Region:Global

Author(s):Shubham

Product Code:KRAA2658

Pages:92

Published On:August 2025

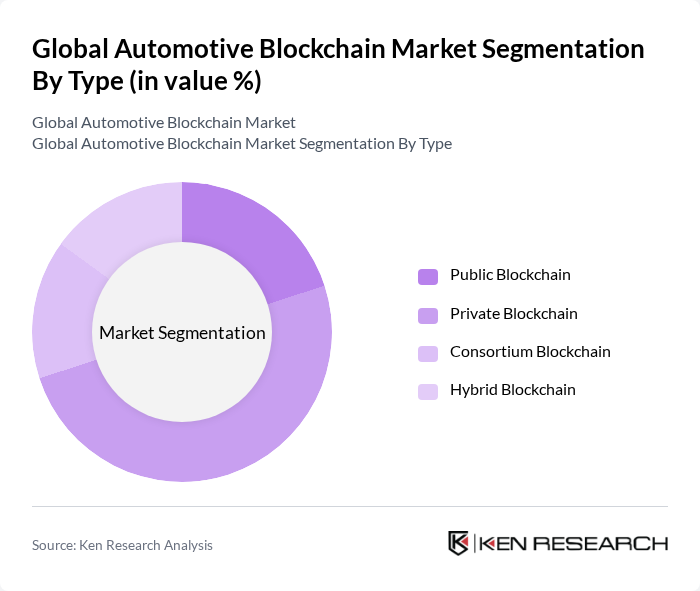

By Type:The market is segmented into four types: Public Blockchain, Private Blockchain, Consortium Blockchain, and Hybrid Blockchain. Among these, Private Blockchain is gaining traction due to its enhanced security features and granular control over data access, making it a preferred choice for automotive manufacturers and suppliers. The demand for secure, efficient, and auditable data management solutions is driving the adoption of Private Blockchain solutions in the automotive sector, particularly for applications in supply chain, finance, and vehicle identity management .

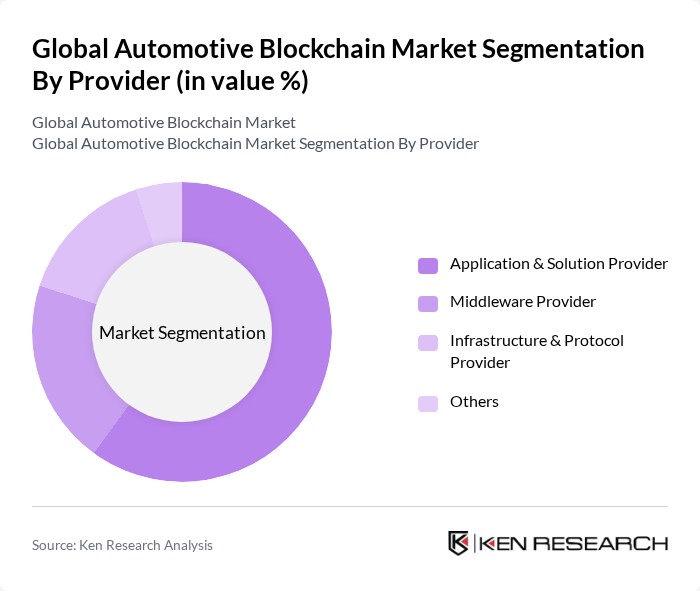

By Provider:This segmentation includes Application & Solution Providers, Middleware Providers, Infrastructure & Protocol Providers, and Others. The Application & Solution Providers segment leads the market, driven by the increasing demand for tailored blockchain solutions that address specific automotive challenges such as secure data sharing, smart contracts, and digital identity. These providers play a critical role in developing innovative applications that enhance operational efficiency, compliance, and security in the automotive industry .

The Global Automotive Blockchain Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, VeChain Foundation, R3 CEV LLC, Accenture PLC, Deloitte Touche Tohmatsu Limited, SAP SE, Oracle Corporation, Hyperledger Foundation, IOTA Foundation, ChainSafe Systems, Modum.io AG, Ambrosus AG, Everledger Ltd., and MOBI (Mobility Open Blockchain Initiative) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive blockchain market appears promising, driven by technological advancements and increasing collaboration among industry stakeholders. As more companies recognize the benefits of blockchain for enhancing supply chain transparency and security, investment in this technology is expected to rise. Additionally, the integration of artificial intelligence and machine learning with blockchain could further streamline operations, making it a critical component in the evolution of the automotive industry, particularly in the context of electric and autonomous vehicles.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Blockchain Private Blockchain Consortium Blockchain Hybrid Blockchain |

| By Provider | Application & Solution Provider Middleware Provider Infrastructure & Protocol Provider Others |

| By Mobility Type | Personal Mobility Shared Mobility Commercial Mobility |

| By Application | Supply Chain Management Vehicle Identity Management Smart Contracts Payment & Financing Services Warranty & Fraud Detection Ownership Transfer Mobility Solutions |

| By End-User | Automotive Manufacturers (OEMs) Tier 1 & Tier 2 Suppliers Fleet Operators Insurance Companies Regulatory Bodies Mobility Service Providers |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Distribution Mode | B2B B2C |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain in Supply Chain Management | 60 | Supply Chain Managers, Logistics Coordinators |

| Vehicle Identity and Ownership Tracking | 40 | Compliance Officers, IT Managers |

| Smart Contracts in Automotive Transactions | 50 | Legal Advisors, Blockchain Developers |

| Blockchain for Parts Traceability | 45 | Procurement Managers, Quality Assurance Specialists |

| Consumer Attitudes towards Blockchain in Automotive | 70 | End Consumers, Automotive Enthusiasts |

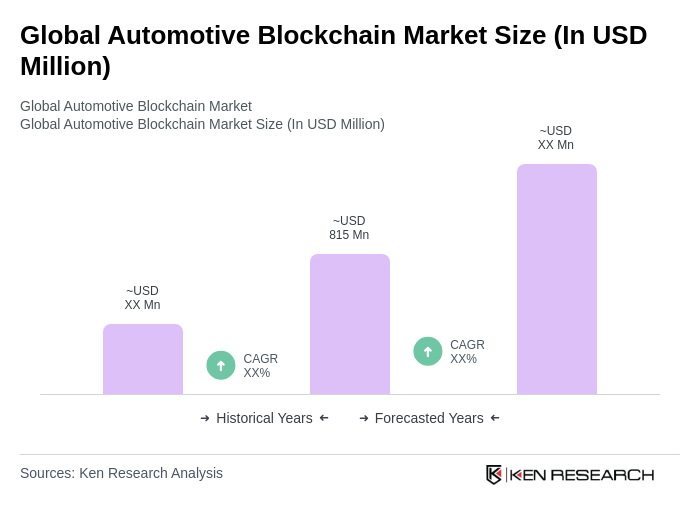

The Global Automotive Blockchain Market is valued at approximately USD 815 million, driven by the need for transparency and security in automotive transactions, as well as the adoption of electric vehicles and connected car technologies.