footwear, Jewelry, Watches, Beauty Products (Perfumes & Cosmetics), and Others (Experiential Luxury, Personalized Services). Among these, Fashion Apparel and Accessories remain the most dominant segments, reflecting consumer preferences for high-end fashion and iconic luxury brands. Leather goods, in particular, are experiencing strong growth due to consumer interest in durable, investment-grade products and sustainable sourcing .

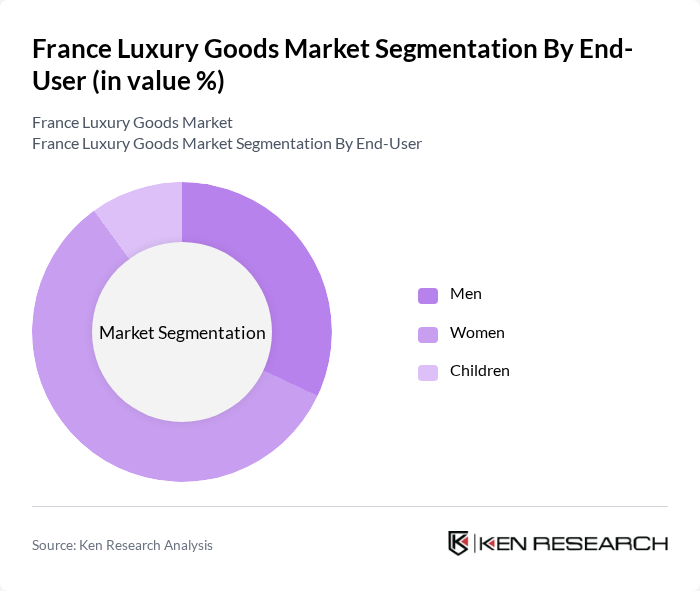

By End-User:The luxury goods market is also segmented by end-user demographics, including Men, Women, and Children. Women constitute the largest consumer base, driven by higher spending on fashion and beauty products. Men are increasingly significant consumers, particularly in fashion, accessories, and watches, reflecting a broader trend of male engagement in luxury categories .

France Luxury Goods Market Competitive Landscape

The France Luxury Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering S.A., Chanel S.A., Hermès International S.A., Compagnie Financière Richemont S.A., Christian Dior S.E., Prada S.p.A., Burberry Group plc, Valentino S.p.A., Celine S.A., Givenchy S.A., Balenciaga S.A., Fendi S.r.l., Montblanc International GmbH, and Boucheron S.A. contribute to innovation, geographic expansion, and service delivery in this space.

France Luxury Goods Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The disposable income in France is projected to reach €1.6 trillion in future, reflecting a growth of approximately €100 billion from previous periods. This increase allows consumers to allocate more funds towards luxury goods, driving demand. The affluent segment, which constitutes about 10% of the population, is expected to contribute significantly to this growth, as their spending on luxury items is anticipated to rise by 9% annually, further bolstering the market.

- Rising Demand for Sustainable Luxury:In future, the sustainable luxury segment in France is expected to grow to €15 billion, driven by consumer preferences shifting towards eco-friendly products. Approximately 75% of luxury consumers are willing to pay a premium for sustainable brands, indicating a robust market trend. This demand is supported by the increasing awareness of environmental issues, prompting brands to adopt sustainable practices, which enhances their appeal and market share in the luxury sector.

- Growth of E-commerce Platforms:E-commerce sales in the French luxury goods market are projected to reach €10 billion in future, marking a significant increase from €7 billion in previous periods. This growth is fueled by the rising internet penetration rate, which is expected to hit 96% in future. Additionally, the convenience of online shopping and the proliferation of mobile payment options are driving consumers towards digital platforms, allowing luxury brands to expand their reach and enhance customer engagement.

Market Challenges

- Economic Uncertainty:France's GDP growth is projected to slow to 1.1% in future, down from 1.5% in previous periods, creating a challenging environment for luxury goods. This economic uncertainty can lead to reduced consumer spending, particularly in high-end markets. Additionally, inflation rates are expected to remain elevated at around 4%, further straining disposable incomes and potentially dampening demand for luxury products as consumers prioritize essential goods over discretionary spending.

- Counterfeit Products:The counterfeit luxury goods market in France is estimated to cost the industry approximately €8 billion annually. This issue undermines brand integrity and consumer trust, posing a significant challenge for legitimate luxury brands. The rise of online marketplaces has exacerbated this problem, making it easier for counterfeiters to reach consumers. As a result, luxury brands are investing heavily in anti-counterfeiting technologies and legal measures to protect their intellectual property and maintain market share.

France Luxury Goods Market Future Outlook

The France luxury goods market is poised for a transformative phase, driven by digitalization and sustainability trends. As brands increasingly adopt e-commerce strategies, the online luxury segment is expected to flourish, enhancing accessibility for consumers. Furthermore, the focus on sustainable practices will likely reshape product offerings, aligning with consumer values. Innovations in technology, such as augmented reality and AI, will also play a crucial role in enhancing customer experiences, ensuring that the market remains dynamic and responsive to evolving consumer preferences.

Market Opportunities

- Expansion into Emerging Markets:Luxury brands have a significant opportunity to penetrate emerging markets, particularly in Asia and Africa, where the middle class is expanding rapidly. In future, these regions are expected to account for 35% of global luxury consumption, presenting a lucrative avenue for growth. Targeting these markets can enhance brand visibility and drive sales, capitalizing on the increasing affluence of consumers.

- Collaborations with Influencers:Collaborating with social media influencers can significantly enhance brand reach and engagement. In future, brands that leverage influencer partnerships are projected to see a 25% increase in customer acquisition. This strategy allows luxury brands to tap into niche markets and connect with younger consumers, who are increasingly influenced by social media trends, thereby driving sales and brand loyalty.