Region:Middle East

Author(s):Shubham

Product Code:KRAA8918

Pages:83

Published On:November 2025

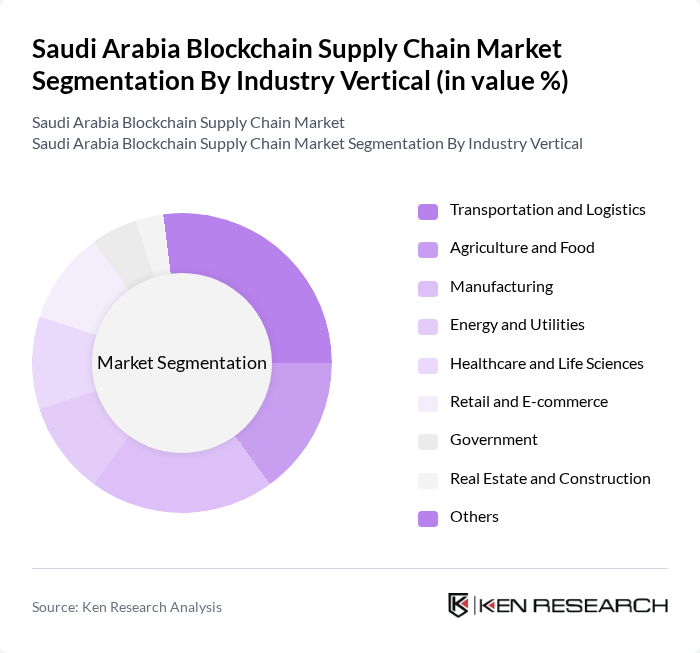

By Industry Vertical:The industry vertical segmentation includes various sectors that utilize blockchain technology to enhance their supply chain processes. The key segments are Transportation and Logistics, Agriculture and Food, Manufacturing, Energy and Utilities, Healthcare and Life Sciences, Retail and E-commerce, Government, Real Estate and Construction, and Others. Each of these sectors leverages blockchain for improved traceability, efficiency, and security in their operations, with logistics and retail leading adoption due to their need for real-time tracking and fraud prevention. Manufacturing and energy sectors are increasingly integrating blockchain to optimize resource management and ensure compliance with sustainability standards .

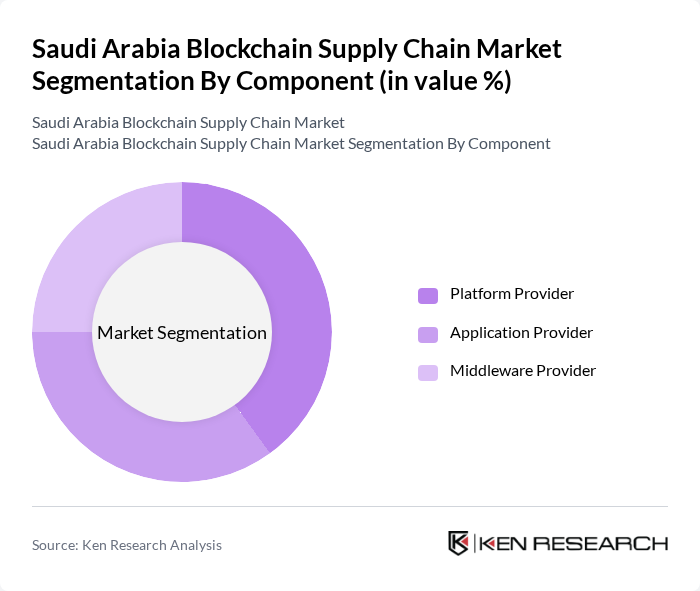

By Component:The component segmentation focuses on the different elements that make up blockchain solutions in the supply chain. This includes Platform Providers, Application Providers, and Middleware Providers. Each component plays a crucial role in the development and implementation of blockchain technology, facilitating seamless integration and functionality across various supply chain processes. Platform providers dominate due to their ability to offer scalable, secure, and flexible solutions for large enterprises, while application and middleware providers support customization and interoperability for diverse industry needs .

The Saudi Arabia Blockchain Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM, SAP, Oracle, VeChain, R3 Corda, Microsoft, ConsenSys, Hyperledger, ChainSafe Systems, Waltonchain, Ambrosus, Modum, OriginTrail, Everledger, Saudi Aramco, Elm Company, STC (Saudi Telecom Company), SABB (Saudi British Bank), Ma’aden (Saudi Arabian Mining Company), Bahri (National Shipping Company of Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabian blockchain supply chain market appears promising, driven by ongoing technological advancements and increasing government support. As companies continue to recognize the benefits of blockchain for enhancing transparency and efficiency, adoption rates are expected to rise significantly. Furthermore, the integration of artificial intelligence and IoT with blockchain will likely create new opportunities for innovation, enabling businesses to optimize their supply chains and respond more effectively to market demands.

| Segment | Sub-Segments |

|---|---|

| By Industry Vertical | Transportation and Logistics Agriculture and Food Manufacturing Energy and Utilities Healthcare and Life Sciences Retail and E-commerce Government Real Estate and Construction Others |

| By Component | Platform Provider Application Provider Middleware Provider |

| By Blockchain Type | Public Blockchain Private Blockchain Consortium Blockchain Hybrid Blockchain |

| By Organization Size | Large Enterprises Small and Medium-Sized Enterprises (SMEs) |

| By Application | Asset Tracking Product Traceability Smart Contracts Payment and Settlement Risk and Compliance Management Counterfeit Detection Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Integration | 100 | Supply Chain Managers, IT Directors |

| Logistics and Transportation Services | 80 | Operations Managers, Fleet Supervisors |

| Retail Blockchain Applications | 70 | Retail Managers, E-commerce Directors |

| Food and Beverage Traceability | 50 | Quality Assurance Managers, Compliance Officers |

| Pharmaceutical Supply Chain Security | 60 | Regulatory Affairs Managers, Supply Chain Analysts |

The Saudi Arabia Blockchain Supply Chain Market is valued at approximately USD 230 million, reflecting significant growth driven by the adoption of blockchain technology across various sectors, enhancing transparency, efficiency, and traceability in supply chains.