Region:Asia

Author(s):Geetanshi

Product Code:KRAA0114

Pages:96

Published On:August 2025

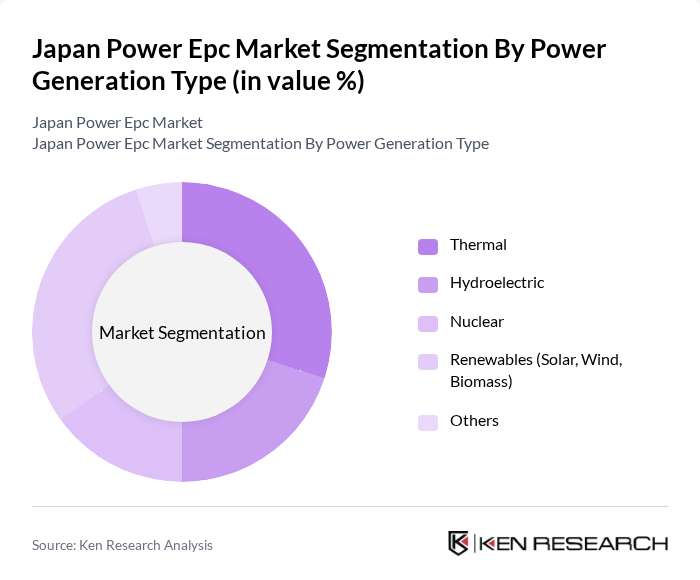

By Power Generation Type:The power generation type segmentation includes various sources such as thermal, hydroelectric, nuclear, renewables, and others. Among these, renewables are gaining significant traction due to government policies favoring sustainable energy solutions. The increasing focus on reducing carbon emissions and enhancing energy efficiency is driving investments in renewable technologies, making it the leading sub-segment in the market .

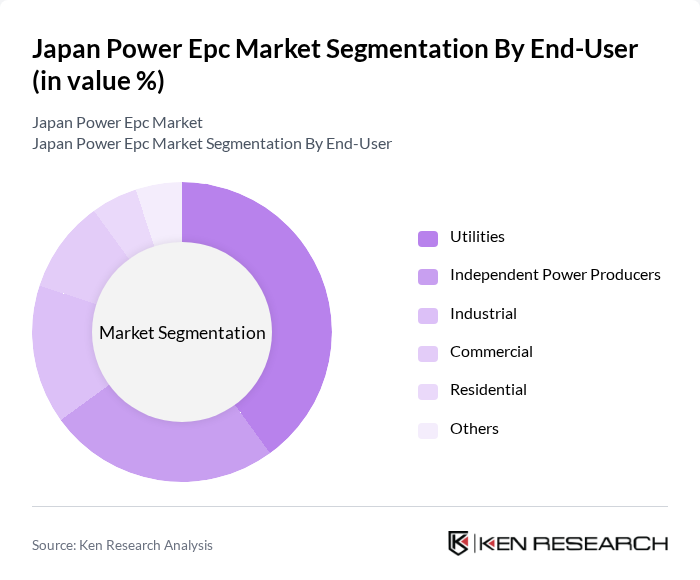

By End-User:The end-user segmentation encompasses utilities, independent power producers, industrial, commercial, residential, and others. Utilities are the dominant segment, driven by the increasing demand for reliable power supply and the need for infrastructure upgrades. The trend towards deregulation and privatization in the energy sector is also contributing to the growth of independent power producers, making them a significant player in the market .

The Japan Power EPC market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsubishi Heavy Industries, Hitachi, Ltd., Toshiba Energy Systems & Solutions Corporation, JGC Holdings Corporation, Chiyoda Corporation, Sumitomo Corporation, Marubeni Corporation, IHI Corporation, Shimizu Corporation, Obayashi Corporation, Tokyo Electric Power Company Holdings (TEPCO), Kansai Electric Power Co., Inc. (KEPCO), Fuji Electric Co., Ltd., Shizen Energy Inc., Electric Power Development Co., Ltd. (J-POWER) contribute to innovation, geographic expansion, and service delivery in this space.

The Japan Power EPC market is poised for significant transformation as the country accelerates its transition to renewable energy. With a projected increase in investment in smart grid technologies and energy storage solutions, the market is expected to adapt to evolving energy demands. Furthermore, the collaboration between local firms and international investors is likely to enhance technological capabilities, driving innovation and efficiency in project execution. This dynamic environment will create new opportunities for growth and sustainability in the power sector.

| Segment | Sub-Segments |

|---|---|

| By Power Generation Type | Thermal Hydroelectric Nuclear Renewables Others |

| By End-User | Utilities Independent Power Producers Industrial Commercial Residential Others |

| By Region | Honshu Hokkaido Kyushu Shikoku Okinawa |

| By Technology | Photovoltaic Onshore Wind Offshore Wind Biomass Geothermal Hydroelectric Others |

| By Application | Power Generation Transmission & Distribution Grid Integration Storage Solutions Others |

| By Investment Source | Domestic Foreign Direct Investment Public-Private Partnership Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates Feed-in Tariffs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Renewable Energy Projects | 100 | Project Managers, Renewable Energy Consultants |

| Conventional Power Plant EPC | 70 | Operations Managers, Engineering Directors |

| Energy Policy Analysts | 50 | Government Officials, Regulatory Affairs Specialists |

| Construction and Engineering Firms | 60 | Business Development Managers, Technical Leads |

| Investment and Financing in Power Sector | 40 | Financial Analysts, Investment Managers |

The Japan Power EPC market is valued at approximately USD 42 billion, reflecting significant growth driven by increasing energy infrastructure demand, government initiatives for renewable energy, and modernization of existing power plants.