Region:Middle East

Author(s):Dev

Product Code:KRAC4111

Pages:100

Published On:October 2025

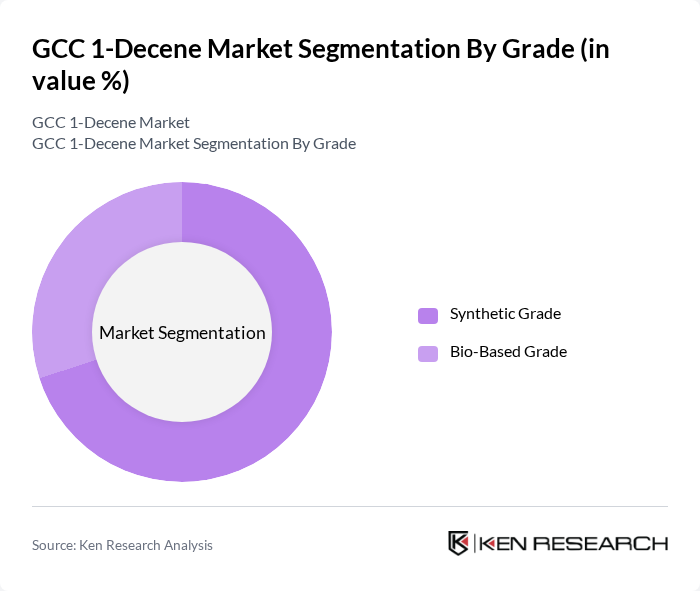

By Grade:The market is segmented into two primary grades:Synthetic GradeandBio-Based Grade. Synthetic Grade dominates due to its established use in high-performance lubricants, plastics, and chemical intermediates. However, Bio-Based Grade is gaining momentum as industries and consumers increasingly prioritize sustainability, regulatory compliance, and reduced carbon footprints. The shift toward bio-based solutions is also supported by advancements in renewable feedstock technologies and growing demand for green chemistry in the region .

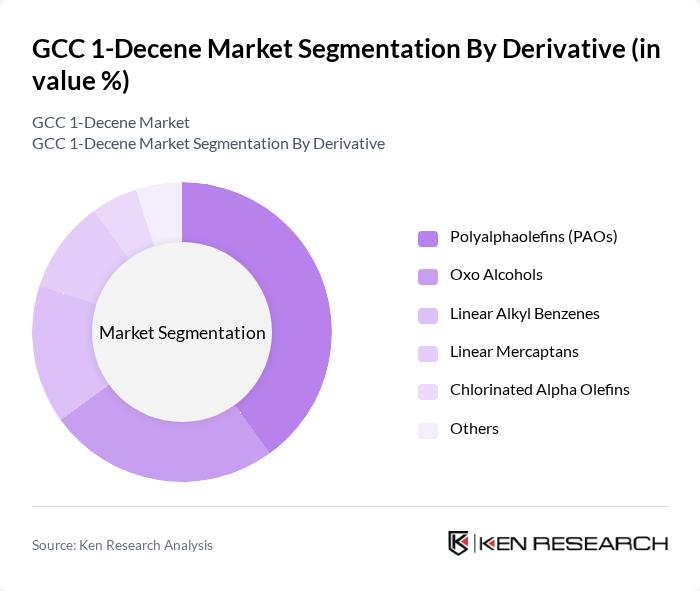

By Derivative:The market is further segmented by derivatives, includingPolyalphaolefins (PAOs),Oxo Alcohols,Linear Alkyl Benzenes,Linear Mercaptans,Chlorinated Alpha Olefins, andOthers. PAOs lead due to their critical role in high-performance lubricants for automotive and industrial applications. Oxo Alcohols are significant for their use in plasticizers and surfactants. Linear Alkyl Benzenes and Linear Mercaptans are important for detergents and specialty chemicals, while Chlorinated Alpha Olefins and other derivatives serve niche industrial functions .

The GCC 1-Decene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Qatar Petrochemical Company (QAPCO), Abu Dhabi National Oil Company (ADNOC), Chevron Phillips Chemical Company, ExxonMobil Corporation, INEOS Group Holdings S.A., LyondellBasell Industries N.V., Shell plc, Reliance Industries Limited, Formosa Plastics Corporation, Mitsubishi Chemical Corporation, TotalEnergies SE, Eastman Chemical Company, BASF SE, Huntsman Corporation, and Clariant AG contribute to innovation, geographic expansion, and service delivery in this space.

The GCC 1-decene market is poised for substantial growth, driven by increasing demand across various sectors, particularly in automotive and consumer goods. As manufacturers invest in sustainable production methods and innovative applications, the market is expected to adapt to evolving consumer preferences. Additionally, the ongoing expansion of the petrochemical industry will enhance the supply chain, ensuring that 1-decene remains a critical component in the production of high-performance materials and eco-friendly products, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Grade | Synthetic Grade Bio-Based Grade |

| By Derivative | Polyalphaolefins (PAOs) Oxo Alcohols Linear Alkyl Benzenes Linear Mercaptans Chlorinated Alpha Olefins Others |

| By Application | Synthetic Lubricants Polyethylene Production Surfactants Detergent Alcohols Plasticizers Specialty Chemicals |

| By End-Use Industry | Automotive Industrial Consumer Goods Construction Agriculture |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | Saudi Arabia UAE Qatar Kuwait |

| By Price Range | Low Price Mid Price High Price |

| By Others | Niche Applications Emerging Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastics Manufacturing Sector | 100 | Production Managers, Procurement Officers |

| Lubricants and Greases Industry | 80 | Product Development Managers, Technical Directors |

| Surfactants and Detergents Market | 70 | R&D Managers, Quality Assurance Heads |

| Chemical Intermediates Sector | 60 | Supply Chain Managers, Operations Directors |

| Research Institutions and Academia | 40 | Research Scientists, Industry Analysts |

The GCC 1-Decene Market is valued at approximately USD 1.1 billion, driven by increasing demand for synthetic lubricants and polyethylene production, essential in automotive, packaging, and industrial applications.