Region:Middle East

Author(s):Shubham

Product Code:KRAD0607

Pages:98

Published On:August 2025

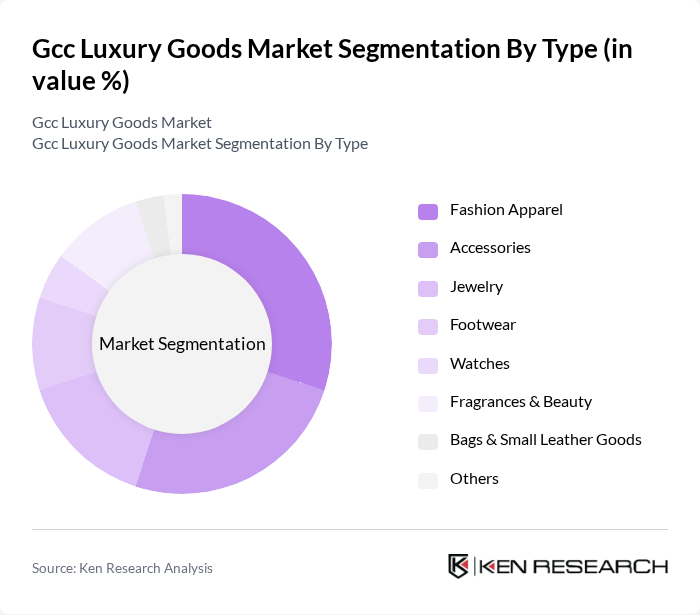

By Type:The luxury goods market can be segmented into various types, including fashion apparel, accessories, jewelry, footwear, watches, fragrances & beauty, bags & small leather goods, and others. Among these, fashion apparel and accessories are the most dominant segments, driven by changing consumer preferences and the influence of social media on fashion trends. The demand for high-quality, branded products continues to rise, particularly among younger consumers who prioritize style and brand reputation.

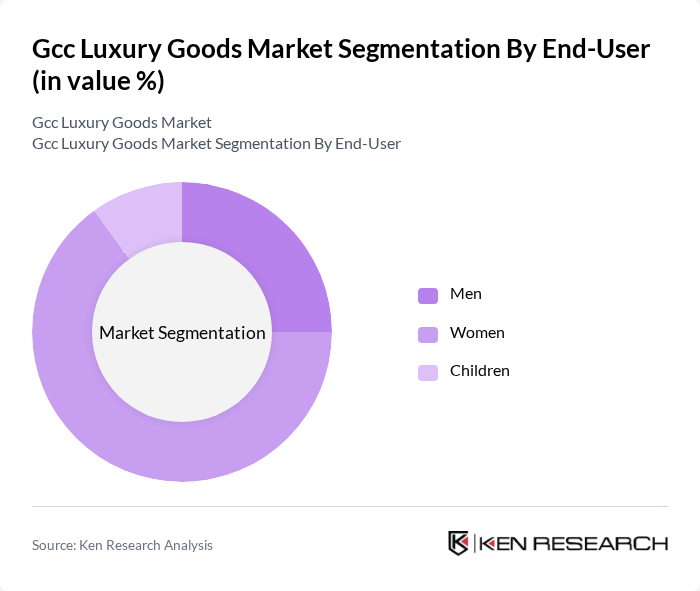

By End-User:The luxury goods market is segmented by end-user demographics, including men, women, and children. Women represent the largest consumer group, driven by a strong inclination towards fashion and beauty products. The increasing participation of men in luxury shopping is notable, as they seek high-end apparel and accessories. Children’s luxury products are also gaining traction, reflecting a growing trend of premium offerings for younger demographics.

The GCC luxury goods market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton SE, Kering S.A. (Gucci, Saint Laurent, Bottega Veneta), Chanel S.A., Hermès International S.A., Prada S.p.A. (Prada, Miu Miu), Burberry Group plc, Cartier (Compagnie Financière Richemont SA), Tiffany & Co. (LVMH), Rolex SA, Christian Dior Couture (LVMH), Fendi (LVMH), Versace (Capri Holdings Limited), Bulgari (Bvlgari) (LVMH), Valentino S.p.A., Salvatore Ferragamo S.p.A., The Estée Lauder Companies Inc. (La Mer, Tom Ford Beauty, Jo Malone London), L’Oréal Luxe (Lancôme, YSL Beauty, Giorgio Armani Beauty), Richemont (Jaeger?LeCoultre, Piaget, Van Cleef & Arpels), The Swatch Group (Omega, Breguet, Blancpain), Chalhoub Group (Regional luxury distributor/retailer), Al Tayer Group (Ounass; regional luxury retail), Doha Jewellery & Watches Exhibition Brands (regional cluster) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC luxury goods market appears promising, driven by evolving consumer preferences and technological advancements. As personalization and digital transformation continue to shape the retail landscape, brands are expected to invest in innovative strategies to enhance customer experiences. Additionally, sustainability will play a crucial role, with consumers increasingly favoring eco-friendly luxury products. The market is likely to adapt to these trends, ensuring continued growth and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion Apparel Accessories Jewelry Footwear Watches Fragrances & Beauty Bags & Small Leather Goods Others |

| By End-User | Men Women Children |

| By Sales Channel | Mono-brand (Single-brand) Boutiques Multi-brand/Specialty Stores Department Stores Online Stores Duty-Free & Travel Retail |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Distribution Mode | Direct-to-Consumer (Owned Retail & E-commerce) Indirect (Franchise, Wholesale, Concessions) |

| By Brand Origin | Local/Regional Luxury Brands International Luxury Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Country | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Purchases | 150 | Affluent Consumers, Fashion Enthusiasts |

| High-End Cosmetics Usage | 100 | Beauty Product Consumers, Makeup Artists |

| Luxury Accessories Market | 80 | Affluent Consumers, Accessory Shoppers |

| Luxury Travel Expenditures | 70 | Affluent Travelers, Frequent International Travelers |

| Online Luxury Shopping Trends | 90 | Affluent E-commerce Shoppers, Digital Buyers |

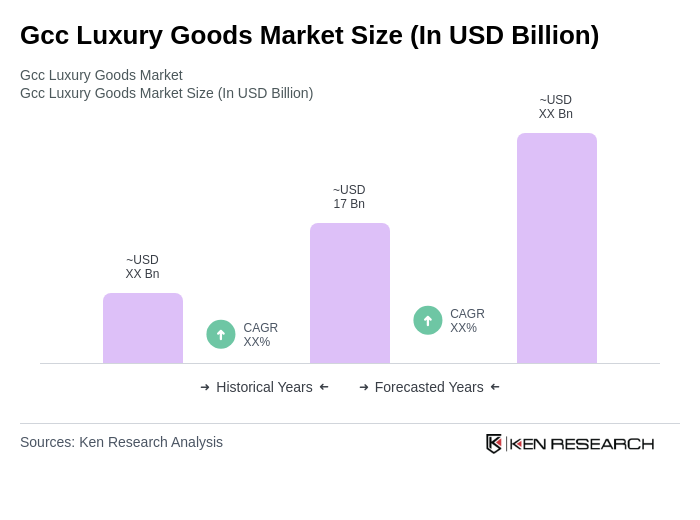

The GCC luxury goods market is valued at approximately USD 17 billion, driven by rising disposable incomes, an affluent population, and increasing consumer interest in luxury brands, particularly in fashion, accessories, and beauty segments.