Region:Middle East

Author(s):Shubham

Product Code:KRAD0965

Pages:99

Published On:November 2025

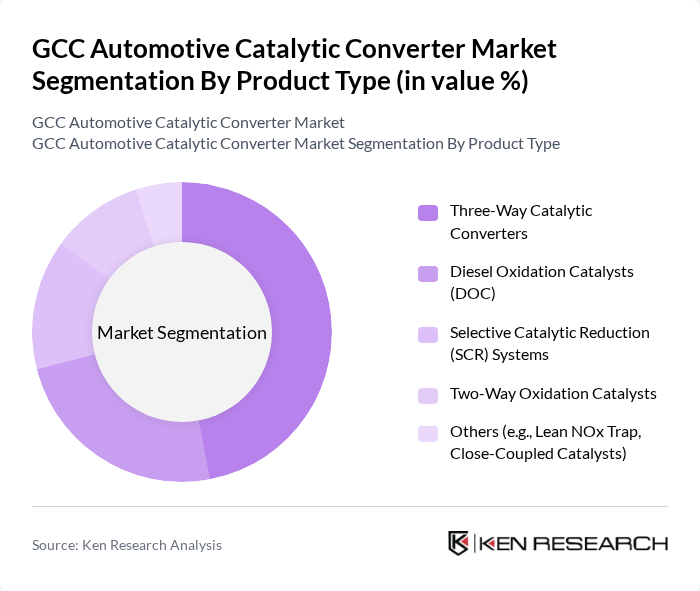

By Product Type:The product type segmentation includes various types of catalytic converters that cater to different vehicle requirements. The primary subsegments are Three-Way Catalytic Converters, Diesel Oxidation Catalysts (DOC), Selective Catalytic Reduction (SCR) Systems, Two-Way Oxidation Catalysts, and Others, which include Lean NOx Trap and Close-Coupled Catalysts. Among these, Three-Way Catalytic Converters hold the largest share due to their widespread use in gasoline vehicles, which are prevalent in the GCC region. The increasing focus on emission control, regulatory compliance, and fuel efficiency has further solidified their market leadership.

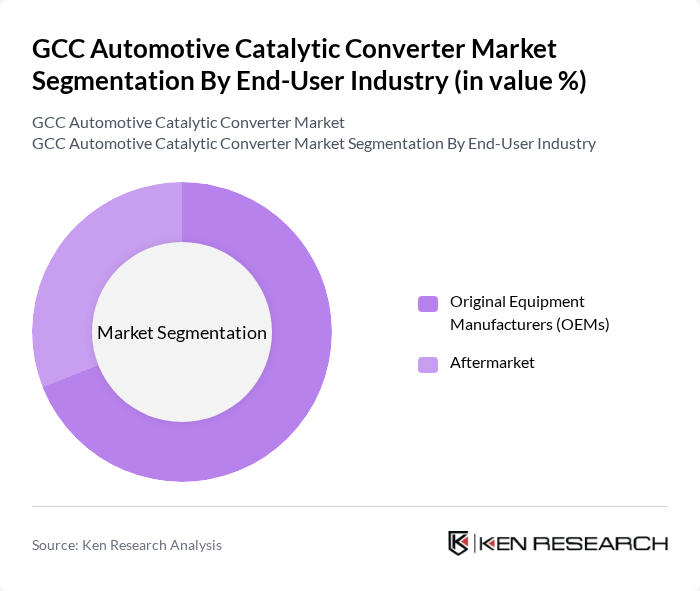

By End-User Industry:This segmentation focuses on the primary consumers of catalytic converters, which are Original Equipment Manufacturers (OEMs) and the Aftermarket. The OEM segment leads, driven by the increasing production and importation of vehicles in the GCC region. As manufacturers and importers strive to meet stringent emission regulations, the demand for high-quality catalytic converters from OEMs continues to rise. The aftermarket segment is also expanding, as vehicle owners seek to replace or upgrade their catalytic converters to enhance performance and comply with environmental standards.

The GCC Automotive Catalytic Converter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Matthey, BASF SE, Umicore, Tenneco Inc., Continental AG, Eberspächer, Faurecia (FORVIA), Denso Corporation, Marelli Holdings Co., Ltd., Calsonic Kansei Corporation (now Marelli), Aisin Corporation, Delphi Technologies (now part of BorgWarner Inc.), Yutaka Giken Co., Ltd., Sango Co., Ltd., Sejong Industrial Co., Ltd., European Exhaust & Catalyst Ltd., Deccats contribute to innovation, geographic expansion, and service delivery in this space.

The GCC automotive catalytic converter market is poised for significant transformation, driven by a combination of regulatory pressures and technological advancements. As governments intensify their focus on reducing emissions, manufacturers will increasingly invest in innovative catalytic converter technologies. Additionally, the growing popularity of electric and hybrid vehicles will further reshape the market landscape, creating new opportunities for growth. The emphasis on sustainability will likely lead to increased collaboration among industry players, fostering a more resilient and adaptive market environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Three-Way Catalytic Converters Diesel Oxidation Catalysts (DOC) Selective Catalytic Reduction (SCR) Systems Two-Way Oxidation Catalysts Others (e.g., Lean NOx Trap, Close-Coupled Catalysts) |

| By End-User Industry | Original Equipment Manufacturers (OEMs) Aftermarket |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Two-Wheelers Others (e.g., Off-Highway Vehicles) |

| By Material Type | Platinum Palladium Rhodium Others (e.g., Cerium, Iron, Manganese) |

| By Application | Emission Control Fuel Efficiency Improvement Performance Enhancement Others |

| By Sales Channel | Offline (Dealerships, Distributors) Online Sales |

| By Country | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs in Automotive Manufacturing | 60 | Product Managers, R&D Engineers |

| Aftermarket Suppliers of Catalytic Converters | 50 | Sales Managers, Supply Chain Coordinators |

| Environmental Compliance Officers | 40 | Regulatory Affairs Managers, Environmental Engineers |

| Automotive Repair Shops | 45 | Service Managers, Technicians |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

The GCC Automotive Catalytic Converter Market is valued at approximately USD 1.1 billion, driven by increasing vehicle production, advanced emission reduction technologies, and growing consumer awareness of environmental sustainability.