Region:Asia

Author(s):Dev

Product Code:KRAC2752

Pages:86

Published On:October 2025

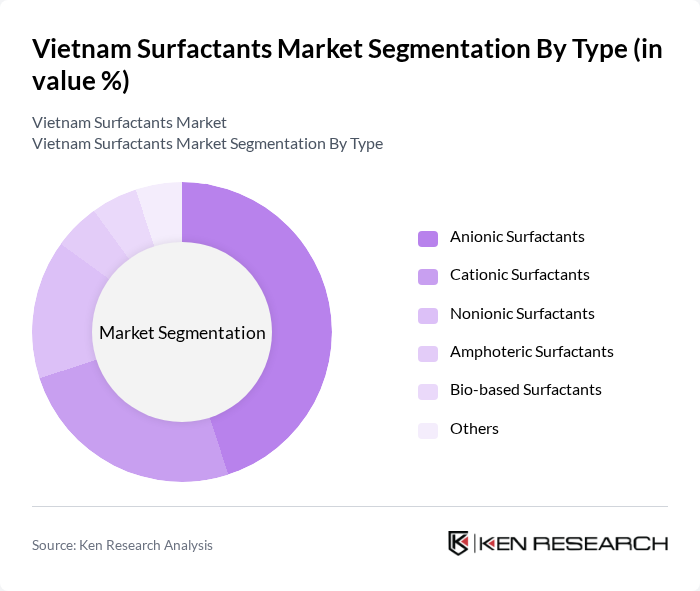

By Type:The surfactants market in Vietnam is segmented into Anionic Surfactants, Cationic Surfactants, Nonionic Surfactants, Amphoteric Surfactants, Bio-based Surfactants, and Others. Anionic Surfactants remain the most widely used type due to their strong cleaning efficiency, cost-effectiveness, and compatibility with detergent formulations. Cationic Surfactants are increasingly utilized in personal care products for their conditioning and antimicrobial properties. The demand for Bio-based Surfactants is rising, driven by consumer preference for sustainable, biodegradable, and low-toxicity ingredients in both household and personal care products .

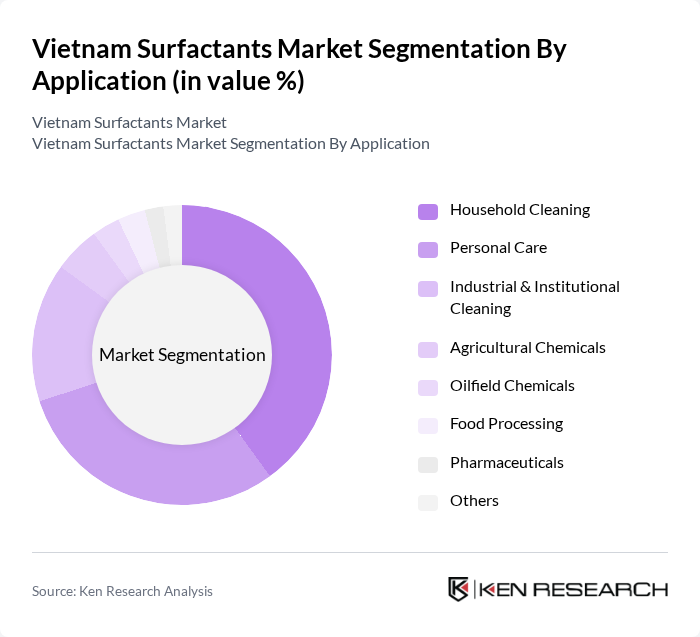

By Application:Surfactants in Vietnam are applied across Household Cleaning, Personal Care, Industrial & Institutional Cleaning, Agricultural Chemicals, Oilfield Chemicals, Food Processing, Pharmaceuticals, and Others. The Household Cleaning segment holds the largest share, driven by sustained demand for detergents, dishwashing liquids, and all-purpose cleaners. Personal Care applications—including shampoos, body washes, and skincare—represent a significant and rapidly growing portion of the market, reflecting evolving consumer preferences for hygiene and grooming. Industrial & Institutional Cleaning, as well as Agricultural and Oilfield Chemicals, also contribute notably to overall market demand .

The Vietnam Surfactants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever Vietnam, Procter & Gamble Vietnam, BASF Vietnam Co., Ltd., Dow Chemical Vietnam LLC, Clariant (Vietnam) Ltd., Evonik Vietnam Co., Ltd., Kao Vietnam Co., Ltd., Huntsman Vietnam Co., Ltd., Solvay Vietnam Co., Ltd., Croda Vietnam Co., Ltd., AkzoNobel Vietnam, Wilmar CLV (Vietnam) Co., Ltd., AAK Vietnam Co., Ltd., Eastman Chemical Vietnam Co., Ltd., Oxiteno Vietnam Co., Ltd., LIX Detergent Joint Stock Company, Net Detergent Joint Stock Company, Sai Gon Petrochemical Joint Stock Company contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam surfactants market is poised for significant transformation, driven by increasing consumer demand for sustainable and eco-friendly products. As the government emphasizes green initiatives, manufacturers are likely to invest in biodegradable surfactants and innovative formulations. Additionally, the rise of e-commerce platforms is expected to reshape distribution channels, allowing companies to reach a broader audience. This evolving landscape presents opportunities for growth, particularly in the personal care and household cleaning sectors, aligning with global sustainability trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Anionic Surfactants Cationic Surfactants Nonionic Surfactants Amphoteric Surfactants Bio-based Surfactants Others |

| By Application | Household Cleaning (Detergents, Dishwashing Liquids, Laundry Care) Personal Care (Shampoos, Body Wash, Cosmetics) Industrial & Institutional Cleaning Agricultural Chemicals (Adjuvants, Wetting Agents) Oilfield Chemicals Food Processing Pharmaceuticals Others |

| By End-User | Consumer Goods Manufacturers Food & Beverage Industry Pharmaceutical Industry Textile & Leather Industry Agriculture Sector Oil & Gas Industry Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Product Form | Liquid Powder Granular Paste Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Products | 100 | Product Managers, R&D Specialists |

| Household Cleaning Products | 80 | Marketing Directors, Supply Chain Managers |

| Industrial Applications | 60 | Operations Managers, Procurement Officers |

| Food and Beverage Industry | 50 | Quality Assurance Managers, Production Supervisors |

| Textile and Leather Processing | 40 | Technical Directors, Process Engineers |

The Vietnam Surfactants Market is valued at approximately USD 1.1 billion, reflecting a robust growth trajectory driven by increasing demand in personal care, household cleaning, and industrial applications, particularly in urban areas.