Region:Middle East

Author(s):Dev

Product Code:KRAB8006

Pages:85

Published On:October 2025

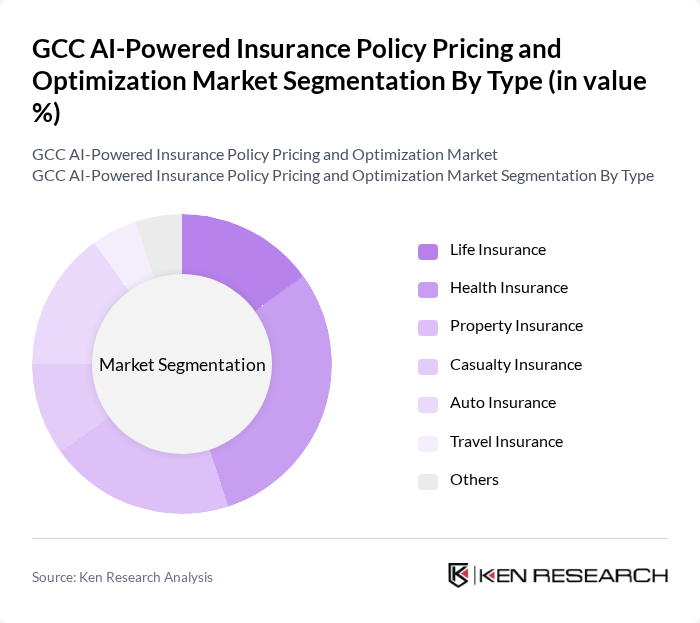

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Auto Insurance, Travel Insurance, and Others. Among these, Health Insurance is currently the leading sub-segment, driven by rising healthcare costs and increasing consumer awareness regarding health coverage. The demand for comprehensive health plans has surged, particularly in the wake of the COVID-19 pandemic, leading to a significant market share for this category.

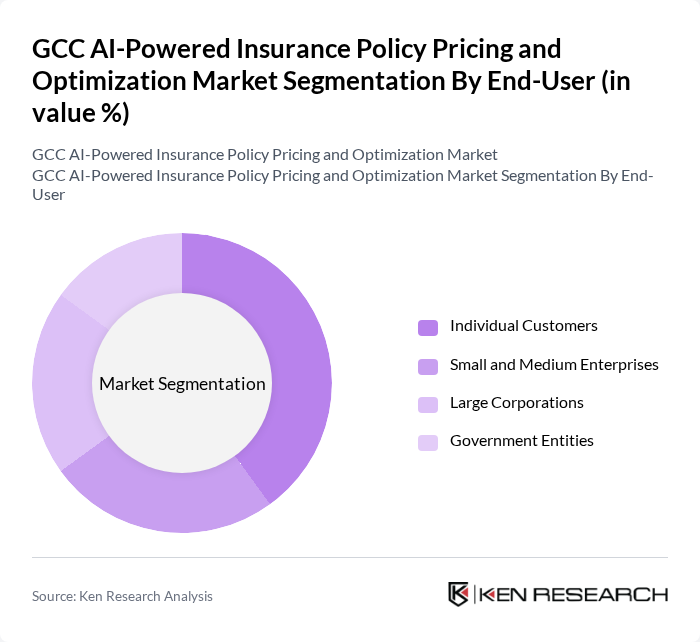

By End-User:The market is segmented by end-users, including Individual Customers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Customers represent the largest segment, driven by the increasing need for personal insurance products and the growing awareness of financial security. The trend towards digital insurance solutions has also made it easier for individuals to access and purchase insurance, further solidifying their dominance in the market.

The GCC AI-Powered Insurance Policy Pricing and Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz SE, AXA Group, Zurich Insurance Group, AIG (American International Group), MetLife, Inc., Munich Re, Chubb Limited, Berkshire Hathaway Inc., Aviva plc, Generali Group, Tokio Marine Holdings, Inc., Cigna Corporation, Liberty Mutual Insurance, Aon plc, Willis Towers Watson contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-powered insurance market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As insurers increasingly adopt AI and machine learning, operational efficiencies will improve, leading to enhanced customer experiences. Additionally, the integration of IoT devices will provide real-time data, enabling more accurate risk assessments. Strategic partnerships with technology firms will further accelerate innovation, positioning the market for significant advancements in policy pricing and optimization strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Casualty Insurance Auto Insurance Travel Insurance Others |

| By End-User | Individual Customers Small and Medium Enterprises Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers and Agents Online Platforms Bancassurance |

| By Policy Type | Standard Policies Customized Policies Group Policies |

| By Customer Segment | High Net-Worth Individuals Middle-Class Families Young Professionals |

| By Risk Assessment Methodology | Traditional Risk Assessment AI-Driven Risk Assessment Hybrid Models |

| By Policy Duration | Short-Term Policies Long-Term Policies Renewable Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Pricing Strategies | 100 | Underwriters, Pricing Analysts |

| Property Insurance AI Implementation | 80 | Data Scientists, Risk Managers |

| Life Insurance Market Trends | 75 | Actuaries, Product Development Managers |

| Insurance Brokers' Perspectives on AI | 90 | Insurance Brokers, Sales Directors |

| Regulatory Impact on Pricing Models | 70 | Compliance Officers, Legal Advisors |

The GCC AI-Powered Insurance Policy Pricing and Optimization Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in the insurance sector, enhancing pricing accuracy and operational efficiency.