Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3137

Pages:82

Published On:October 2025

Radiology Market.png)

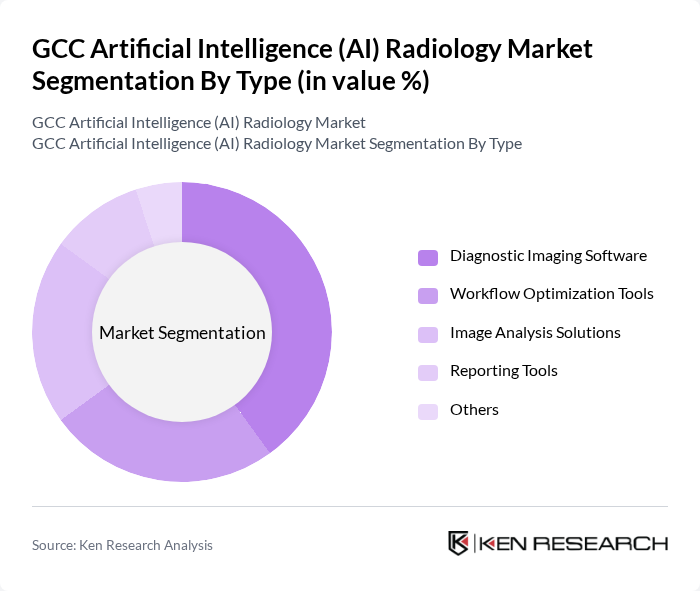

By Type:The market is segmented into various types, including Diagnostic Imaging Software, Workflow Optimization Tools, Image Analysis Solutions, Reporting Tools, and Others. Among these, Diagnostic Imaging Software is the leading sub-segment, driven by the increasing demand for accurate and efficient diagnostic tools. The rise in chronic diseases and the need for early detection have led to a surge in the adoption of these software solutions, making them essential in modern radiology practices. Deep learning algorithms and convolutional neural networks have significantly improved the accuracy and effectiveness of medical image analysis, enhancing the capabilities of diagnostic imaging software.

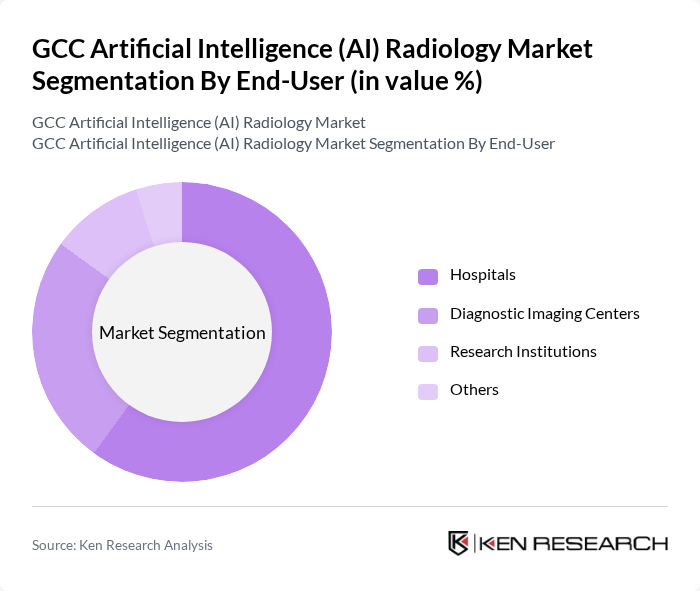

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Research Institutions, and Others. Hospitals are the dominant end-user segment, primarily due to their extensive patient base and the need for advanced imaging technologies to support various medical specialties. The increasing investment in hospital infrastructure and the growing trend of integrating AI solutions into hospital systems further enhance their market share. Healthcare organizations are experiencing substantial returns on AI investments, with studies indicating a return of USD 3.20 for every USD 1 invested in AI technology, driving accelerated adoption across hospital networks.

The GCC Artificial Intelligence (AI) Radiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Aidoc, Qure.ai, Zebra Medical Vision, Arterys, Nuance Communications (Microsoft), IBM Watson Health, Agfa HealthCare, Sectra, Lunit, Vuno, RadNet contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI radiology market appears promising, driven by technological advancements and increasing healthcare investments. As AI technologies continue to evolve, their integration into radiology practices will enhance diagnostic accuracy and efficiency. Furthermore, the growing emphasis on preventive healthcare will likely spur demand for AI-driven solutions. Collaborative efforts between healthcare providers and technology firms will also play a crucial role in overcoming existing challenges, paving the way for innovative applications in the radiology sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Software Workflow Optimization Tools Image Analysis Solutions Reporting Tools Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Others |

| By Technology | Machine Learning Deep Learning Natural Language Processing (NLP) Computer Vision Context-Aware Computing |

| By Modality | Computed Tomography (CT) Magnetic Resonance Imaging (MRI) X-ray / Radiography Ultrasound Mammography / Tomosynthesis Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Component | AI-Enabled Devices Software & Platform Services |

| By Application | Oncology Neurology Cardiology Orthopedics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Adoption in Public Hospitals | 50 | Radiology Department Heads, IT Managers |

| AI Solutions in Private Clinics | 40 | Clinic Owners, Radiologists |

| Healthcare Technology Providers | 60 | Product Managers, Sales Directors |

| Regulatory Impact on AI in Radiology | 50 | Healthcare Policy Makers, Compliance Officers |

| Patient Perspectives on AI Diagnostics | 50 | Patients, Healthcare Advocates |

The GCC Artificial Intelligence (AI) Radiology Market is valued at approximately USD 1.15 billion, reflecting significant growth driven by the adoption of AI technologies in healthcare, enhancing diagnostic accuracy and operational efficiency across the region.