Region:Middle East

Author(s):Rebecca

Product Code:KRAD6196

Pages:90

Published On:December 2025

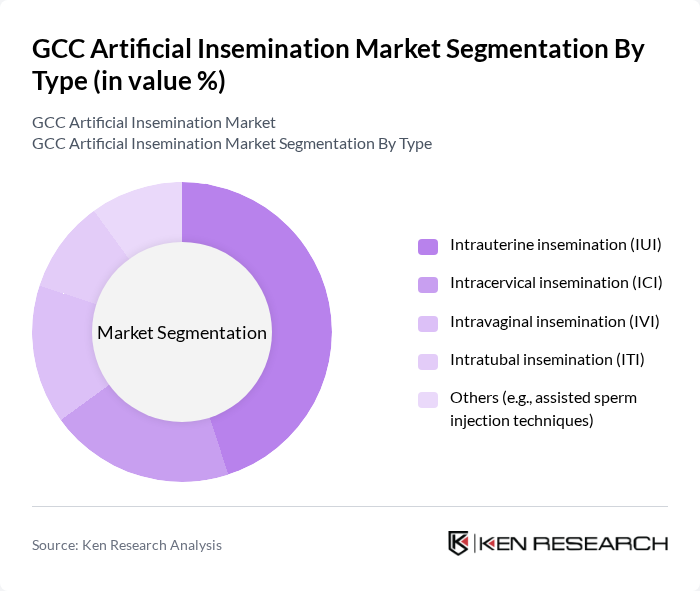

By Type:The market is segmented into various types of artificial insemination techniques, including Intrauterine insemination (IUI), Intracervical insemination (ICI), Intravaginal insemination (IVI), Intratubal insemination (ITI), and others such as assisted sperm injection techniques. Among these, Intrauterine insemination (IUI) is the most widely adopted method due to its effectiveness and simplicity, making it a preferred choice for many couples facing infertility challenges.

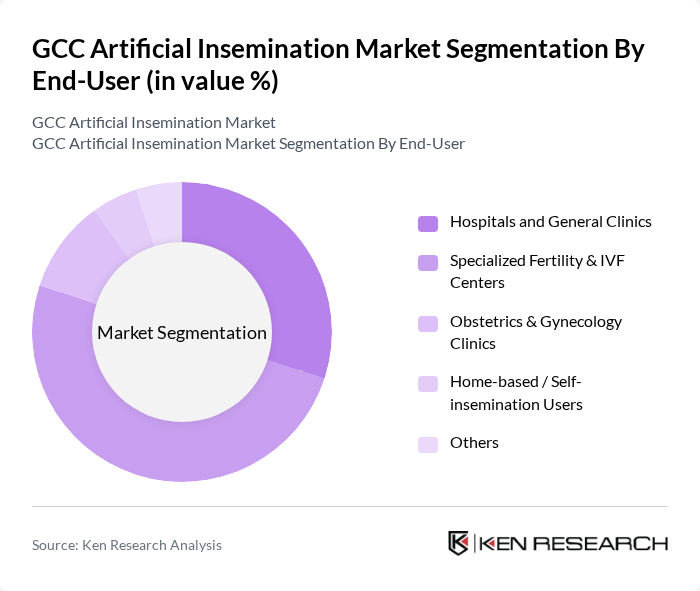

By End-User:The end-user segmentation includes Hospitals and General Clinics, Specialized Fertility & IVF Centers, Obstetrics & Gynecology Clinics, Home-based / Self-insemination Users, and others. Specialized Fertility & IVF Centers dominate this segment due to their focused expertise, advanced technologies, and higher success rates, attracting couples seeking effective solutions for infertility.

The GCC Artificial Insemination Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fakih IVF Fertility Center (UAE), Bourn Hall Fertility Centre (UAE), IVI Middle East Fertility Clinic (UAE), Orchid Fertility Clinic (UAE), The Dubai Fertility Centre (UAE – Government), Saudi German Hospital – Fertility & IVF Units (Saudi Arabia/UAE), Dr. Sulaiman Al Habib Medical Group – Fertility Services (Saudi Arabia), King Faisal Specialist Hospital & Research Centre – Reproductive Medicine (Saudi Arabia), Sidra Medicine – Reproductive Surgery & Fertility Services (Qatar), Hamad Medical Corporation – ART & Fertility Services (Qatar), Reproductive Medicine & Infertility Center, Kuwait Hospital (Kuwait), Royal Hospital – Fertility & IVF Clinic (Oman), Bahrain Defence Force Hospital – IVF & Fertility Center (Bahrain), Royal Bahrain Hospital – Fertility Services (Bahrain), NMC Royal Hospital & NMC Fertility Network (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC artificial insemination market appears promising, driven by technological advancements and increasing government support. As precision livestock farming gains traction, farmers are expected to adopt data-driven breeding practices, enhancing productivity and sustainability. Furthermore, the integration of artificial intelligence in breeding processes will likely optimize genetic selection, improving livestock quality. These trends indicate a shift towards more efficient and sustainable livestock production systems, positioning the market for significant growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Intrauterine insemination (IUI) Intracervical insemination (ICI) Intravaginal insemination (IVI) Intratubal insemination (ITI) Others (e.g., assisted sperm injection techniques) |

| By End-User | Hospitals and General Clinics Specialized Fertility & IVF Centers Obstetrics & Gynecology Clinics Home-based / Self-insemination Users Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Technology | Conventional insemination techniques Ultrasound-guided insemination Catheter-based intrauterine insemination systems Cryopreservation and thawing technologies Others |

| By Application | Male factor infertility Unexplained infertility Cervical factor infertility Use of donor sperm Others (e.g., same?sex couples, single women) |

| By Investment Source | Private fertility chains and clinic groups Government and public healthcare funding Insurance and third?party payers Foreign direct investment and medical tourism operators Others |

| By Policy Support | ART and fertility treatment reimbursement policies Licensing and accreditation frameworks for ART centers Regulations on gamete and donor sperm use Cross?border reproductive care and medical tourism policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Farm Operators | 120 | Farm Owners, Herd Managers |

| Beef Cattle Breeders | 90 | Livestock Producers, Veterinary Technicians |

| Veterinary Clinics Specializing in Reproduction | 60 | Veterinarians, Animal Health Specialists |

| Agricultural Extension Services | 50 | Extension Officers, Agricultural Advisors |

| Artificial Insemination Service Providers | 70 | Service Managers, Technicians |

The GCC Artificial Insemination Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing awareness of fertility treatments and advancements in reproductive technologies.