Region:Middle East

Author(s):Dev

Product Code:KRAD3227

Pages:92

Published On:November 2025

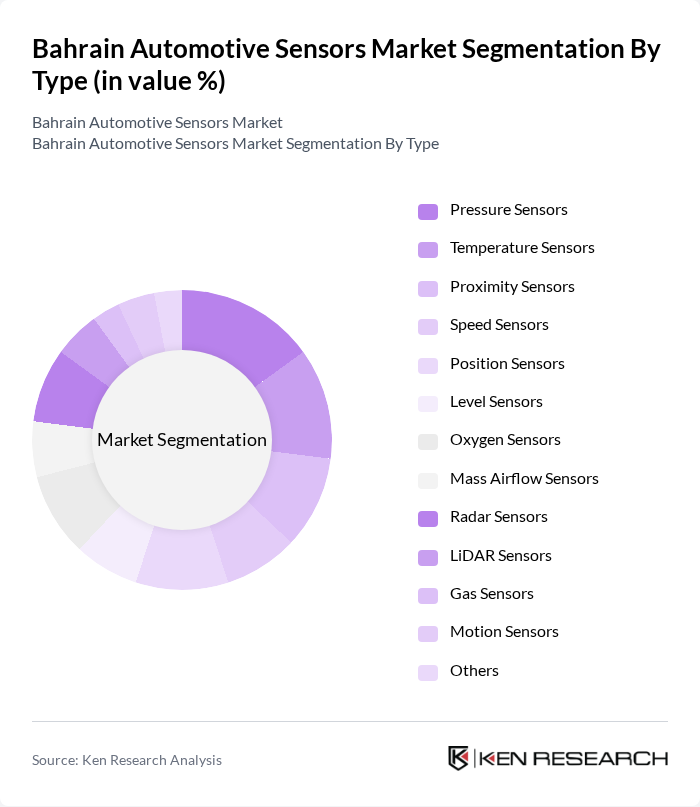

By Type:The market is segmented into various types of sensors, including Pressure Sensors, Temperature Sensors, Proximity Sensors, Speed Sensors, Position Sensors, Level Sensors, Oxygen Sensors, Mass Airflow Sensors, Radar Sensors, LiDAR Sensors, Gas Sensors, Motion Sensors, and Others. Each type serves specific functions in vehicle performance, emissions control, and safety systems .

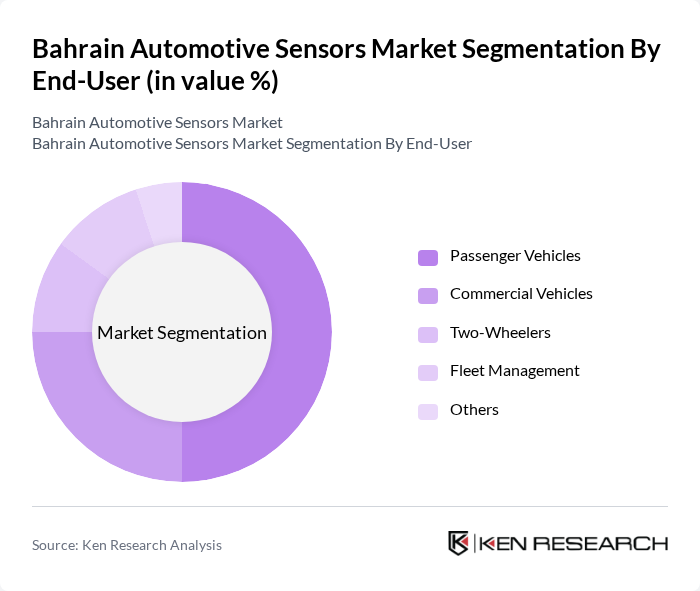

By End-User:The market is segmented by end-user into Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Fleet Management, and Others. Each segment has unique requirements for sensors based on vehicle type, regulatory standards, and operational needs .

The Bahrain Automotive Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, Denso Corporation, Honeywell International Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Texas Instruments Incorporated, Analog Devices, Inc., Aptiv PLC, Autoliv Inc., Valeo SA, Aisin Corporation, ZF Friedrichshafen AG, Mitsubishi Electric Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive sensors market in Bahrain appears promising, driven by increasing investments in smart city initiatives and a growing focus on sustainability. As the government continues to promote electric vehicle adoption and smart technologies, the integration of IoT in automotive sensors is expected to enhance vehicle connectivity. Furthermore, the shift towards autonomous vehicles will likely accelerate sensor development, creating a dynamic environment for innovation and collaboration among local and international players in the automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Pressure Sensors Temperature Sensors Proximity Sensors Speed Sensors Position Sensors Level Sensors Oxygen Sensors Mass Airflow Sensors Radar Sensors LiDAR Sensors Gas Sensors Motion Sensors Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Fleet Management Others |

| By Vehicle Type | Electric Vehicles Hybrid Vehicles Internal Combustion Engine Vehicles Luxury Vehicles Others |

| By Application | Engine Management Safety and Security (including ADAS) Comfort and Convenience Navigation and Communication Powertrain Chassis Vehicle Body Electronics Telematics Others |

| By Distribution Channel | Original Equipment Manufacturer (OEM) Aftermarket Online Sales Retail Sales Distributors Others |

| By Technology | Analog Sensors Digital Sensors Smart Sensors MEMS Sensors Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Product Managers, Engineering Leads |

| Sensor Technology Suppliers | 80 | Sales Directors, Technical Support Engineers |

| Automotive Aftermarket Services | 60 | Service Managers, Parts Distributors |

| Research Institutions | 40 | Research Scientists, Academic Professors |

| Government Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Bahrain Automotive Sensors Market is valued at approximately USD 120 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for advanced driver-assistance systems (ADAS) and the adoption of electric vehicles.