France Sustainable Fashion and Apparel Market Overview

- The France Sustainable Fashion and Apparel Market is valued at USD 8.0 billion, based on a five-year historical analysis. This growth is primarily driven by rising consumer awareness of environmental impact, increased demand for circular and eco-friendly materials, and the adoption of sustainable production practices by both established brands and new entrants. The sector’s expansion is further supported by innovation in textile recycling, upcycling, and the rapid growth of secondhand and resale platforms, reflecting a broader shift toward responsible consumption and waste reduction .

- Key cities such as Paris, Lyon, and Marseille continue to dominate the market due to their established fashion culture, high consumer spending, and concentration of sustainable fashion brands. Paris, as a global fashion capital, leads in the adoption of innovative sustainable practices and attracts both domestic and international brands focused on eco-friendly apparel and circular business models .

- In 2023, the French government enacted the "Anti-Waste Law for a Circular Economy" (Loi n° 2020-105 relative à la lutte contre le gaspillage et à l'économie circulaire, issued by the French Ministry for the Ecological Transition), which requires textile producers to incorporate a minimum percentage of recycled materials in their products and to implement extended producer responsibility schemes. This regulation aims to reduce textile waste, promote recycling, and drive sustainable practices throughout the fashion industry .

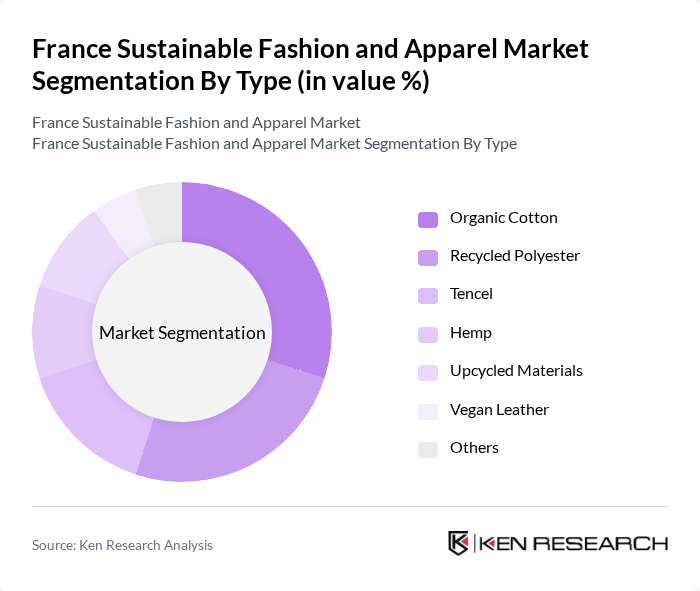

France Sustainable Fashion and Apparel Market Segmentation

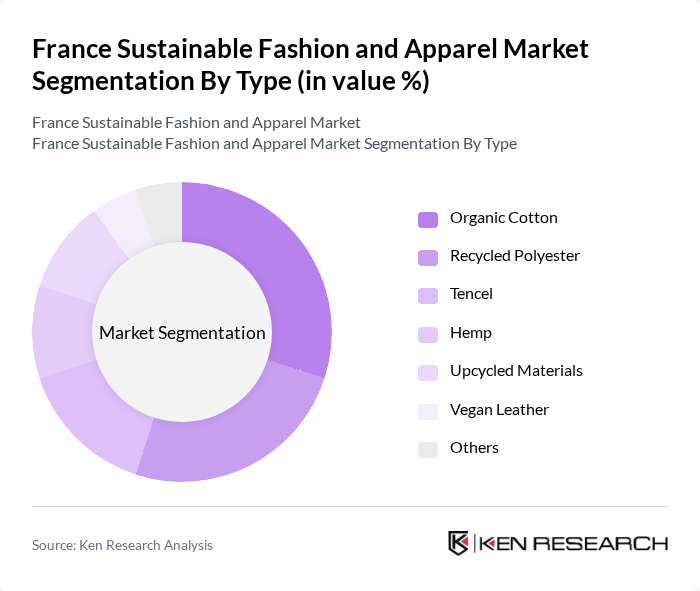

By Type:The market is segmented into Organic Cotton, Recycled Polyester, Tencel, Hemp, Upcycled Materials, Vegan Leather, and Others. Organic Cotton is gaining significant traction due to its lower environmental impact and consumer preference for natural, chemical-free fibers. Recycled Polyester is increasingly popular as brands seek to reduce plastic waste and carbon emissions. Demand for Tencel and Hemp is rising, driven by their biodegradability and resource-efficient cultivation. Upcycled Materials and Vegan Leather address niche markets focused on innovation, animal welfare, and ethical production, while the “Others” category includes emerging sustainable fibers and blends .

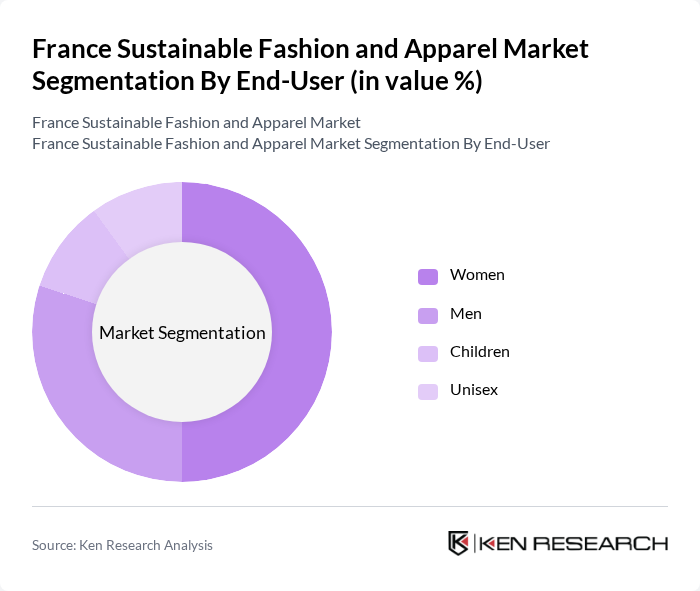

By End-User:The end-user segmentation includes Women, Men, Children, and Unisex. Women represent the largest segment, supported by a wide range of sustainable fashion offerings and heightened interest in eco-friendly apparel. The Men’s segment is expanding as brands introduce more sustainable lines for male consumers. The Children’s segment is growing due to increased parental focus on health and sustainability, while Unisex clothing appeals to consumers seeking versatility, inclusivity, and gender-neutral designs .

France Sustainable Fashion and Apparel Market Competitive Landscape

The France Sustainable Fashion and Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chanel, LVMH (Louis Vuitton Moët Hennessy), Kering (Gucci, Saint Laurent, Balenciaga), Veja, Reformation, Patagonia, Amour Vert, Nudie Jeans, Ecoalf, People Tree, Etnies, MUD Jeans, Tentree, Arket, Faithfull the Brand, Stella McCartney, Armedangels, Thought Clothing, Allbirds, Outerknown, Girlfriend Collective, and Toms contribute to innovation, geographic expansion, and service delivery in this space.

France Sustainable Fashion and Apparel Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Sustainability:In France, consumer awareness regarding sustainability has surged, with 70% of consumers actively seeking eco-friendly products. This shift is driven by a growing understanding of environmental issues, as evidenced by a survey indicating that 65% of respondents prioritize sustainable practices when making purchasing decisions. The French market is witnessing a notable increase in demand for sustainable apparel, with sales of eco-friendly clothing rising by €1.3 billion in future alone, reflecting a robust trend towards responsible consumption.

- Government Initiatives Promoting Eco-Friendly Practices:The French government has implemented various initiatives to promote sustainable fashion, including the Circular Economy Law, which mandates that 50% of textiles sold must be recycled or reused in future. Additionally, the government allocated €350 million in future to support sustainable fashion startups and innovations. These initiatives are expected to enhance the market's growth by fostering a regulatory environment that encourages eco-friendly practices and investments in sustainable technologies.

- Innovations in Sustainable Materials:The development of sustainable materials is a significant growth driver in the French fashion market. In future, the production of organic cotton increased by 16%, while the use of recycled polyester surged by 22%. Innovations such as bio-based fabrics and biodegradable materials are gaining traction, with over 32% of fashion brands in France incorporating these materials into their collections. This trend not only meets consumer demand for sustainability but also positions brands competitively in a rapidly evolving market landscape.

Market Challenges

- High Production Costs:One of the primary challenges facing the sustainable fashion market in France is the high production costs associated with eco-friendly materials and ethical manufacturing processes. For instance, the cost of organic cotton is approximately 31% higher than conventional cotton, which can deter brands from fully committing to sustainable practices. Additionally, the investment in sustainable technologies and supply chain adjustments can lead to increased operational expenses, impacting profit margins and pricing strategies for brands.

- Competition from Fast Fashion Brands:The dominance of fast fashion brands poses a significant challenge to the sustainable fashion market in France. In future, fast fashion accounted for 61% of the total apparel market, driven by low prices and rapid production cycles. This competitive pressure makes it difficult for sustainable brands to attract price-sensitive consumers. Furthermore, the marketing strategies of fast fashion companies often overshadow the efforts of sustainable brands, complicating their visibility and market penetration.

France Sustainable Fashion and Apparel Market Future Outlook

The future of the sustainable fashion market in France appears promising, driven by increasing consumer demand for transparency and ethical practices. As digital technologies continue to reshape retail, brands are expected to leverage e-commerce platforms to reach a broader audience. Additionally, the growing emphasis on circular fashion models will likely encourage innovation in recycling and upcycling, fostering a more sustainable industry. With supportive government policies and rising consumer awareness, the market is poised for significant transformation in the coming years.

Market Opportunities

- Growth of Online Retail Channels:The expansion of online retail channels presents a significant opportunity for sustainable fashion brands in France. In future, online sales of sustainable apparel increased by 26%, driven by consumer preferences for convenience and accessibility. This trend allows brands to reach eco-conscious consumers more effectively, enhancing their market presence and sales potential.

- Development of Circular Fashion Models:The development of circular fashion models offers a promising avenue for growth. In future, the circular economy in the fashion sector was valued at €1.6 billion in France, with projections indicating a potential increase to €3.2 billion in future. Brands that adopt circular practices, such as take-back schemes and rental services, can tap into this growing market segment, appealing to environmentally conscious consumers.