Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8128

Pages:80

Published On:October 2025

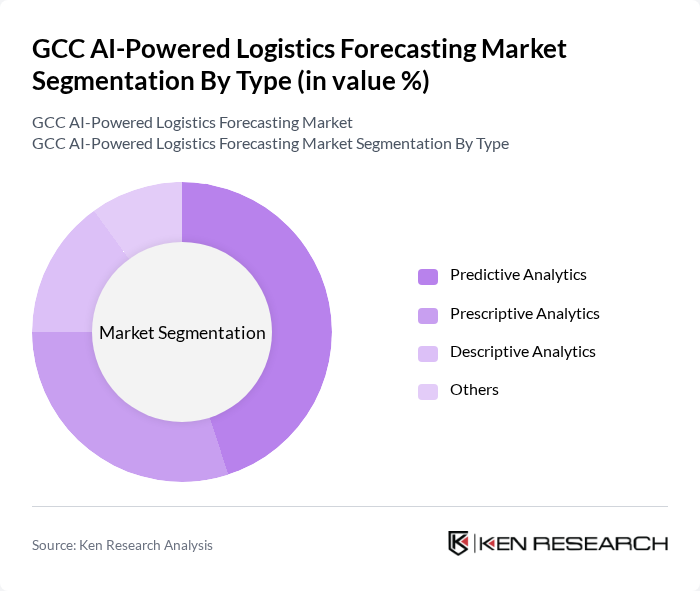

By Type:The market is segmented into Predictive Analytics, Prescriptive Analytics, Descriptive Analytics, and Others. Predictive Analytics is currently the leading sub-segment, driven by its ability to forecast demand and optimize inventory levels. Companies are increasingly relying on predictive models to enhance decision-making processes and improve service delivery.

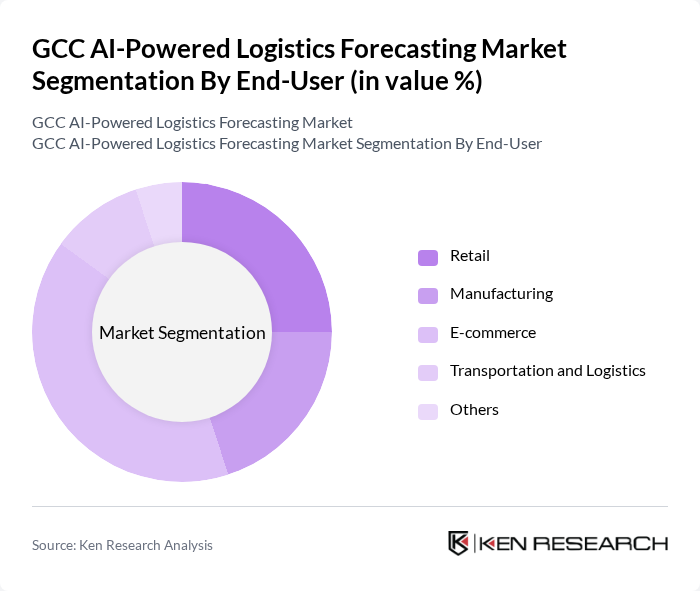

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce, Transportation and Logistics, and Others. The E-commerce sector is the dominant segment, fueled by the rapid growth of online shopping and the need for efficient logistics solutions. Companies are leveraging AI-powered forecasting to manage inventory and streamline delivery processes effectively.

The GCC AI-Powered Logistics Forecasting Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, C.H. Robinson, FedEx Logistics, UPS Supply Chain Solutions, Maersk Logistics, CEVA Logistics, Agility Logistics, Panalpina, Yusen Logistics, DSV Panalpina, SNCF Logistics, and Toll Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-powered logistics forecasting market appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to embrace automation and data analytics, the logistics landscape will evolve significantly. The rise of autonomous delivery solutions and enhanced real-time tracking capabilities will reshape operational strategies. Furthermore, sustainability initiatives will likely gain traction, pushing logistics firms to adopt greener practices, thereby aligning with global environmental goals and enhancing their competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Prescriptive Analytics Descriptive Analytics Others |

| By End-User | Retail Manufacturing E-commerce Transportation and Logistics Others |

| By Application | Demand Forecasting Inventory Management Route Optimization Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Others |

| By Sales Channel | Direct Sales Online Sales Distributors Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Integration in Retail Logistics | 100 | Logistics Managers, IT Directors |

| AI-Driven Supply Chain Optimization | 80 | Supply Chain Analysts, Operations Managers |

| Predictive Analytics in Freight Management | 70 | Data Scientists, Freight Managers |

| AI Applications in E-commerce Fulfillment | 90 | eCommerce Operations Heads, Logistics Coordinators |

| AI Solutions for Last-Mile Delivery | 60 | Last-Mile Delivery Managers, Technology Officers |

The GCC AI-Powered Logistics Forecasting Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in logistics, which enhance operational efficiency and reduce costs.