Region:Middle East

Author(s):Rebecca

Product Code:KRAC1226

Pages:87

Published On:October 2025

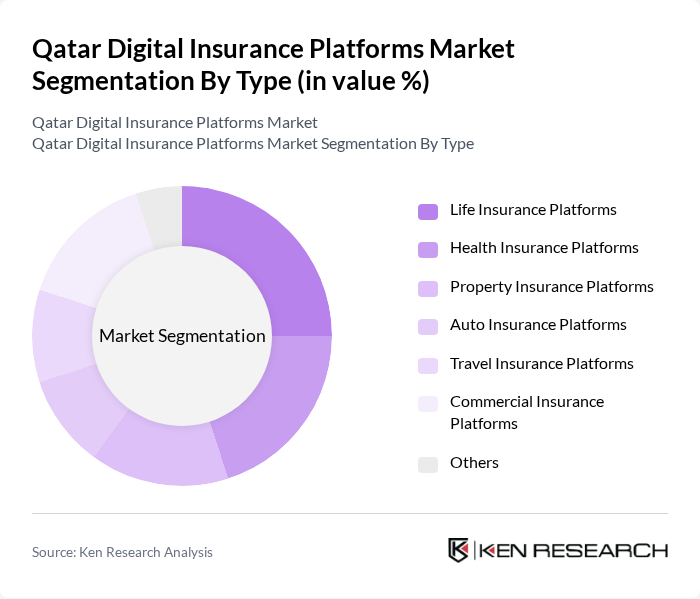

By Type:The segmentation of the market by type includes various platforms that cater to different insurance needs. The subsegments are Life Insurance Platforms, Health Insurance Platforms, Property Insurance Platforms, Auto Insurance Platforms, Travel Insurance Platforms, Commercial Insurance Platforms, and Others. Each of these platforms serves distinct customer requirements and preferences, contributing to the overall market dynamics. The insurance sector continues to witness momentum building in life, health, and family takaful segments, driven by regulatory updates mandating visitor health insurance and growing awareness of long-term financial planning tools.

The Life Insurance Platforms segment is currently dominating the market due to the increasing awareness of the importance of life insurance among consumers. This trend is driven by a growing population and rising disposable incomes, leading to higher demand for life insurance products. Additionally, the convenience of digital platforms allows customers to easily compare policies and make informed decisions, further boosting the segment's growth. Health Insurance Platforms also show significant traction, particularly with mandatory visitor health insurance requirements and heightened health consciousness, making them a close competitor in the market. The demand surge for retail insurance, particularly in personal lines and health coverage, continues to drive platform adoption across various segments.

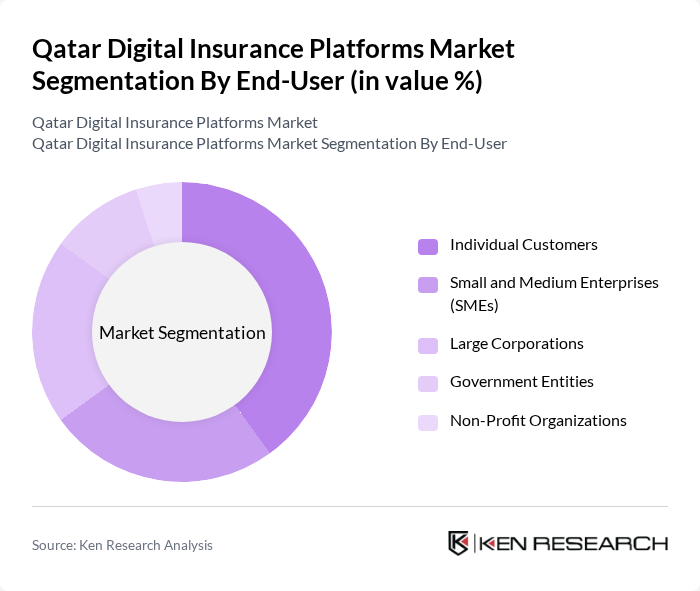

By End-User:The market segmentation by end-user includes Individual Customers, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Non-Profit Organizations. Each of these segments has unique insurance needs and preferences, influencing the overall market landscape. The sector demonstrates strong fundamentals supported by ongoing macroeconomic expansion, government-led infrastructure development, and demographic growth, creating diverse opportunities across all end-user segments.

The Individual Customers segment is the largest in the market, driven by the increasing awareness of personal financial security and the convenience of accessing insurance products online. This segment's growth is further supported by the rise in digital literacy, increased smartphone usage, and the availability of tailored insurance solutions that meet individual needs, including innovative products such as personal lines cyber insurance launched to protect consumers against financial losses from cyber attacks and online fraud. SMEs also represent a significant portion of the market, as they seek affordable and flexible insurance options to protect their businesses, benefiting from improved accessibility through digital channels and enhanced product offerings.

The Qatar Digital Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Insurance Company (QIC), Doha Insurance Group, Al Khaleej Takaful Insurance, Qatar General Insurance and Reinsurance Company, Damaan Islamic Insurance Company (Beema), QLM Life & Medical Insurance Company, Gulf Insurance Group (GIG Qatar), Medgulf Takaful, AXA Gulf (now part of GIG Gulf), Allianz Qatar, Aetna International (Qatar), Cigna Insurance Middle East (Qatar), Bupa Global (Qatar), MetLife Qatar, NextCare Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar digital insurance platforms market appears promising, driven by technological advancements and evolving consumer preferences. As insurers increasingly adopt artificial intelligence and big data analytics, they will enhance their offerings and improve customer experiences. Additionally, the ongoing collaboration between insurance companies and fintech firms is expected to foster innovation, leading to the development of more efficient and user-friendly digital solutions that cater to the diverse needs of consumers in Qatar.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Platforms Health Insurance Platforms Property Insurance Platforms Auto Insurance Platforms Travel Insurance Platforms Commercial Insurance Platforms Others |

| By End-User | Individual Customers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Non-Profit Organizations |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents Bancassurance |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Service Model | Subscription-Based Pay-Per-Use Freemium Models One-Time Payment |

| By Technology Used | Cloud-Based Solutions Mobile Applications AI and Machine Learning |

| By Policy Type | Comprehensive Policies Basic Policies Customizable Policies |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Plans |

| By Customer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Employment Status (Employed, Unemployed, Retired) Nationality (Qatari, Expatriate) |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Renewals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Platforms | 100 | Health Insurance Executives, IT Managers |

| Auto Insurance Digital Solutions | 80 | Product Managers, Customer Experience Leads |

| Home Insurance Digital Offerings | 60 | Marketing Directors, Sales Managers |

| Travel Insurance Digital Services | 50 | Operations Managers, Business Development Executives |

| Consumer Insights on Digital Insurance | 90 | End-users, Insurance Policyholders |

The Qatar Digital Insurance Platforms Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the adoption of digital technologies and increasing consumer demand for convenient insurance solutions.