Region:Middle East

Author(s):Dev

Product Code:KRAC4775

Pages:98

Published On:October 2025

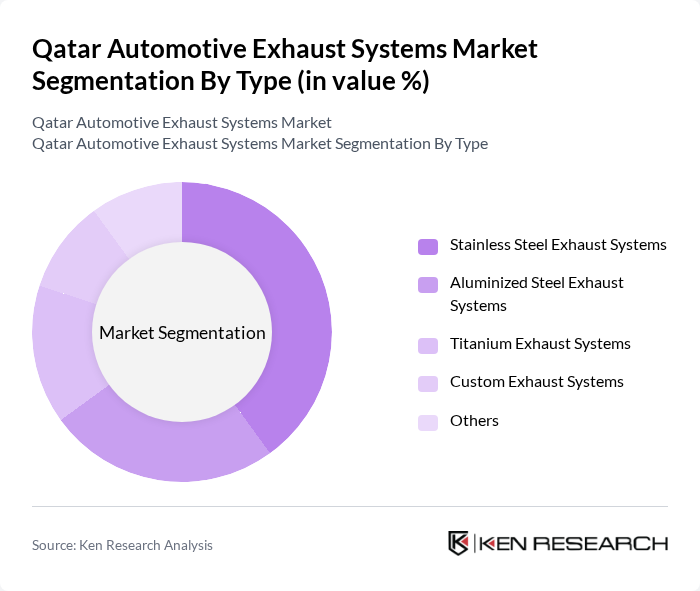

By Type:The market is segmented into Stainless Steel Exhaust Systems, Aluminized Steel Exhaust Systems, Titanium Exhaust Systems, Custom Exhaust Systems, and Others. Stainless steel systems are preferred for their superior corrosion resistance and durability, making them suitable for Qatar’s climate and consumer expectations of longevity. Aluminized steel systems offer a cost-effective alternative with reasonable performance and are popular in the mid-tier segment. Titanium exhaust systems cater to premium and performance-oriented vehicles, valued for their lightweight and heat resistance. Custom exhaust systems are increasingly sought after by automotive enthusiasts for enhanced performance and aesthetic customization. The “Others” category includes hybrid materials and specialty systems designed for niche applications such as motorsport and luxury vehicles .

The Stainless Steel Exhaust Systems segment leads the market due to its durability and resistance to corrosion, which is particularly important in Qatar’s hot and humid environment. Aluminized Steel Exhaust Systems remain popular for their balance of cost and performance. The growing trend toward vehicle customization and performance upgrades has driven increased demand for Custom Exhaust Systems, especially among younger consumers and automotive enthusiasts .

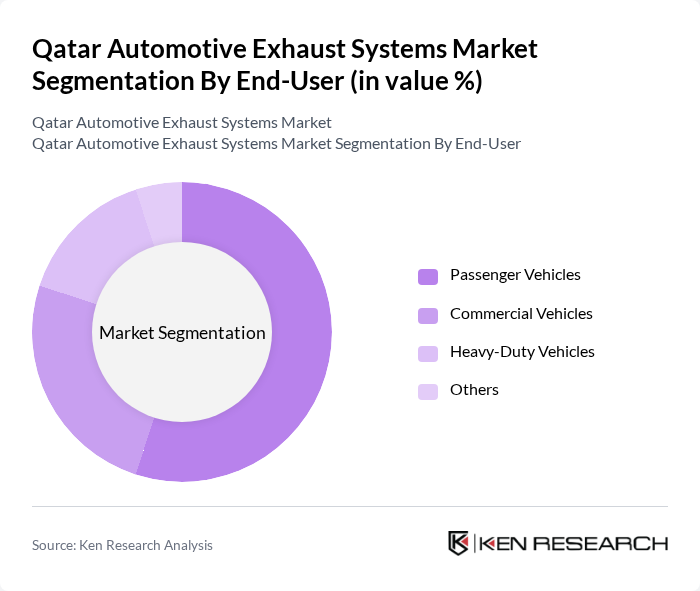

By End-User:The market is segmented into Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles, and Others. Passenger vehicles account for the largest share due to high ownership rates and frequent replacement cycles. Commercial vehicles, including taxis, vans, and light trucks, represent a significant segment as businesses prioritize compliance and reliability. Heavy-duty vehicles, such as buses and construction trucks, require robust exhaust solutions to meet stricter emission standards and operational demands. The “Others” segment includes specialty vehicles, such as emergency and municipal fleet vehicles, which have unique exhaust system requirements .

The Passenger Vehicles segment dominates the market, supported by Qatar’s high personal vehicle ownership and ongoing fleet renewal. Commercial vehicles contribute substantially, driven by business and logistics sector expansion. Heavy-Duty Vehicles maintain steady demand for robust exhaust solutions, especially as regulatory compliance and operational efficiency become increasingly important for fleet operators .

The Qatar Automotive Exhaust Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Faurecia, Tenneco Inc. (DRiV Incorporated), Eberspächer Group, Magna International Inc., Bosal Group, Sango Co., Ltd., AP Exhaust Technologies, Walker Exhaust Systems, HJS Emission Technology GmbH & Co. KG, Calsonic Kansei Corporation (now Marelli), Aisin Corporation, Denso Corporation, Johnson Matthey, Continental AG, Friedrich Boysen GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar automotive exhaust systems market appears promising, driven by technological advancements and regulatory support. As the government continues to enforce stringent emission standards, manufacturers will likely invest in innovative exhaust solutions. Additionally, the shift towards electric vehicles will create new opportunities for specialized exhaust systems. The market is expected to see increased collaboration between local manufacturers and international brands, fostering growth and enhancing product offerings in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Stainless Steel Exhaust Systems Aluminized Steel Exhaust Systems Titanium Exhaust Systems Custom Exhaust Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Heavy-Duty Vehicles Others |

| By Component | Mufflers Catalytic Converters Exhaust Pipes Exhaust Manifolds Diesel Particulate Filters (DPF) Selective Catalytic Reduction (SCR) Systems Others |

| By Sales Channel | OEMs Aftermarket Online Retail Others |

| By Distribution Mode | Direct Sales Distributors Retail Outlets Others |

| By Price Range | Budget Mid-Range Premium |

| By Application | Performance Enhancement Noise Reduction Emission Control Others |

| By Fuel Type | Gasoline Diesel Hybrid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Exhaust Systems | 100 | Product Managers, Automotive Engineers |

| Commercial Vehicle Exhaust Solutions | 80 | Fleet Managers, Procurement Specialists |

| Aftermarket Exhaust System Providers | 60 | Retail Managers, Sales Executives |

| Regulatory Compliance and Standards | 50 | Compliance Officers, Environmental Engineers |

| Emerging Technologies in Exhaust Systems | 70 | R&D Managers, Innovation Leads |

The Qatar Automotive Exhaust Systems Market is valued at approximately USD 85 million, reflecting a five-year historical analysis. This valuation aligns with regional trends in vehicle demand and emission compliance requirements, indicating a robust market environment.