Region:Middle East

Author(s):Dev

Product Code:KRAB7245

Pages:96

Published On:October 2025

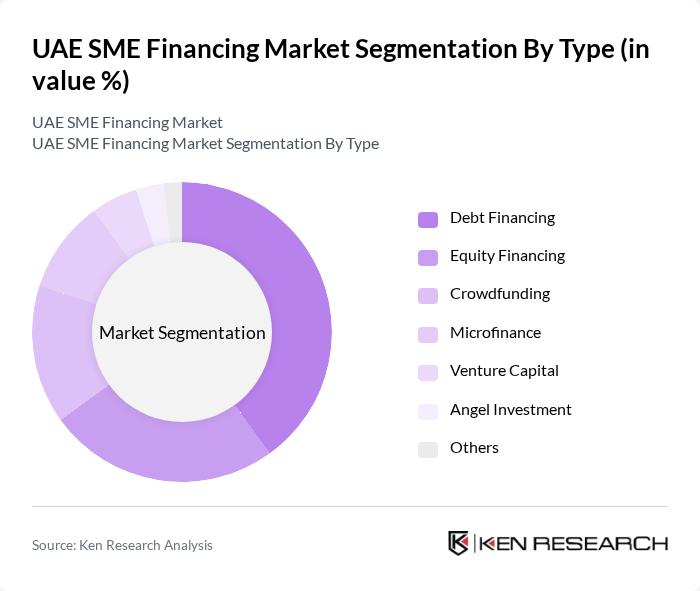

By Type:The SME financing market can be segmented into various types, including debt financing, equity financing, crowdfunding, microfinance, venture capital, angel investment, and others. Debt financing remains the most popular choice among SMEs due to its structured repayment terms and lower cost of capital. Equity financing is gaining traction as businesses seek to leverage investor expertise and networks. Crowdfunding has emerged as a viable alternative for startups, while microfinance caters to smaller enterprises with limited access to traditional banking services.

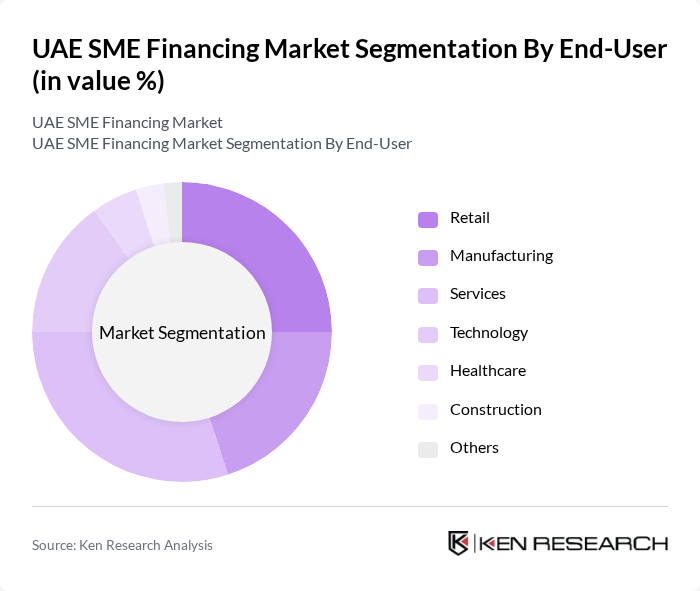

By End-User:The end-user segmentation of the SME financing market includes retail, manufacturing, services, technology, healthcare, construction, and others. The services sector dominates the market, driven by the increasing demand for professional services and consultancy. Retail and technology sectors are also significant contributors, as they continue to expand rapidly in the UAE. The healthcare and construction sectors are witnessing growth due to ongoing investments in infrastructure and health services, further diversifying the market.

The UAE SME Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, First Abu Dhabi Bank, Sharjah Islamic Bank, RAK Bank, National Bank of Fujairah, Ajman Bank, Abu Dhabi Investment Authority, Dubai Investments, Gulf Capital, Fincasa, Beehive, YAPILI, and Fintech Galaxy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE SME financing market appears promising, driven by ongoing government support and the rapid adoption of digital financial solutions. As the entrepreneurial ecosystem continues to expand, more innovative financing options are likely to emerge, catering to the unique needs of SMEs. Additionally, the integration of advanced technologies, such as AI and blockchain, will enhance credit assessment processes, making financing more accessible and efficient for small businesses in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Debt Financing Equity Financing Crowdfunding Microfinance Venture Capital Angel Investment Others |

| By End-User | Retail Manufacturing Services Technology Healthcare Construction Others |

| By Investment Source | Bank Loans Government Grants Private Equity Family and Friends Institutional Investors Others |

| By Financing Stage | Seed Stage Growth Stage Expansion Stage Mature Stage |

| By Business Model | B2B B2C C2C Subscription-Based Freemium Others |

| By Geographic Focus | Local Market Regional Market International Market Export-Oriented Others |

| By Risk Profile | Low Risk Medium Risk High Risk Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing SMEs | 100 | Owners, Financial Managers |

| Service Sector SMEs | 80 | Business Development Managers, CFOs |

| Retail SMEs | 90 | Store Managers, Financial Analysts |

| Technology Startups | 70 | Founders, Product Managers |

| Construction SMEs | 60 | Project Managers, Financial Controllers |

The UAE SME financing market is valued at approximately USD 30 billion, reflecting significant growth driven by an increasing number of SMEs and supportive government initiatives aimed at fostering entrepreneurship and innovation in the region.