Middle East Automotive Cybersecurity (Connected Vehicles) Market Overview

- The Middle East Automotive Cybersecurity (Connected Vehicles) Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of connected vehicles, rising concerns over vehicle safety, and the need for robust cybersecurity measures to protect against cyber threats. The market is further supported by advancements in technology and the growing integration of IoT in the automotive sector.

- Countries such as the United Arab Emirates and Saudi Arabia dominate the market due to their rapid urbanization, high vehicle ownership rates, and significant investments in smart city initiatives. These nations are also focusing on enhancing their automotive infrastructure, which includes the implementation of advanced cybersecurity solutions to safeguard connected vehicles.

- In 2023, the UAE government introduced a comprehensive cybersecurity framework aimed at protecting connected vehicles. This regulation mandates that all automotive manufacturers and service providers implement stringent cybersecurity measures to ensure the safety and security of vehicle data and communications, thereby fostering consumer trust and enhancing the overall security landscape in the automotive sector.

Market.png)

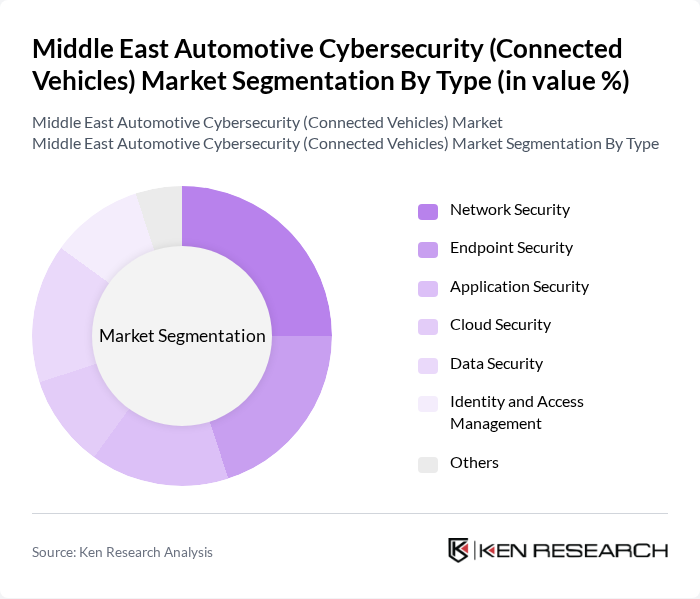

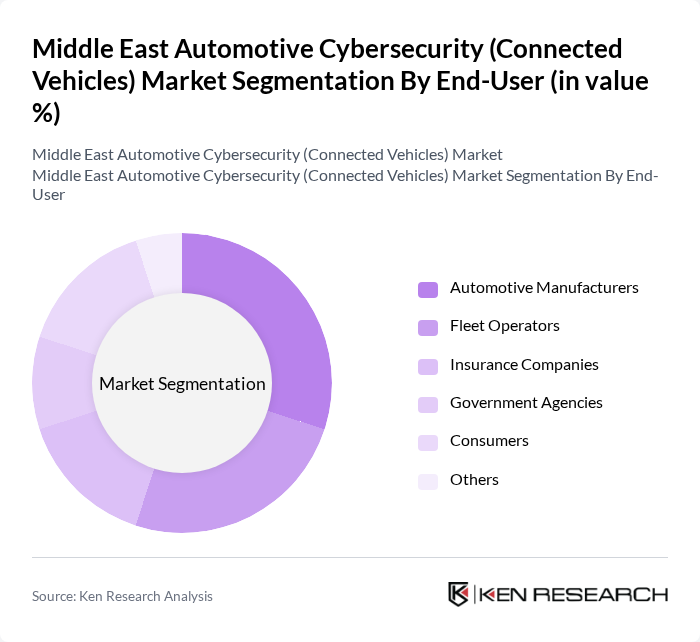

Middle East Automotive Cybersecurity (Connected Vehicles) Market Segmentation

By Type:The market is segmented into various types of cybersecurity solutions that cater to the needs of connected vehicles. The primary types include Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments plays a crucial role in ensuring the safety and integrity of vehicle systems and data.

By End-User:The end-user segmentation includes Automotive Manufacturers, Fleet Operators, Insurance Companies, Government Agencies, Consumers, and Others. Each of these segments has unique requirements and challenges, driving the demand for tailored cybersecurity solutions in the automotive sector.

Middle East Automotive Cybersecurity (Connected Vehicles) Market Competitive Landscape

The Middle East Automotive Cybersecurity (Connected Vehicles) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Check Point Software Technologies Ltd., Harman International Industries, Inc., Argus Cyber Security Ltd., Karamba Security, Cisco Systems, Inc., Palo Alto Networks, Inc., McAfee Corp., Symantec Corporation, Trend Micro Incorporated, Fortinet, Inc., Kaspersky Lab, BlackBerry Limited, Thales Group, IBM Corporation, Microsoft Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Automotive Cybersecurity (Connected Vehicles) Market Industry Analysis

Growth Drivers

- Increasing Cyber Threats to Connected Vehicles:The Middle East has witnessed a 300% increase in cyberattacks targeting connected vehicles from 2020 to 2023, according to cybersecurity reports. This alarming trend has prompted automotive manufacturers to prioritize cybersecurity measures. With over 1.5 million connected vehicles projected to be on the roads in the future, the demand for robust cybersecurity solutions is expected to surge, driving investments in advanced security technologies and protocols.

- Rising Adoption of IoT in Automotive Sector:The Internet of Things (IoT) is transforming the automotive landscape, with an estimated 70% of new vehicles in the Middle East expected to be connected in the future. This rapid adoption is fueled by consumer demand for enhanced connectivity features, such as real-time navigation and remote diagnostics. Consequently, the need for comprehensive cybersecurity solutions to protect these connected systems is becoming increasingly critical, driving market growth.

- Stringent Government Regulations on Vehicle Security:Governments in the Middle East are implementing stricter regulations to enhance vehicle cybersecurity. For instance, the UAE's National Cybersecurity Strategy mandates that all connected vehicles undergo rigorous security assessments. In the future, compliance with these regulations is expected to drive an estimated $200 million in investments in cybersecurity technologies across the region, further propelling market growth.

Market Challenges

- High Implementation Costs:The initial costs associated with implementing advanced cybersecurity measures for connected vehicles can be prohibitively high. Estimates suggest that automotive manufacturers may incur costs ranging from $500,000 to $2 million per model for comprehensive cybersecurity integration. This financial burden can deter smaller manufacturers from investing in necessary security technologies, hindering overall market growth in the region.

- Lack of Standardization in Cybersecurity Protocols:The absence of universally accepted cybersecurity standards poses a significant challenge for the automotive sector. Currently, only 30% of manufacturers adhere to established cybersecurity frameworks, leading to inconsistencies in security measures. This lack of standardization complicates compliance efforts and increases vulnerability to cyber threats, ultimately stalling the market's growth potential in the Middle East.

Middle East Automotive Cybersecurity (Connected Vehicles) Market Future Outlook

The future of the Middle East automotive cybersecurity market is poised for significant transformation, driven by technological advancements and regulatory pressures. As electric and autonomous vehicles gain traction, the demand for sophisticated cybersecurity solutions will intensify. Additionally, partnerships between automotive manufacturers and technology firms are expected to foster innovation, leading to the development of more resilient security frameworks. The region's commitment to smart city initiatives will further enhance the integration of cybersecurity measures in connected vehicles, ensuring a safer driving environment.

Market Opportunities

- Expansion of Electric and Autonomous Vehicles:The shift towards electric and autonomous vehicles presents a lucrative opportunity for cybersecurity providers. With the Middle East aiming for 30% of vehicles to be electric in the future, the demand for tailored cybersecurity solutions to protect these advanced systems is expected to rise significantly, creating a multi-million dollar market opportunity.

- Partnerships with Technology Providers:Collaborations between automotive manufacturers and technology firms can enhance cybersecurity capabilities. In the future, strategic partnerships are projected to generate over $150 million in investments, enabling the development of innovative cybersecurity solutions that address emerging threats in connected vehicles, thus expanding market potential.

Market.png)