Region:Middle East

Author(s):Shubham

Product Code:KRAC8902

Pages:98

Published On:November 2025

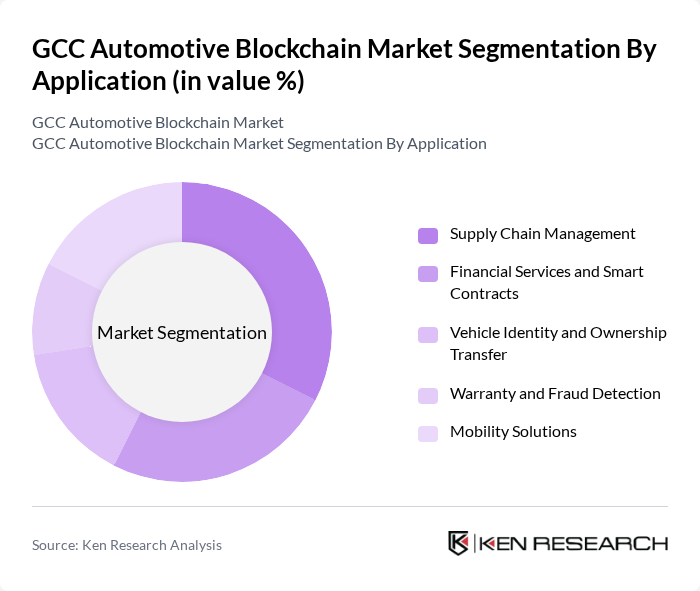

By Application:The application segment encompasses various functionalities that blockchain technology serves within the automotive industry. The subsegments include Supply Chain Management, Financial Services and Smart Contracts, Vehicle Identity and Ownership Transfer, Warranty and Fraud Detection, and Mobility Solutions. Among these, Supply Chain Management is currently the leading subsegment due to its critical role in enhancing transparency and efficiency in automotive logistics. The increasing complexity of supply chains and the need for real-time tracking have driven significant investments in this area. Blockchain enables tamper-proof records, improves regulatory compliance, and supports sustainable practices in automotive logistics .

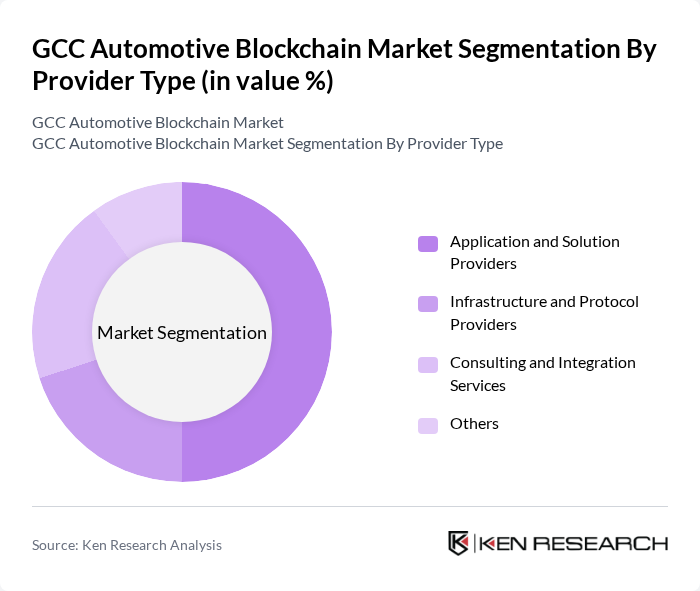

By Provider Type:This segmentation focuses on the different types of providers that contribute to the automotive blockchain ecosystem. The subsegments include Application and Solution Providers, Infrastructure and Protocol Providers, Consulting and Integration Services, and Others. Application and Solution Providers dominate this segment, driven by the increasing demand for tailored blockchain solutions that address specific challenges in the automotive sector. Their ability to innovate and provide comprehensive solutions has positioned them as key players in the market. These providers lead due to their broad utility across supply chain, payment systems, and vehicle identity verification .

The GCC Automotive Blockchain Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM, Microsoft Azure Blockchain, Accenture, Oracle Blockchain Platform, SAP, ConsenSys, R3 Corda, VeChain, Hyperledger Foundation, Everledger, DLT Labs, Ambrosus contribute to innovation, geographic expansion, and service delivery in this space.

The GCC automotive blockchain market is poised for transformative growth, driven by technological advancements and increasing consumer expectations. As the region embraces digitalization, blockchain's role in enhancing supply chain transparency and security will become more pronounced. By future, the integration of blockchain solutions is expected to streamline operations, reduce costs, and foster innovation. Additionally, the collaboration between automotive manufacturers and technology firms will accelerate the development of tailored blockchain applications, further enhancing market dynamics and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Application | Supply Chain Management Financial Services and Smart Contracts Vehicle Identity and Ownership Transfer Warranty and Fraud Detection Mobility Solutions |

| By Provider Type | Application and Solution Providers Infrastructure and Protocol Providers Consulting and Integration Services Others |

| By Mobility Type | Personal Mobility Commercial Fleet Management Shared Mobility Services Others |

| By End-User | OEMs (Original Equipment Manufacturers) Tier 1 and Tier 2 Suppliers Fleet Operators and Logistics Providers Insurance Companies Consumers and Vehicle Owners |

| By Technology Type | Public Cloud Deployment Private Cloud Deployment On-Premise Solutions Hybrid Models |

| By Region | UAE Saudi Arabia Qatar Kuwait Bahrain Oman |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Chief Technology Officers, Supply Chain Managers |

| Blockchain Solution Providers | 60 | Product Development Leads, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Logistics and Supply Chain Firms | 50 | Operations Managers, IT Directors |

| Industry Experts and Consultants | 40 | Market Analysts, Blockchain Specialists |

The GCC Automotive Blockchain Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for transparency, security in transactions, and the adoption of electric vehicles and connected car technologies.