Region:Middle East

Author(s):Rebecca

Product Code:KRAC0217

Pages:80

Published On:August 2025

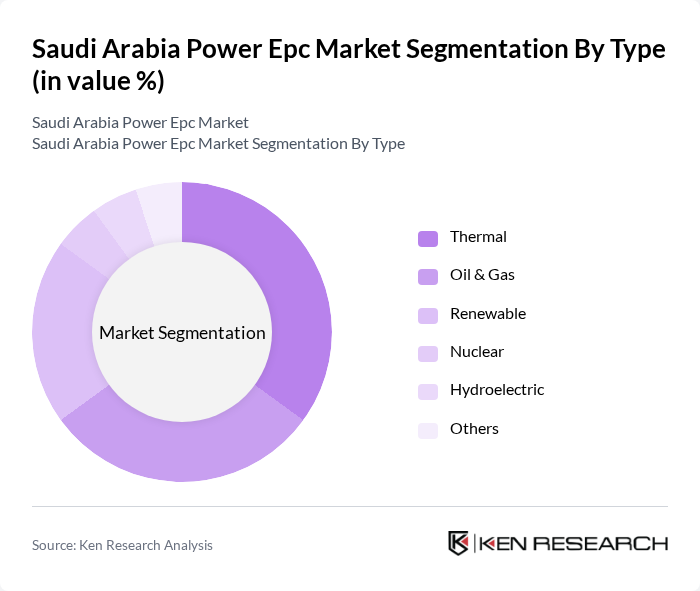

By Type:The market is segmented into various types, including Thermal, Oil & Gas, Renewable, Nuclear, Hydroelectric, and Others. Each type plays a crucial role in meeting the energy demands of the country. Renewable energy is gaining significant traction due to government initiatives and global sustainability trends, while Thermal and Oil & Gas remain dominant, supported by existing infrastructure and the need for reliable baseload power .

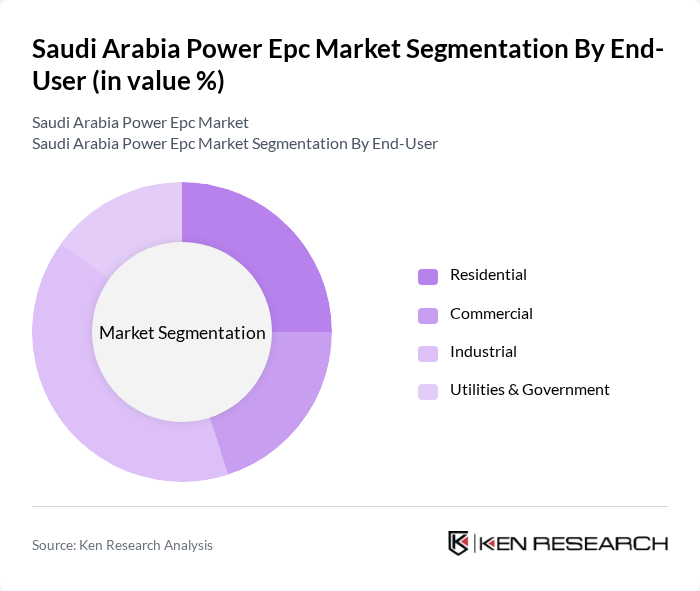

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Utilities & Government. The industrial sector is the largest consumer of power, driven by manufacturing and construction activities. The residential sector is also growing due to urbanization and population growth, while commercial usage is increasing with the expansion of businesses and services .

The Saudi Arabia Power EPC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Electricity Company, ACWA Power, National Contracting Company Limited, Doosan Heavy Industries & Construction Co., Ltd., Larsen & Toubro Limited, Power Construction Corporation of China Ltd., Electrical & Power Contracting Co. Ltd., Siemens AG, General Electric, ABB Ltd., Schneider Electric, Samsung C&T Corporation, Hyundai Engineering & Construction, Marubeni Corporation, JGC Corporation, SENER Grupo de Ingeniería, Black & Veatch, Fluor Corporation, KBR, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia Power EPC market is poised for significant transformation, driven by a strong focus on renewable energy and technological advancements. As the government continues to invest in infrastructure and sustainable energy solutions, EPC contractors will need to adapt to evolving market demands. The integration of smart grid technologies and digital transformation will enhance operational efficiency. Furthermore, the emphasis on energy efficiency will shape project designs, ensuring that future developments align with global sustainability goals and local energy needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermal Oil & Gas Renewable Nuclear Hydroelectric Others |

| By End-User | Residential Commercial Industrial Utilities & Government |

| By Application | Utility-Scale Power Plants Industrial Facilities Transmission & Distribution Infrastructure Distributed Generation |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Project Size | Small Scale Medium Scale Large Scale |

| By Financing Model | Equity Financing Debt Financing Hybrid Financing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Power EPC Projects | 60 | Project Managers, Technical Directors |

| Wind Energy Developments | 50 | Operations Managers, Environmental Consultants |

| Gas-Fired Power Plants | 45 | Procurement Managers, Engineering Leads |

| Renewable Energy Policy Impact | 40 | Regulatory Affairs Specialists, Policy Analysts |

| Energy Storage Solutions | 40 | Product Managers, R&D Engineers |

The Saudi Arabia Power EPC market is valued at approximately USD 6.5 billion, reflecting significant growth driven by the Vision 2030 initiative, which aims to diversify the economy and enhance energy infrastructure through investments in renewable and traditional energy sources.