Region:Middle East

Author(s):Dev

Product Code:KRAD7703

Pages:95

Published On:December 2025

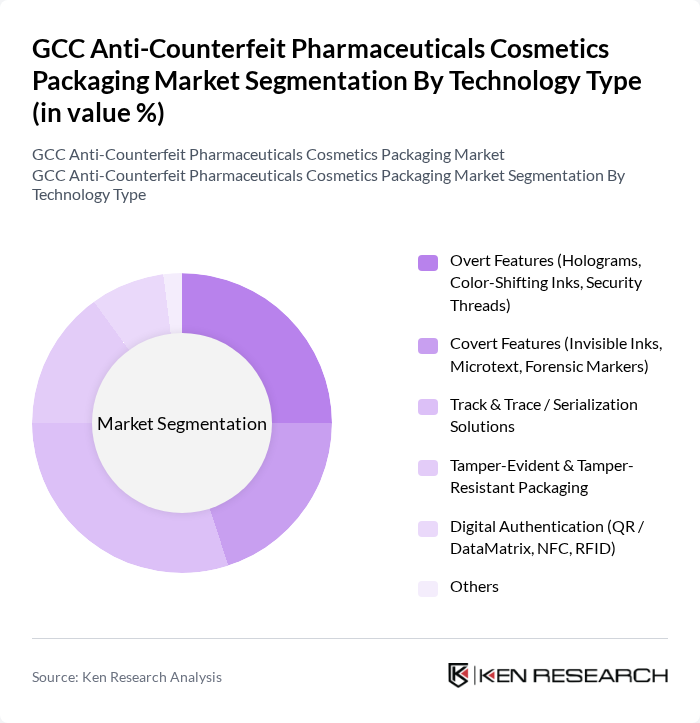

By Technology Type:

The technology type segment is dominated by Track & Trace / Serialization Solutions, which account for a significant portion of the market. This dominance is attributed to the increasing regulatory requirements for product traceability and the growing need for supply chain transparency. Consumers are becoming more aware of counterfeit risks, prompting manufacturers to adopt advanced serialization technologies to ensure product authenticity. The demand for tamper-evident packaging is also rising, driven by consumer safety concerns and the need for reliable product protection.

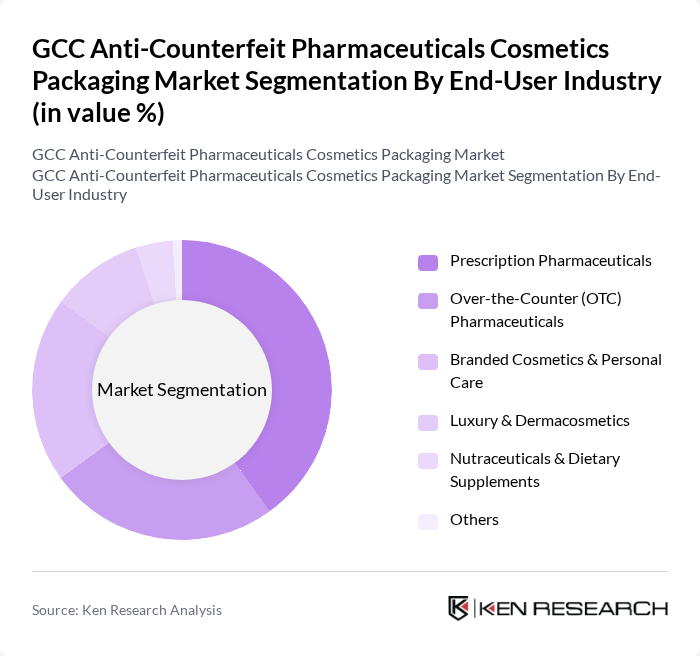

By End-User Industry:

The end-user industry segment is led by Prescription Pharmaceuticals, which holds the largest market share. This is primarily due to stringent regulations and the high value of prescription medications, which necessitate robust anti-counterfeit measures. The growing awareness of counterfeit drugs among consumers and healthcare professionals has further propelled the demand for secure packaging solutions in this sector. Over-the-Counter (OTC) Pharmaceuticals also show significant growth, driven by increasing consumer health consciousness and the rising demand for safe and authentic products.

The GCC Anti-Counterfeit Pharmaceuticals Cosmetics Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avery Dennison Corporation, 3M Company, SATO Holdings Corporation, Zebra Technologies Corporation, CCL Industries Inc., SICPA Holding SA, Authentix, Inc., DuPont de Nemours, Inc., Markem-Imaje Corporation, tesa SE, Krones AG, Honeywell International Inc., Sealed Air Corporation, R.R. Donnelley & Sons Company, WestRock Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC anti-counterfeit pharmaceuticals and cosmetics packaging market appears promising, driven by technological advancements and increasing regulatory pressures. As manufacturers adopt innovative solutions like blockchain and IoT, the market is expected to evolve significantly in future. Additionally, the growing emphasis on sustainability will likely influence packaging designs, aligning with consumer preferences for eco-friendly products. These trends indicate a robust shift towards more secure and responsible packaging practices in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Overt Features (Holograms, Color-Shifting Inks, Security Threads) Covert Features (Invisible Inks, Microtext, Forensic Markers) Track & Trace / Serialization Solutions Tamper-Evident & Tamper-Resistant Packaging Digital Authentication (QR / DataMatrix, NFC, RFID) Others |

| By End-User Industry | Prescription Pharmaceuticals Over-the-Counter (OTC) Pharmaceuticals Branded Cosmetics & Personal Care Luxury & Dermacosmetics Nutraceuticals & Dietary Supplements Others |

| By Packaging Format | Primary Packaging (Blisters, Bottles, Vials, Tubes) Secondary Packaging (Cartons, Sleeves, Labels) Tertiary / Transport Packaging Unit-Level vs Case- / Pallet-Level Solutions Others |

| By Material | Plastic Paper & Paperboard Metal Glass Hybrid & Smart Materials Others |

| By Authentication & Tracking Platform | Cloud-Based Track & Trace Platforms On-Premise Track & Trace Systems Brand Protection & Consumer Engagement Apps Government / Regulator-Driven Systems Others |

| By Distribution & Channel Risk Profile | Hospital & Clinic Pharmacies Retail Pharmacies & Drugstores E-Pharmacies & Online Beauty Retailers Duty-Free & Travel Retail Informal & Grey Channels Others |

| By Country | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 110 | Production Managers, Quality Assurance Officers |

| Cosmetics Brands | 85 | Brand Managers, Product Development Leads |

| Packaging Technology Providers | 75 | Sales Directors, R&D Managers |

| Regulatory Bodies | 45 | Compliance Officers, Policy Makers |

| Consumer Focus Groups | 60 | End-users, Retail Customers |

The GCC Anti-Counterfeit Pharmaceuticals Cosmetics Packaging Market is valued at approximately USD 135 million, reflecting a significant growth driven by increasing regulatory measures and consumer awareness regarding product authenticity.