Region:Europe

Author(s):Shubham

Product Code:KRAA1866

Pages:81

Published On:August 2025

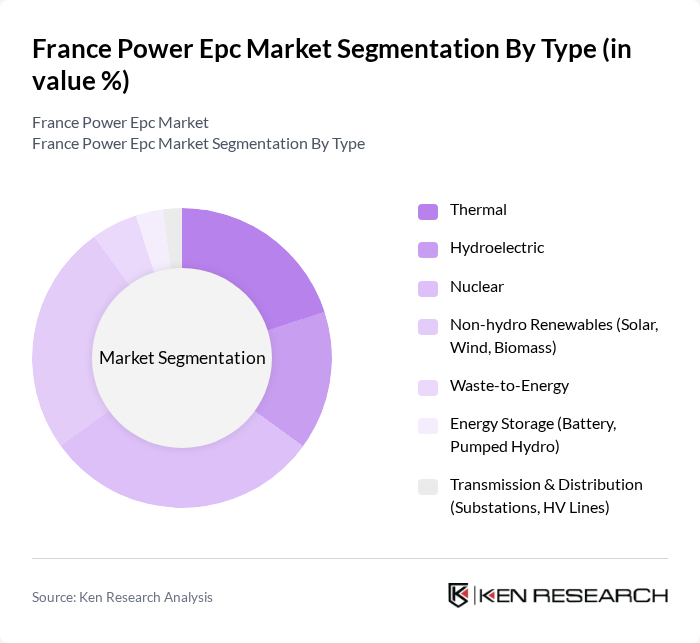

By Type:The market is segmented into various types, including Thermal, Hydroelectric, Nuclear, Non-hydro Renewables (Solar, Wind, Biomass), Waste-to-Energy, Energy Storage (Battery, Pumped Hydro), and Transmission & Distribution (Substations, HV Lines). Each of these segments plays a crucial role in the overall energy landscape, with specific applications and technologies driving their growth .

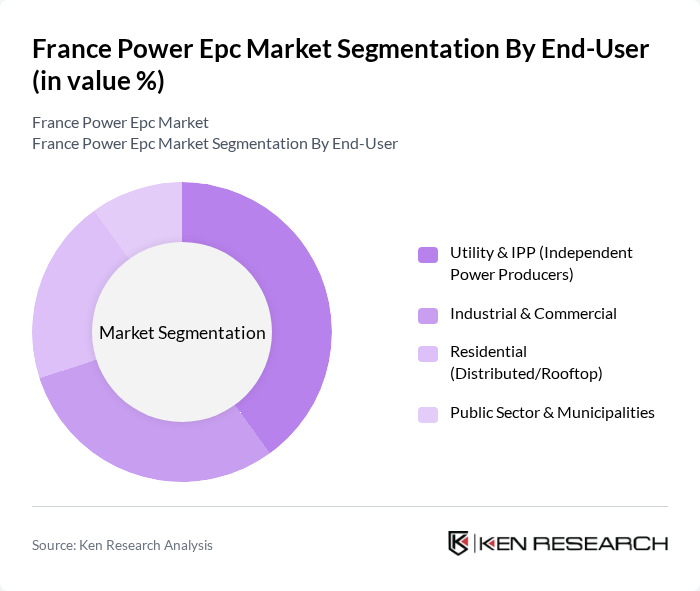

By End-User:The end-user segmentation includes Utility & IPP (Independent Power Producers), Industrial & Commercial, Residential (Distributed/Rooftop), and Public Sector & Municipalities. Each segment has distinct requirements and influences the overall demand for power EPC services .

The France Power EPC market is characterized by a dynamic mix of regional and international players. Leading participants such as ENGIE Solutions, EDF Renewables, TotalEnergies Renewables France, Eiffage Énergie Systèmes, Bouygues Energies & Services, VINCI Energies (Omexom), GE Vernova (Grid Solutions, ex-ALSTOM Grid), RTE (Réseau de Transport d’Électricité), Enedis, Siemens Gamesa Renewable Energy, Nordex Group, Vestas Wind Systems, Schneider Electric, Acciona Energía, Saipem (EPCI for Offshore Wind) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France Power EPC market appears promising, driven by a robust commitment to renewable energy and technological advancements. As the government continues to implement supportive policies, the market is expected to witness increased investments in innovative energy solutions. Additionally, the growing emphasis on sustainability and energy efficiency will likely propel the adoption of smart grid technologies, enhancing operational capabilities and project delivery in the EPC sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermal Hydroelectric Nuclear Non-hydro Renewables (Solar, Wind, Biomass) Waste-to-Energy Energy Storage (Battery, Pumped Hydro) Transmission & Distribution (Substations, HV Lines) |

| By End-User | Utility & IPP (Independent Power Producers) Industrial & Commercial Residential (Distributed/Rooftop) Public Sector & Municipalities |

| By Investment Source | Domestic Private Foreign Direct Investment (FDI) Public-Private Partnership (PPP/Concessions) Government Programs (e.g., CRE tenders, ADEME support) |

| By Application | Grid-Connected (Onshore/Offshore) Off-Grid & Microgrids Distributed/Rooftop Systems Utility-Scale Projects |

| By Policy Support | Feed-in Tariffs/Contracts for Difference (CfD) & CRE Auctions Tax Incentives & Accelerated Depreciation Guarantees of Origin/Certificates |

| By Technology | Solar PV (Ground-mounted, Rooftop, Agri-PV) CSP/Concentrated Solar Thermal (niche) Wind (Onshore, Offshore) Biomass/Biogas & Waste-to-Energy |

| By Distribution Mode | Direct EPC Contracts Consortium/Joint Venture EPC EPC + O&M/Turnkey (EPC-M/EPC-O) Engineering/Procurement/Construction Subcontracting |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility-Scale Solar Projects | 120 | Project Managers, Technical Directors |

| Wind Farm Developments | 100 | Site Engineers, Operations Managers |

| Energy Storage Solutions | 80 | Product Managers, R&D Specialists |

| Grid Modernization Initiatives | 70 | Infrastructure Planners, Policy Advisors |

| Biomass and Bioenergy Projects | 60 | Environmental Consultants, Project Developers |

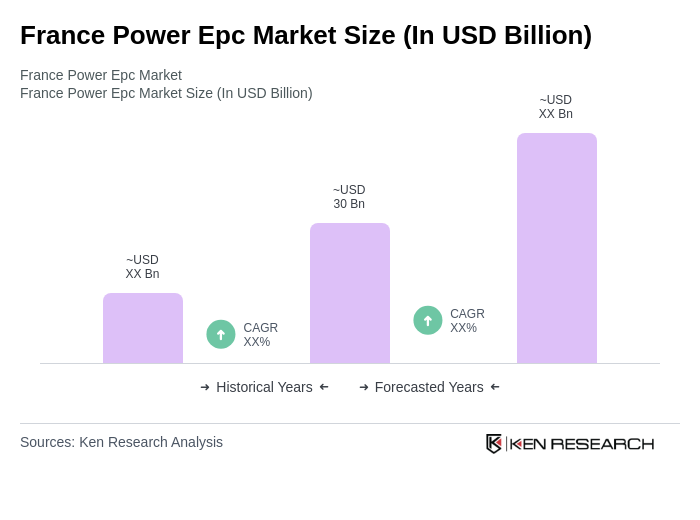

The France Power EPC market is valued at approximately USD 30 billion, reflecting sustained activity across various sectors such as generation, grid, and storage, driven by the country's energy transition agenda and increasing demand for renewable energy.