UAE Cybersecurity Insurance Market Overview

- The UAE Cybersecurity Insurance Market is valued at USD 70 million, based on a five-year historical analysis. This growth is primarily driven by the increasing frequency of cyberattacks, rising awareness of cybersecurity risks among businesses, and the growing need for regulatory compliance. Organizations are increasingly investing in cybersecurity measures, leading to a higher demand for insurance products that can mitigate financial losses associated with cyber incidents .

- Dubai and Abu Dhabi are the dominant cities in the UAE Cybersecurity Insurance Market due to their status as major business hubs and their concentration of financial services, technology firms, and government institutions. The presence of multinational corporations and a robust regulatory framework further enhance the demand for cybersecurity insurance in these regions, making them key players in the market .

- The National Cybersecurity Strategy, issued by the UAE Telecommunications and Digital Government Regulatory Authority (TDRA) in 2019, sets out mandatory cybersecurity measures for critical infrastructure sectors, including requirements for incident response, risk management, and compliance with national standards. While the strategy does not explicitly mandate insurance coverage, it has driven organizations in critical sectors to adopt comprehensive cybersecurity frameworks and seek insurance as part of risk mitigation .

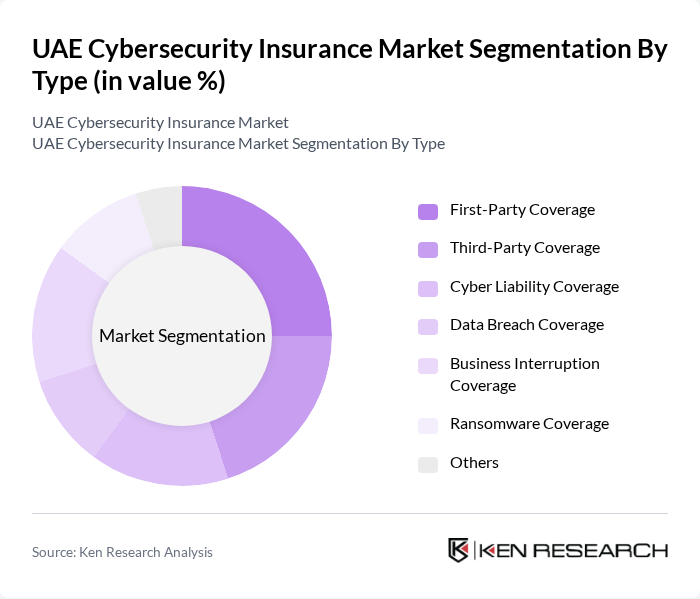

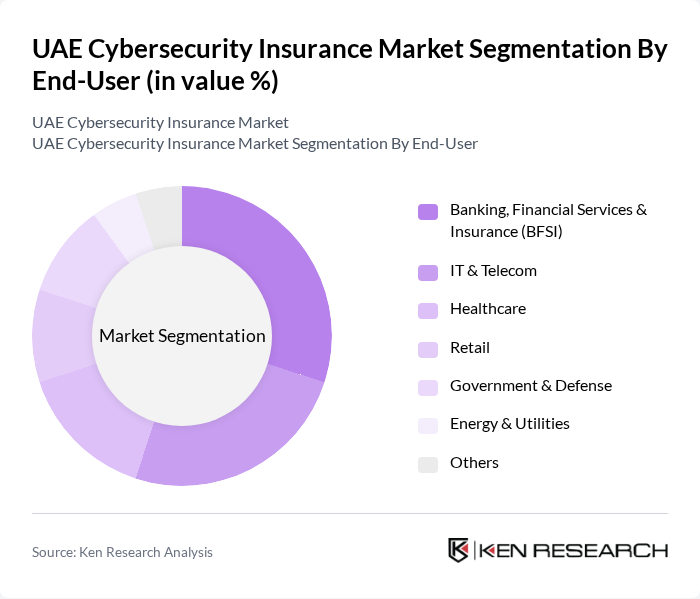

UAE Cybersecurity Insurance Market Segmentation

By Type:The market is segmented into various types of coverage, including First-Party Coverage, Third-Party Coverage, Cyber Liability Coverage, Data Breach Coverage, Business Interruption Coverage, Ransomware Coverage, and Others. Each of these segments addresses specific risks associated with cyber incidents, catering to the diverse needs of businesses .

By End-User:The end-user segmentation includes Banking, Financial Services & Insurance (BFSI), IT & Telecom, Healthcare, Retail, Government & Defense, Energy & Utilities, and Others. Each sector has unique cybersecurity needs, influencing the type of insurance coverage they seek .

UAE Cybersecurity Insurance Market Competitive Landscape

The UAE Cybersecurity Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AIG, Allianz, Chubb, Zurich Insurance Group, AXA, Marsh & McLennan Companies, Beazley, CNA Financial, Hiscox, Lockton Companies, Berkshire Hathaway, Tokio Marine, QBE Insurance, Travelers, Liberty Mutual, Lloyd's of London, Munich Re, Assicurazioni Generali, Cyence, PolicyGenius, Safeshare, ORYXLABS, CyberHive, Practical Security Lab, Permus contribute to innovation, geographic expansion, and service delivery in this space .

UAE Cybersecurity Insurance Market Industry Analysis

Growth Drivers

- Increasing Cyber Threats:The UAE has witnessed a significant rise in cyber threats, with reported incidents increasing by 30% in the future, according to the UAE Cybersecurity Council. This surge in cyberattacks, including ransomware and phishing, has prompted businesses to seek robust cybersecurity insurance solutions. The estimated cost of cybercrime in the UAE reached approximately $2 billion in the future, highlighting the urgent need for protective measures, thereby driving demand for cybersecurity insurance products.

- Regulatory Compliance Requirements:The UAE government has implemented stringent data protection regulations, including the Federal Decree-Law on Data Protection, which came into effect in 2022. Companies are now required to comply with these regulations, leading to an increased demand for cybersecurity insurance. In the future, over 70% of businesses reported investing in compliance-related cybersecurity measures, with insurance becoming a critical component to mitigate potential legal and financial repercussions from data breaches.

- Rising Awareness of Cyber Risks:Awareness of cyber risks among businesses in the UAE has grown significantly, with 80% of organizations acknowledging the importance of cybersecurity insurance in the future. This shift is driven by high-profile data breaches and the increasing sophistication of cyber threats. As a result, companies are prioritizing risk management strategies, leading to a projected increase in cybersecurity insurance uptake, with an estimated 50% growth in policy purchases over the next year.

Market Challenges

- Lack of Awareness Among SMEs:Small and medium-sized enterprises (SMEs) in the UAE often lack awareness regarding the importance of cybersecurity insurance. In the future, only 30% of SMEs reported having any form of cyber insurance, primarily due to misconceptions about costs and coverage. This gap in understanding poses a significant challenge for insurers aiming to penetrate this market segment, limiting overall market growth and adoption rates.

- High Premium Costs:The cost of cybersecurity insurance premiums has been rising, with average premiums increasing by 25% in the future. This trend is attributed to the escalating frequency and severity of cyber incidents. Many businesses, particularly SMEs, find these costs prohibitive, leading to a reluctance to invest in necessary coverage. Consequently, this challenge hampers the overall growth of the cybersecurity insurance market in the UAE.

UAE Cybersecurity Insurance Market Future Outlook

The future of the UAE cybersecurity insurance market appears promising, driven by increasing digital transformation initiatives and a growing emphasis on risk management. As businesses continue to adopt advanced technologies, the demand for comprehensive cybersecurity solutions will rise. Additionally, the integration of cybersecurity insurance with IT services is expected to become more prevalent, enhancing the overall value proposition for organizations. This trend will likely lead to a more robust market landscape, fostering innovation and tailored insurance products to meet evolving needs.

Market Opportunities

- Expansion of Cybersecurity Solutions:The growing demand for advanced cybersecurity solutions presents a significant opportunity for insurers to develop specialized products. With the UAE's cybersecurity spending projected to reach $4 billion in the future, insurers can capitalize on this trend by offering tailored policies that address specific risks associated with emerging technologies, thereby enhancing their market presence.

- Partnerships with Tech Firms:Collaborating with technology firms can create synergies that enhance the cybersecurity insurance offering. By partnering with cybersecurity solution providers, insurers can develop comprehensive packages that combine insurance with proactive risk management services. This approach not only increases customer value but also positions insurers as key players in the evolving cybersecurity landscape, fostering long-term growth.