Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7734

Pages:81

Published On:October 2025

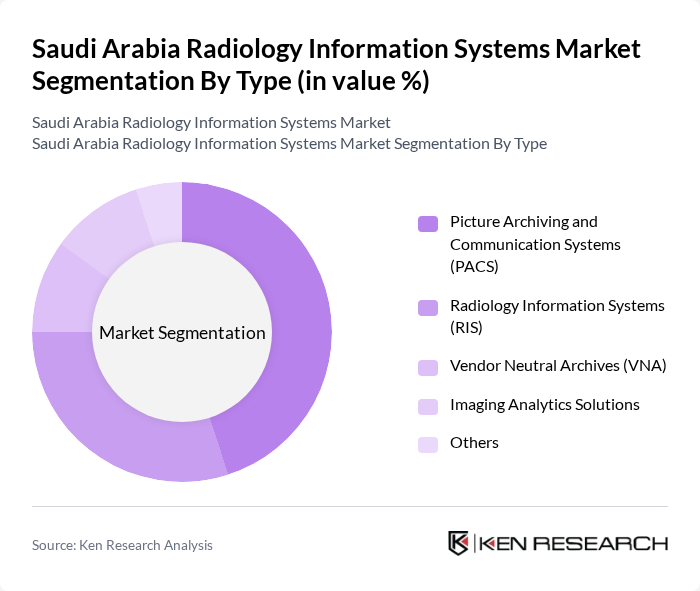

By Type:

The market is segmented into various types, including Picture Archiving and Communication Systems (PACS), Radiology Information Systems (RIS), Vendor Neutral Archives (VNA), Imaging Analytics Solutions, and Others. Among these, PACS is the leading sub-segment due to its ability to store, retrieve, and share medical images efficiently, which is crucial for radiologists and healthcare providers. The increasing adoption of digital imaging technologies and the need for streamlined workflows in healthcare facilities are driving the demand for PACS. RIS also holds a significant share as it enhances the management of radiology departments, improving operational efficiency and patient care.

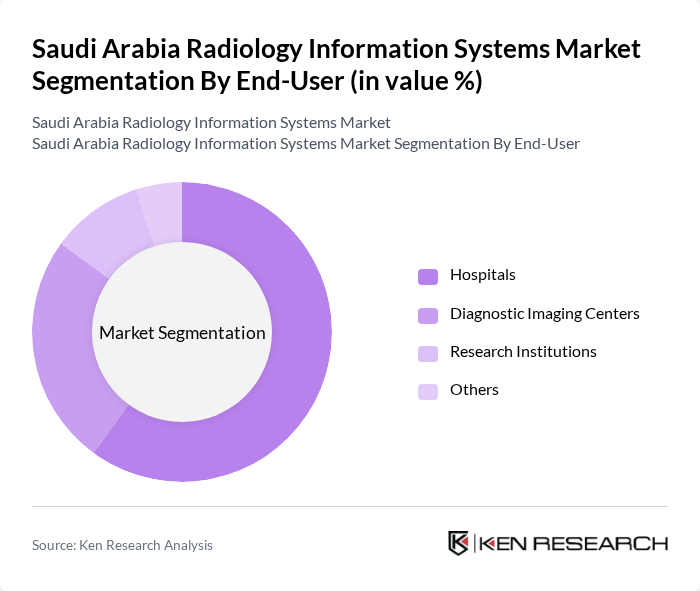

By End-User:

The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Research Institutions, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of healthcare facilities and the growing demand for advanced imaging solutions. The need for efficient patient management and the integration of radiology systems into hospital information systems are key factors contributing to this dominance. Diagnostic Imaging Centers also play a significant role, as they require specialized systems to manage imaging workflows and patient data effectively.

The Saudi Arabia Radiology Information Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Agfa HealthCare, Cerner Corporation, McKesson Corporation, Fujifilm Holdings Corporation, Allscripts Healthcare Solutions, IBM Watson Health, Medtronic, Varian Medical Systems, Canon Medical Systems, Infinitt Healthcare, Nuance Communications, Carestream Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia radiology information systems market appears promising, driven by technological advancements and a commitment to improving healthcare services. The integration of artificial intelligence and machine learning into diagnostic processes is expected to enhance accuracy and efficiency. Additionally, the expansion of telemedicine services will facilitate remote consultations, further increasing the demand for advanced radiology solutions. As the healthcare landscape evolves, stakeholders must adapt to these trends to remain competitive and meet patient needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Picture Archiving and Communication Systems (PACS) Radiology Information Systems (RIS) Vendor Neutral Archives (VNA) Imaging Analytics Solutions Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Others |

| By Application | Oncology Cardiology Neurology Orthopedics Others |

| By Component | Software Services Hardware |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Radiology Departments | 100 | Radiology Department Heads, IT Managers |

| Private Healthcare Facilities | 80 | Healthcare Administrators, Radiologists |

| Healthcare IT Vendors | 60 | Sales Managers, Product Development Leads |

| Academic Medical Centers | 70 | Chief Radiologists, Research Coordinators |

| Telemedicine Providers | 50 | Operations Managers, Technology Officers |

The Saudi Arabia Radiology Information Systems Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by advancements in imaging technologies and the increasing demand for efficient healthcare management systems.